Mortgage Brokers in Dumfriesshire: If you are looking to find a mortgage adviser in Dumfriesshire, Connect Experts makes the process simple and transparent. Our platform helps you connect with experienced mortgage advisers who understand the local property market and your individual circumstances.

All advisers listed are FCA authorised and provide advice based on your needs. There is no obligation to proceed and no impact on the mortgage deals available to you.

Buying or refinancing a property can feel complex without the right guidance. A local mortgage adviser in Dumfriesshire can help you understand your options clearly and confidently.

Whether you are a first-time buyer, moving home, or reviewing your current mortgage, an adviser can research lenders and explain suitable products in plain English. Advice is tailored to your financial position and future plans.

You can also explore our wider mortgage advisers directory to compare professionals across the UK. If mortgage brokers in Powys are unavailable, explore options nearby in Scotland.

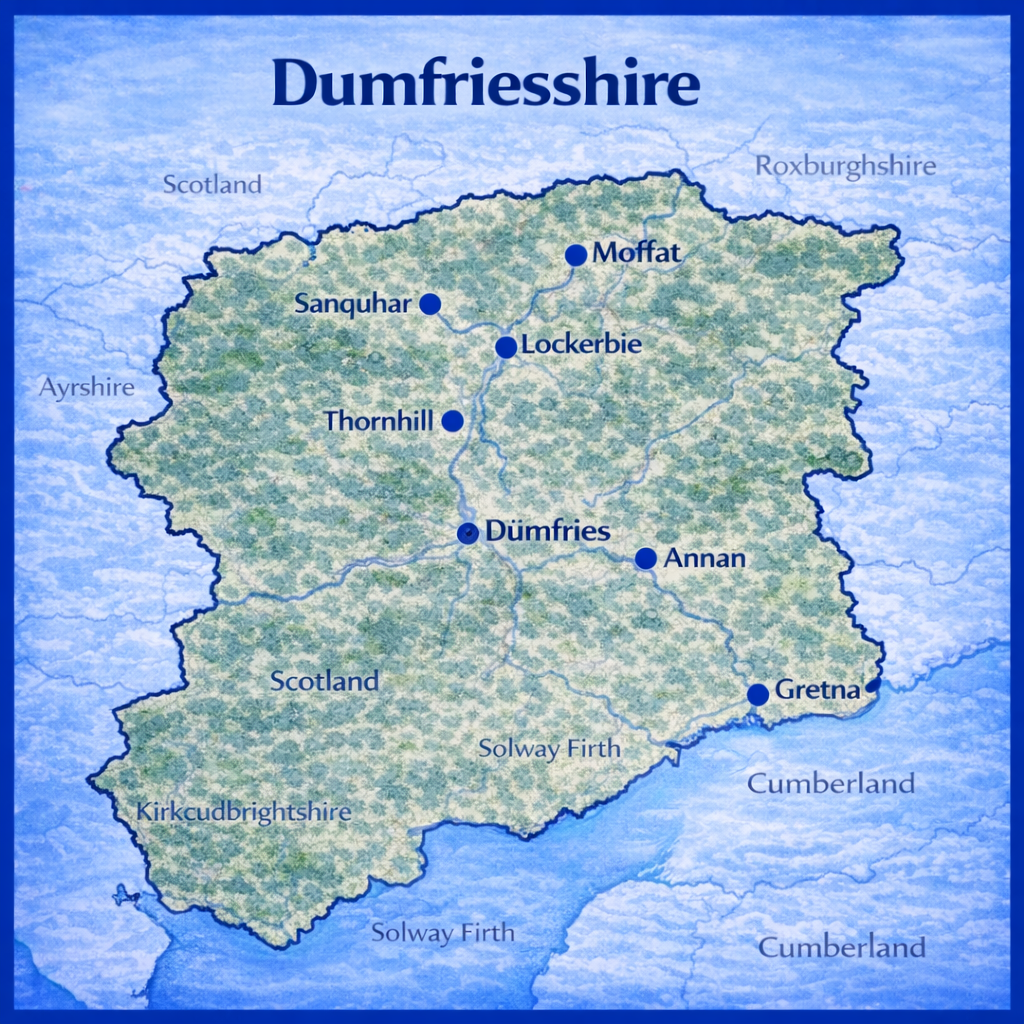

Map with Our Mortgage Brokers in Dumfriesshire

Add Your Tooltip Text Here

Mortgage Advice in Dumfriesshire that Reflects Local Property Needs

Dumfriesshire has a distinct property landscape shaped by border towns, agricultural land, coastal influence, and smaller population centres. Mortgage assessments in the area are often influenced by location, access, and transaction frequency rather than simple averages.

