Finding the Right Mortgage Broker in Retford, Nottinghamshire | Retford is a historic market town in the district of Bassetlaw, Nottinghamshire. It sits in the heart of the East Midlands with a rich heritage, Georgian architecture and a traditional market square that still hosts regular markets today. The town is known for its connections to the Mayflower Pilgrims and offers a characterful blend of history and modern amenities for residents and visitors.

Finding the Right Mortgage Broker in Retford, Nottinghamshire | Retford is a historic market town in the district of Bassetlaw, Nottinghamshire. It sits in the heart of the East Midlands with a rich heritage, Georgian architecture and a traditional market square that still hosts regular markets today. The town is known for its connections to the Mayflower Pilgrims and offers a characterful blend of history and modern amenities for residents and visitors.

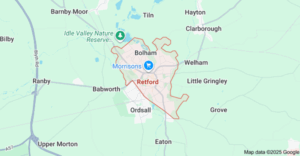

With a population of around 23,700 at the last census, Retford is the second largest town in Bassetlaw after Worksop. It is classed as a Main Town in the Bassetlaw Local Plan because it offers extensive local services, including an East Coast Main Line railway station, bus station, schools, healthcare, leisure facilities and supermarkets. Retford has strong transport links. Rail services on the East Coast Main Line and local routes connect residents to Sheffield, Doncaster, Lincoln, Nottingham and London. Bus routes such as the Sherwood Arrow provide direct access to Nottingham, Worksop and attractions including Rufford Abbey and Sherwood Forest. The nearby A1 and wider regional road network support both commuting and business activity.

Retford’s Property Market

The local property market is varied, with period terraces, character townhouses, traditional cottages and newer family homes on modern developments. The surrounding villages offer semi-rural living with good access back into Retford and to major routes.

Recent data suggests the average property price in Retford over the last year is around £219,000, with a mix of terraced, semi-detached and detached homes appealing to a broad range of buyers. Bassetlaw’s Local Plan anticipates significant housing growth in the town, with a total of 2,331 new homes planned in Retford by 2038, of which around 1,402 are still to be allocated.

This combination of accessible price points, planned new housing and good connectivity helps support long-term demand in the area.

Meet Louise Leggott – Mortgage Broker in Retford

Louise Leggott is your dedicated mortgage broker in Retford, providing tailored mortgage advice across Nottinghamshire. With detailed knowledge of the local area and access to a wide panel of lenders, she helps clients match their property goals with suitable mortgage options.

Louise supports a wide range of clients, including first-time landlords, bridging finance clients, remortgagers, landlords, and investors. Whether you are buying in the town centre, one of Retford’s newer developments or a nearby village, Louise offers clear and practical guidance.

Louise can help with:

- Remortgage advice, including capital raising for home improvements on existing buy-to-let mortgages

-

Buy-to-let and HMO mortgages for landlords and investors

-

Limited company and portfolio landlord mortgages

-

Specialist lending, such as bridging loans and short-term finance

-

General insurance to help safeguard your home, income and family

She explains your options in straightforward language, supports you with paperwork and liaises with lenders, estate agents and solicitors on your behalf.

👉 Available through the Connect Expert Directory

Exploring Nottinghamshire: Retford and Surrounding Areas

The wider Nottinghamshire and North Nottinghamshire region appeals to buyers who value good transport links, access to the countryside, and a choice of town and village settings. Retford’s neighbouring towns and villages offer distinct property opportunities and mortgage considerations.

Worksop: Property Snapshot

Located around eight miles west of Retford, Worksop is Bassetlaw’s largest town. It offers a mix of traditional terraces, family homes and newer estates, with strong links to local employment and nearby attractions such as Clumber Park and Sherwood Forest. Rail and bus connections between Worksop and Retford, including regular services on local routes, support commuting and day-to-day travel.

Mortgage tips for Worksop buyers and landlords

-

First-time buyers: Competitive price points in parts of Worksop can work well with low deposit mortgages and schemes aimed at getting on the ladder.

-

Commuters: Consider fixed-rate mortgages that match your medium-term plans, particularly if you rely on rail travel to Sheffield, Nottingham or Doncaster.

-

Investors: Properties close to transport links and employment centres can support consistent rental demand.

Gainsborough: Property Snapshot

Gainsborough, across the county border in Lincolnshire and approximately 14 miles north east of Retford, is a historic riverside town with both traditional and modern housing. Regeneration in and around the town centre and along the River Trent has created a variety of flats, townhouses and family homes.

