Healthiest Places to Live

Healthiest Places to Live: As we become increasingly health-conscious, it’s important to pay attention to the environments that support our well-being. Healthy living involves more than diet and exercise.

Choosing the right area ensures access to clean air, green spaces, and a strong local community. These factors create a healthier setting, supporting both physical and emotional well-being.

Buying a property is a major financial decision that requires a thorough assessment of affordability and mortgage options. The right location improves quality of life and affects property value and future returns. Mortgage choices must reflect individual circumstances, balancing affordability with long-term financial security.

For those considering a move, experienced Mortgage Brokers in Reading and nearby areas provide tailored guidance. They review financial situations, suggest suitable mortgage products, and simplify the borrowing process. With expert support, securing a mortgage that fits both lifestyle and budget becomes more straightforward.

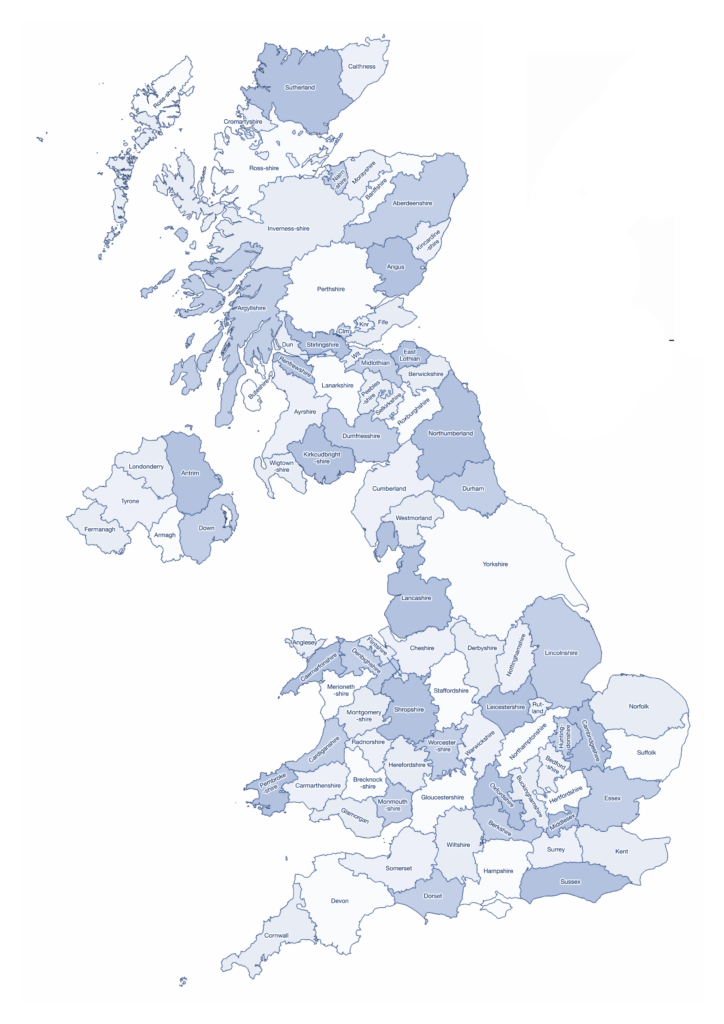

Locations with the Highest Life Expectancy

If long-term living is important when buying a home, some UK areas offer the highest life expectancy. Wealthy regions often provide excellent healthcare, top-quality amenities, and a calm environment, all contributing to longer and healthier lives.