Properties in Dumfries, Annan, Lockerbie, and surrounding villages may be viewed differently by lenders depending on transport links, buyer demand, and recent comparable sales. These local elements can affect valuation confidence, loan-to-value limits, and lender appetite before a mortgage offer is issued.

Understanding how Dumfriesshire differs from larger urban markets can help borrowers prepare earlier in the process.

Property Types in Dumfriesshire and How Lenders View Them

Housing across Dumfriesshire reflects a mix of historic settlement and rural development. Common property types include:

- Traditional stone homes in town centres and villages

- Detached and semi-detached homes built post-war

- Rural cottages and farm-related dwellings

- Properties with land or outbuildings

Smaller new-build developments in expanding areas

Some rural or non-standard properties may attract additional scrutiny, particularly when comparable sales are limited or when access, construction, or services differ from those in modern estates. Awareness of these factors can help identify potential valuation questions before an application is submitted.

Employment Patterns and Income Profiles in Dumfriesshire

Employment in Dumfriesshire spans public services, healthcare, education, logistics, agriculture, tourism, and cross-border commuting. Mortgage applications from the area often involve income structures that require careful presentation, such as:

- Self-employed applicants linked to farming or local trades

- Seasonal income or variable earnings

Applicants working across the England-Scotland border - Multiple income streams within one household

- Applicants combining employed and self-employed income

While lender rules are set nationally, how income is evidenced and explained can influence affordability outcomes. Clear documentation helps ensure income is assessed accurately rather than conservatively.

Mortgage Advice Based on Property and Circumstances Fit

Mortgage suitability goes beyond headline interest rates. Property type, valuation risk, and borrower circumstances all affect how smoothly an application progresses.

Support may include:

- Reviewing credit history and deposit sources

- Matching lender criteria to Dumfriesshire property values

- Flagging valuation sensitivity early

Supporting communication with solicitors and agents - Explaining lender decisions in clear terms

This approach is particularly helpful where properties fall outside standard lending profiles.

Local Variation Within Dumfriesshire

Mortgage outcomes can vary across the region due to transaction volume, buyer demand, and local infrastructure. Dumfriesshire includes areas such as:

- Market towns with mixed-age housing

- Border locations influenced by cross-border employment

- Rural villages with limited comparable evidence

- Coastal and semi-rural areas with seasonal demand

- Transport linked locations near major road routes

Understanding how lenders assess risk in each location helps manage expectations during underwriting and valuation.

If you wish to compare options beyond the region, you can explore the full mortgage broker directory available through Connect Experts.

Clear Communication and Accessible Mortgage Guidance

Mortgage terminology and criteria can feel complex, particularly where financial arrangements are detailed or unfamiliar. Some borrowers value advisers who can adapt explanations to their background or preferred language.

Connect Experts supports this through its Bilingual Mortgage Brokers network, which provides access to advisers who can explain mortgage concepts clearly across different languages or communication styles. This can be particularly valuable for households where English is not the first language or where clarity is essential for long-term financial decisions.

Understanding how your mortgage works is a key part of responsible borrowing.

Common Mortgage Needs in Dumfriesshire

Advisers available through Connect Experts may support clients in Dumfriesshire with:

- First-time buyer purchases

- Home mover applications

- Remortgaging to review existing terms

- Buy-to-let properties in areas of rental demand

- Applications involving complex income or credit history

All advice is tailored to individual circumstances, affordability checks, and current lender criteria.

To begin locally, you can use the Find a mortgage adviser tool to connect with advisers familiar with Dumfriesshire housing conditions.

Regulation and Consumer Protection

All advisers featured through Connect Experts are authorised and regulated by the Financial Conduct Authority. Mortgage advice is provided in line with UK regulations designed to support fair outcomes and consumer protection.

Your home may be repossessed if you do not keep upwith repayments on your mortgage.

Local Insight

In Dumfriesshire, properties with similar features can receive different valuations depending on location, access, and recent sales evidence. Awareness of these regional factors can help borrowers anticipate lender responses and reduce delays during the approval process.

Why Work With Mortgage Brokers in Dumfriesshire

If you are thinking of moving to Dumfriesshire, arranging the right mortgage is a key part of settling into the area. The region offers a mix of border towns, rural communities, and coastal locations, each of which can influence how lenders assess affordability and property suitability.

