Stop Guessing: Why Blindly Choosing a Mortgage Broker Could Cost You More Than You Think. Think, A Mortgage Directory. We’ve all done it. You search online for a mortgage broker and end up calling the first number you see. Someone answers—friendly enough—but you don’t know who they are, how experienced they are, or whether they’ve ever handled a case like yours before.

It’s a shot in the dark. And when it comes to something as serious as your mortgage, that’s a dangerous gamble.

Would you book surgery without knowing anything about your surgeon? Probably not.

So why do so many people blindly choose a mortgage broker without checking their background, specialism, or even if they’re a good fit?

❌ The Problem: You Don’t Know Who’s on the Other End of the Phone

Most mortgage platforms give you one thing: a phone number. Sometimes it rings a local office. Sometimes it connects to a call centre. But almost never does it give you the full picture:

-

Who is this person?

-

What’s their experience?

-

Have they handled cases like mine before?

-

Do they understand my language or cultural background?

-

Can I trust them to represent me to a lender?

You could be speaking to someone who’s never handled a case like yours—or worse, doesn’t have access to the lenders you actually need.

In today’s mortgage market, guesswork can cost you in higher rates, missed opportunities, or delayed purchases.

The Smart Solution: A Mortgage Directory That Lets You Choose

At Connect Experts, we think it’s time to flip the process on its head.

Instead of being assigned a random broker or calling someone blindly, you choose who you want to work with, based on what matters most to you.

Our smart mortgage broker directory allows you to filter advisers by:

-

📍 Location – find someone near you for face-to-face support

-

🧠 Expertise – match with brokers experienced in your exact scenario (e.g. self-employed, bad credit, buy-to-let)

-

🌍 Language – work with someone who speaks your preferred language

-

👩💼 Gender – if you feel more comfortable with a male or female adviser, that choice is yours

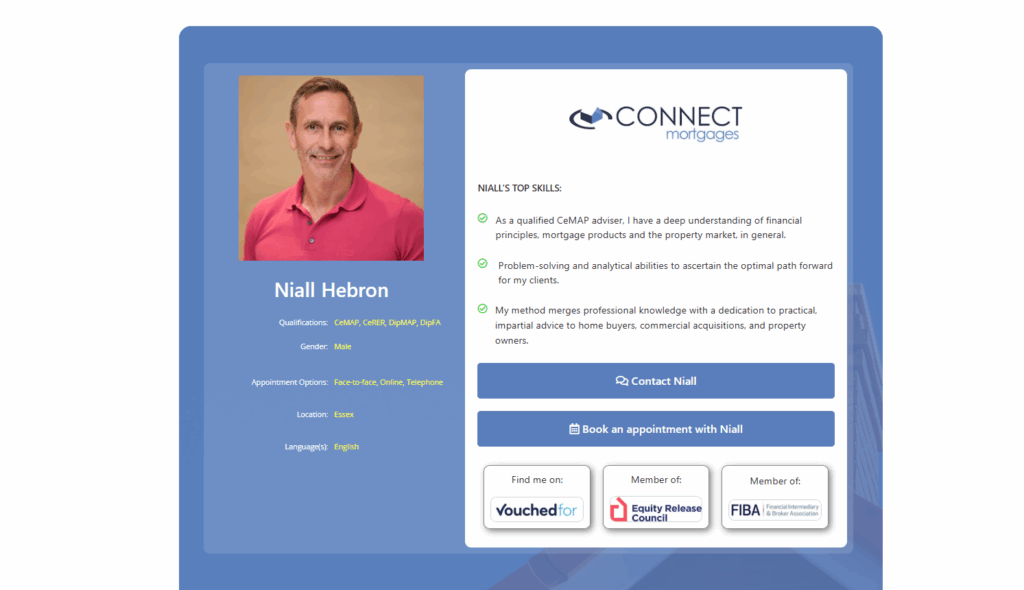

Once you apply your filters, you’re shown a list of matching broker profiles—each with detailed bios, areas of expertise, qualifications, and client reviews. You can make an informed decision before you even pick up the phone.

No more guessing. No more random referrals. Just the right adviser, the first time.

Why It Matters: The Right Match Means Better Outcomes

Let’s say you’re a single parent buying a home for the first time. You might feel more comfortable speaking to a female adviser who’s been through the process herself, and who specialises in first-time buyers with tight budgets.

Or maybe you’re a landlord with a growing portfolio who needs a broker familiar with complex buy-to-let structures.

The wrong match could mean delays, declined applications, or missed opportunities. The right one? It could mean lower rates, a faster offer, and a whole lot less stress.

A Mortgage Directory | Real Advice from Real People, Not Random Names

All advisers listed in the Connect Experts directory are:

-

Fully regulated by the FCA

-

Qualified and insured to provide mortgage advice

-

Supported by the Connect Network—one of the UK’s leading specialist mortgage networks

You’ll see their background, qualifications, and even read client feedback, so you can be confident before reaching out.

A Mortgage Directory | Ready to Stop Guessing?

Head to the Connect Experts Broker Finder Tool and search using your preferences. Whether you want someone near you, someone who understands your language, or a broker who’s an expert in your specific case, you’re in control.

Thank you for reading our “A Mortgage Directory | Find a Mortgage Broker” publication. Stay “Connect“-ed for more updates soon!