Top Locations for Male Life Expectancy:

Kensington & Chelsea, London – A hub of cultural and historical landmarks, with access to world-class healthcare. (Life expectancy: 83.3 years, Avg. house price: £2.2 million)

St Albans, Hertfordshire – A historic cathedral city with ample parks and open spaces. (Life expectancy: 82.9 years, Avg. house price: £558,878)

East Dorset – Known for its serene countryside and relaxed pace of life. (Life expectancy: 82.8 years, Avg. house price: £390,286)

Harrow, London – A diverse, family-friendly area with excellent local services. (Life expectancy: 82.7 years, Avg. house price: £460,841)

South Cambridgeshire – Surrounded by scenic walking and cycling routes. (Life expectancy: 82.7 years, Avg. house price: £500,000)

Top Locations for Female Life Expectancy:

Chiltern, Buckinghamshire – A picturesque region with a blend of countryside and affluent residential areas. (Life expectancy: 86.7 years, Avg. house price: £675,714)

Camden, London – Surprisingly ranks high, offering green spaces like Regent’s Park. (Life expectancy: 86.7 years, Avg. house price: £1.08 million)

Hart, Hampshire – An area rich in natural beauty and farmland. (Life expectancy: 86.6 years, Avg. house price: £622,048)

Kensington & Chelsea, London – A sought-after location for affluent buyers. (Life expectancy: 86.4 years, Avg. house price: £2.2 million)

Westminster, London – An area boasting luxury residences and top-tier amenities. (Life expectancy: 86.3 years, Avg. house price: £1.14 million)

The Cleanest Air in the UK

Living in an area with low air pollution is important for many people. The cleanest places to live include:

Isle of Skye, Scotland (Avg. house price: £223,583)

Island life is not for everyone, but the Isle of Skye has been voted the most desirable place to live in Britain. With fresh sea air, stunning landscapes, and minimal light pollution, it offers a peaceful retreat from city life. The largest island in the Inner Hebrides is linked to the mainland via the Skye Bridge. It is famous for its dramatic scenery, including the Old Man of Storr and the rugged Cuillin mountain range.

If you are thinking about moving or investing in property here, a mortgage broker in the Isle of Skye can assist with all mortgage-related products. Whether you are a first-time buyer, remortgaging, or looking for buy-to-let options, expert guidance ensures you secure the right mortgage for your needs.

Aberystwyth, Wales (Avg. house price: £198,572)

Aberystwyth is a charming coastal town known for its Blue Flag beaches, historic castle ruins, and stunning countryside. It has some of the freshest air in the UK and has been recognised as one of the friendliest places to live. A survey revealed that 89% of residents greet people as they walk by, making Aberystwyth the most welcoming town in the country.

If you are considering relocating or investing in property here, a mortgage broker in Aberystwyth, Wales, can help. Expert advice can ensure you find the best mortgage solution, whether you are a first-time buyer, remortgaging, or exploring buy-to-let opportunities.

St. Ives, Cornwall (Avg. house price: £347,547)

The fishing village of St. Ives is renowned for its golden sandy beaches, turquoise waters, and rich artistic heritage. Home to the Tate St. Ives, the town has long been a source of inspiration for artists. With its cobbled streets, scenic countryside, and vibrant local community, it offers a peaceful coastal lifestyle.

A mortgage broker in St. Ives, Cornwall, can assist with mortgage-related products for those looking to buy property here. Expert local knowledge ensures access to the best mortgage options available, whether purchasing a first home, investing in a holiday let, or remortgaging.

Allendale Town, Northumberland (Avg. house price: £260,557)

The name Allendale originates from a Celtic term meaning ‘Valley of the Shining Water.’ This picturesque village is surrounded by moorlands, waterfalls, and diverse wildlife and offers a serene environment with fresh air and natural beauty.

If you are looking to settle in Allendale Town or explore property opportunities, a mortgage broker in Northumberland can assist with all mortgage-related products. Expert advice ensures you secure the right mortgage, whether buying your first home, remortgaging, or considering buy-to-let options.

Malvern, Worcestershire (Avg. house price: £289,090)

Malvern is a beautiful spa town celebrated for the Malvern Hills, a designated Area of Outstanding Natural Beauty. It features unique architecture, with many homes built using the distinctive Malvern Stone.

If you are considering a home purchase, remortgage, or property investment, a mortgage broker in Malvern, Worcestershire, can assist. Their knowledge of the local market and access to a variety of lenders ensure tailored mortgage solutions to meet your needs.