Mortgage tips for Gainsborough buyers and landlords

-

Home movers: If you are selling in Retford and buying in Gainsborough, a coordinated home mover mortgage can help manage the transaction and ensure completion dates are met.

-

Value seekers: Some areas offer relatively affordable prices compared with larger cities, making Gainsborough attractive to those seeking more space within a set budget.

-

Landlords: Consider interest-only buy-to-let products with stress testing that reflects current rental yields and local demand.

Newark on Trent: Property Snapshot

Newark-on-Trent sits to the south of Retford and is known for its historic market square, river settings, and strong transport links, including rail services on the East Coast Main Line and access to the A1. It is a popular choice for commuters and families who want a market-town environment with fast access to larger cities.

Mortgage tips for Newark buyers

-

Commuters to Nottingham, Lincoln and London: Look at mortgage products that allow overpayments if you expect income to rise over time.

-

Upsizers: Higher value family homes may require larger loan amounts, so lender choice and affordability assessments become especially important.

-

Remortgagers: If your property has benefited from price growth, you may be able to secure a lower loan-to-value band and improved rates.

Villages around Retford: Ordsall, Sutton cum Lound, Clarborough and Barnby Moor

Villages such as Ordsall, Sutton cum Lound, Clarborough and Barnby Moor give buyers the chance to enjoy semi-rural living while staying close to Retford’s services, schools and transport links. New developments and traditional village streets sit alongside local pubs, primary schools and open countryside.

Mortgage tips for nearby village locations

-

Family buyers: Look at products with flexible features, such as overpayment facilities, if you plan to extend or improve your home in the future.

-

Self-employed clients: Be prepared to provide accounts, tax returns and bank statements. Specialist lenders can support those with complex income.

-

New build purchasers: If you are buying on a new development, talk to Louise early about time-limited mortgage offers and any builder incentives.

Retford’s Property Market Insights

Retford’s classification as a Main Town, planned housing growth, and strong transport connections help underpin local housing demand.

Key characteristics of the Retford property market include:

-

A broad mix of period homes, newer estates and village properties

-

Average prices that are often below those of some larger city centres, helping support affordability for first-time buyers and families.

-

Strong appeal for commuters to Sheffield, Nottingham, Lincoln and London due to rail and road links.

-

Ongoing housing development that is expected to add over 2,000 homes in the period up to 2038.

-

Consistent demand from local workers, families and those relocating from higher-priced regions

In the wider UK, recent data shows a market where many properties are selling slightly below asking price, even though overall activity levels remain high and values are expected to grow modestly through 2025. This environment can favour well-informed buyers who are clear about their borrowing capacity and prepared to negotiate.

Living in Retford: Local Highlights and Amenities

Retford offers an appealing quality of life, combining historic streets, cultural venues and access to green spaces.

Transport Links

-

Mainline rail services from Retford station provide direct or connecting routes to London, Doncaster, Sheffield, Lincoln and other regional centres.

-

The Sherwood Arrow bus service connects Retford with Nottingham, Worksop and key visitor attractions.

-

Proximity to the A1 and wider East Midlands road network supports commuting and business travel.

Mortgage insight: Good connectivity tends to support property demand and long-term values. Lenders often view well-connected towns positively when assessing risk, which can help borrowers secure competitive rates.

Local Amenities

Retford and its surrounding area offer:

-

A traditional market square, independent shops and essential services in the town centre

-

Theatres, including the Little Theatre and Majestic Theatre, contribute to the local cultural scene.

-

Primary and secondary schools, healthcare facilities, a leisure centre and green spaces are recognised in local planning documents.

-

Nearby attractions such as Clumber Park and Sherwood Forest, and family destinations including Sundown Adventureland and Walesby Forest, add to the area’s lifestyle appeal.

Mortgage insight: Areas with strong amenities and educational options usually retain buyer interest over time. This can support future remortgage applications and may help maintain or increase the property’s equity.

Ready To Secure Your Mortgage in Retford

Whether you are:

-

Buying your first investment property in Retford

-

Moving within Nottinghamshire or relocating from another part of the UK

-

Purchasing or remortgaging a buy-to-let property

-

Exploring options such as bridging finance or limited company lending

Louise Leggott is ready to help you make informed decisions about your mortgage. With local insight, access to a wide choice of lenders and a focus on clear, supportive advice, she can guide you through each stage of the process.

📞 Contact Louise Leggott today for a no-obligation mortgage consultation and start your property journey in Retford with confidence.

Thank you for reading our publication “Mortgage Broker in Retford | Find an adviser in Nottinghamshire.” Stay “Connect“-ed for more updates soon!