Mortgage brokers in Dumfriesshire understand how local housing conditions, transaction volumes, and valuation evidence can affect lending decisions. This insight can help buyers prepare more effectively before submitting a mortgage application.

Through Connect Experts, you can access advisers who understand UK mortgage regulations and how the characteristics of Dumfriesshire properties may influence lenders’ decisions.

When a Mortgage Broker in Dumfriesshire Can Add Real Value

Mortgage lending involves more than choosing an interest rate. Lenders review income stability, credit history, and property risk before issuing an offer. A mortgage broker can be particularly helpful where circumstances require explanation or planning.

Support may be beneficial if you are:

- Relocating to Dumfriesshire from elsewhere in the UK

- Changing employment or commuting arrangements as part of a move

- Self-employed or earning income that varies

- Buying a rural or non-standard property

- Reviewing your mortgage under updated affordability rules

- Applying following previous credit challenges

Using the Connect Experts mortgage broker directory lets you compare advisers who work with a wide range of lenders, rather than being limited to one provider.

Dumfriesshire Property Types and Mortgage Considerations

Dumfriesshire features varied housing stock, and lenders may assess properties differently depending on location, construction, and sales evidence.

Property types commonly found in the area include:

- Traditional stone homes in towns and villages

- Detached and semi-detached family housing

- Rural cottages and properties with land

- Smaller new-build developments

Homes influenced by coastal or border location

Some properties may require additional checks during valuation or underwriting, particularly where comparable sales are limited. Mortgage brokers familiar with Dumfriesshire can help identify potential concerns early, reducing delays later in the process.

Support for Buyers Moving to Dumfriesshire

Moving to a new county often brings changes to household finances, travel costs, and long-term budgeting. A mortgage adviser can help present your circumstances clearly to lenders while ensuring borrowing remains sustainable.

This guidance can be useful for:

- First-time buyers entering the Dumfriesshire market

- Families relocating for lifestyle or schooling reasons

- Home movers upsizing or downsizing locally

- Buyers moving from England to Scotland

Connect Experts allows you to choose an adviser based on what matters most to you. This may include selecting a broker based on expertise or communication style, or choosing a mortgage broker of the same gender to help you feel more comfortable throughout the process.

To begin, you can use the Find a mortgage adviser tool to explore local options.

Access to a Broader Range of Mortgage Options

Some mortgage products are only available through intermediaries. Working with a broker can provide access to lenders and products not always available directly to borrowers.

A mortgage broker may be able to help if you:

- Have previously been declined

- Need manual underwriting rather than automated assessment

- Have multiple or complex income sources

- Are buying a property outside standard lending criteria

All recommendations are based on suitability, affordability, and current lender policy.

Ongoing Support Beyond the Mortgage Offer

Mortgage advice often continues throughout the application process. Brokers can provide ongoing support as your case progresses.

This may include:

- Preparing documentation accurately

Responding to lender queries - Liaising with solicitors and estate agents

- Providing clear updates during underwriting

All advisers featured through Connect Experts are authorised and regulated by the Financial Conduct Authority and provide advice in line with UK mortgage standards.

Your home may be repossessed if you do not keep up with your mortgage repayments.

Find a Broker by Language

Clear communication is essential when making mortgage decisions. If you would prefer to discuss your mortgage in another language or feel more confident receiving guidance in a familiar way, support is available.

Connect Experts allows you to “Find a Broker by Language” through its Bilingual Mortgage Brokers network, helping make the mortgage process in Dumfriesshire clearer, more comfortable, and easier to understand.

What Dumfriesshire is Known for Why People Choose to Live Here

Dumfriesshire is a historic county in southern Scotland, located along the English border and facing the Solway Firth. It is known for its wide open landscapes, traditional market towns, and strong connection to Scottish history and literature.

The area attracts buyers who value space, coastal access, and a quieter pace of life while remaining connected to transport routes linking Scotland and northern England. Dumfriesshire combines rural living with established towns that support day-to-day needs, making it appealing to families, retirees, and people relocating for lifestyle reasons.

You can begin by exploring our page of mortgage brokers in Dumfriesshire.

Towns and Areas That Shape Life in Dumfriesshire

Dumfriesshire is made up of towns and smaller communities, each offering different housing options and local character.

