Find a Broker by Gender – Because Comfort, Trust and Communication Matter. Applying for a mortgage is a major financial step. It’s personal, often emotional, and can feel uncomfortable if the process lacks choice. Many borrowers want control over who advises them, especially when it comes to gender. That option rarely exists in most mortgage search tools.

At Connect Experts, we believe choice matters.

Why Choosing a Broker by Gender Matters

Mortgage advice involves more than facts and figures. It requires open discussion about income, spending, family plans, and future goals. These topics can feel intrusive if the adviser doesn’t feel like the right fit.

Some people feel more at ease speaking with a female adviser. Others prefer to deal with a male adviser due to past experiences or cultural reasons. Many just want to work with someone who shares their background or understands their situation.

That’s why comfort and trust should come first. The right adviser is not just qualified, they’re someone you can speak to openly.

Scenario one:

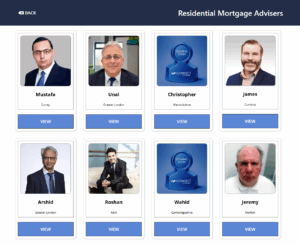

A client is searching for a residential mortgage adviser and prefers to choose exclusively from male brokers. This preference may stem from personal comfort, cultural reasons, or previous experience. The client wants access to a platform that allows them to view and compare only male advisers, ensuring they feel at ease throughout the process. Having the ability to make this choice helps the client feel more in control and confident when discussing financial details such as income, property goals, and future plans.

The Issue: Most Platforms Don’t Offer This Option

Most mortgage platforms only let you filter by postcode, lender panel, or service type. But they miss the point—trust and communication are critical. If the adviser doesn’t feel right, the advice might fall short.

This matters even more for:

-

Single parents

-

Women buying property alone

-

Clients from culturally sensitive communities

-

Individuals with past trauma

-

LGBTQ+ borrowers looking for understanding

When comfort is lacking, the process becomes more challenging. However, when trust is present, advice is more effective, and outcomes improve.

Find a Broker by Gender | Our Approach: Filter by Gender with Connect Experts

At Connect Experts, we’ve built a search tool that puts control back in your hands. You can search for an adviser based on gender, language, location, and specialism. This helps you choose someone who makes you feel at ease right from the start.

Every adviser listed on Connect Experts is:

-

Authorised and regulated by the Financial Conduct Authority (FCA)

-

Qualified to provide mortgage advice in the UK

-

Fully insured and vetted by the Connect Network

You can read adviser profiles, check reviews, and decide who to contact. It’s your mortgage journey—so you choose who to trust.

In this example, the client is seeking a commercial mortgage but wants the option to choose exclusively from female mortgage advisers. This preference may stem from personal comfort, cultural considerations, or past experiences—and having that choice helps create a more open, trusting environment for financial discussions.

Find a Broker by Gender | Real Conversations Lead to Better Results

When you feel safe and supported, it’s easier to ask questions and make clear decisions. This can reduce stress and improve speed throughout the process.

Choosing the right broker can make all the difference in:

-

First-time buyer applications

-

Mortgages following a divorce or separation

-

Affordability checks during maternity or career breaks

-

Sensitive discussions around income or vulnerabilities

Comfort is not a bonus—it should be part of every mortgage plan.

Find a Broker by Gender | Start Your Search Today

Use our Connect Experts Broker Finder to search by gender, language, location, and more. Whether you prefer to speak with a woman, a man, or someone who understands your situation, you’re in control.

Your adviser should feel right from day one. That’s how mortgage advice should work.