Key locations include:

- Dumfries, the largest town and administrative centre

- Annan, a coastal town close to the English border

- Lockerbie, known for rail links and commuter access

- Moffat, a historic spa town popular with visitors

- Sanquhar and Thornhill, smaller towns with traditional housing

Housing across the county includes stone-built town properties, family homes on residential estates, rural cottages, and properties with surrounding land. Demand can vary depending on proximity to transport links, access to employment, and local services.

What Dumfriesshire Is Famous For

Dumfriesshire is recognised for its natural scenery, cultural heritage, and historic landmarks.

Notable features include:

- The Solway Firth coastline, known for open views and wildlife

- Caerlaverock Castle, a well-preserved medieval fortress

- Ellisland Farm, associated with Robert Burns

- The River Nith, which runs through Dumfries

- Moffat Hills and surrounding countryside

These landmarks contribute to Dumfriesshire’s identity and are a key reason many people choose to settle in the area long term.

Buying a Home in Dumfriesshire: What Buyers Should Know

Although mortgage rules are set nationally, buyers in Dumfriesshire may encounter location-specific factors that influence the buying process.

Common considerations include:

- Rural properties with limited comparable sales

- Older stone buildings requiring detailed valuation

- Homes with land or outbuildings

- Coastal or semi-rural locations affect lender appetite

- Lower transaction volumes in some postcodes

Working with advisers familiar with housing conditions in Dumfriesshire can help buyers anticipate how lenders may assess both property suitability and affordability.

Through Connect Experts, buyers can compare advisers by location and experience, helping ensure guidance reflects local property characteristics.

To explore options beyond the region, you can also view the mortgage broker directory.

Living in Dumfriesshire: Community and Lifestyle

Dumfriesshire has a mix of long-standing residents, cross-border commuters, and people relocating from elsewhere in the UK. The area is often chosen for its sense of community, access to outdoor space, and slower pace of life.

Clear communication and practical guidance are important when making long-term financial decisions, such as buying a home. Some buyers value advisers who explain mortgage options clearly and take time to understand individual circumstances.

Find a Broker by Language

Clear understanding is essential when arranging a mortgage. If you prefer to discuss your mortgage in another language or feel more confident receiving guidance in a familiar way, support is available.

You can begin by exploring our page of mortgage brokers in Dumfriesshire, or use the Find a Broker by Language option through our Bilingual Mortgage Brokers network to make your home buying journey clearer and more comfortable.

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Dumfriesshire, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our Dumfriesshire mortgage brokers page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Dumfriesshire.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us

FAQ – Mortgage Brokers in Dumfriesshire

| Question | Answer |

|---|---|

| Are there mortgage brokers based in Dumfriesshire? | Yes. Connect Experts works with a network of experienced mortgage brokers throughout Dumfriesshire, including Dumfries, Lockerbie, and Annan. Each adviser is FCA-authorised and offers whole-of-market mortgage solutions. |

| Can Dumfriesshire brokers help with rural or agricultural properties? | Absolutely. Many local advisers specialise in mortgages for rural and semi-rural homes, farms, and smallholdings — ideal for buyers in Dumfriesshire’s countryside. |

| Do local mortgage brokers in Dumfriesshire offer remote appointments? | Yes. Most advisers provide flexible options, including video calls and phone consultations, alongside face-to-face meetings within the region. |

| What types of mortgages can I arrange through a Dumfriesshire broker? | Local brokers offer residential, buy-to-let, remortgage, and bridging finance advice. Some also handle commercial or self-build mortgages, depending on your needs. |

| Is it better to use a local or national mortgage broker? | A local broker in Dumfriesshire can offer valuable insight into regional lenders, property values, and market conditions, while still accessing national lender panels. This often means a faster, more personalised service. |

| How do I find a mortgage broker near me in Dumfriesshire? | Use Connect Experts’ search tool to filter by location, language, gender, or specialism. Enter your postcode to view trusted mortgage advisers covering Dumfriesshire instantly. |

| Are Dumfriesshire brokers regulated by the FCA? | Yes. Every mortgage adviser listed on Connect Experts is fully FCA-authorised and meets the Financial Conduct Authority’s standards for professional mortgage advice. |

| Can a Dumfriesshire mortgage broker help with poor credit applications? | Yes. Several advisers in the area specialise in helping clients with adverse or limited credit histories find suitable lenders and products. |

| Do local brokers charge a fee for their services? | Fees vary between advisers. Some charge a set fee, while others are paid by the lender upon completion. Each broker will explain their fee structure clearly before you proceed. |