The Best Areas for a Smoke-Free Environment

For non-smokers looking to avoid second-hand smoke, these locations have the lowest percentage of smokers:

Christchurch, Dorset (4.6% smokers, Avg. house price: £393,696)

Christchurch, Dorset, is one of the UK’s top locations for clean living. In 2017, only 4.6% of residents reported smoking, the lowest rate among local authorities. This market town is famous for its stunning harbour and fresh coastal air. Many properties offer private moorings, making it ideal for boating enthusiasts.

Christchurch Priory and the Regent Centre Theatre attract visitors and locals alike, while breathtaking views of the Isle of Wight add to its charm. If you are considering buying property here, a mortgage broker in Christchurch, Dorset, can assist with mortgage-related products to help secure the best deal for your dream home.

West Devon (4.9% smokers, Avg. house price: £276,074)

Towns in West Devon, including Chagford, Okehampton, Princetown, and Tavistock, have some of the lowest smoking rates, with only 4.9% of residents identifying as smokers. Located near Dartmoor National Park, this area is a haven for outdoor enthusiasts, particularly walkers.

The West Devon Way, a scenic 37-mile trail from Okehampton to Plymouth, passes through historic settlements, moorland, and woodland tracks. It offers breathtaking views and showcases Devon’s natural beauty.

For those looking to settle in this area, finding the right mortgage is essential. A mortgage broker in West Devon can help secure the best mortgage-related products, whether you are buying a home, remortgaging, or investing in property. With local knowledge and access to a wide range of lenders, they can assist in finding the most suitable deal.

Maldon, Essex (5.3% smokers, Avg. house price: £348,247)

Maldon, one of Essex’s oldest towns, offers a mix of coastal charm and excellent transport links. Mainline rail connections provide easy access to central London. The town is popular with sailing enthusiasts, with facilities at Heybridge Basin and the historic Thames Barges at Hythe Quay.

If you are looking to buy property, refinance, or explore mortgage options, a mortgage broker in Maldon, Essex, can assist with mortgage-related products. Whether you are a first-time buyer, a home mover, or seeking a buy-to-let investment, expert mortgage advice is available.

Local statistics indicate that around one in 20 residents in Maldon are smokers, reflecting national health trends in small coastal towns.

North Warwickshire (5.7% smokers, Avg. house price: £233,586)

North Warwickshire is a largely rural district with several towns, including Atherstone, Coleshill, Polesworth, Kingsbury, and Hartshill. Historically, the area was linked to the coal mining industry. Today, residents focus on a healthier way of living.

If you are looking to secure a mortgage in this area, whether for a first home, buy-to-let investment, or remortgaging, a mortgage broker in North Warwickshire can assist with mortgage-related products. With expert guidance and access to a range of lenders, finding the right mortgage solution is straightforward.

Orkney Islands (6.3% smokers, Avg. house price: £160,390)

The Orkney Islands are known for their breathtaking landscapes and rich archaeological heritage. A recent Bank of Scotland Quality of Life Survey named it the best place to live in the UK. The archipelago offers natural beauty, with homes set against sandy beaches, rugged cliffs, and coastal vistas.

Whether you are looking for a seaside cottage or a property with panoramic ocean views, a mortgage broker in the Orkney Islands can assist with mortgage-related products. They can help secure the best deal for your ideal home in this idyllic location.

Finding Your Perfect Home with the Right Mortgage Broker

If you have found the perfect home but need financial guidance, Mortgage Brokers in Reading and other prime locations can assist. Their knowledge simplifies the home-buying process, ensuring you secure the best mortgage deal without hassle.

Whether purchasing in a wellness-focused city, a smoke-free town, or an area known for longevity, expert mortgage advice is essential. A broker tailors mortgage solutions to suit your budget while considering your lifestyle and financial goals. This allows you to make a confident and informed investment without unnecessary stress.

Your chosen location greatly impacts well-being, whether you prioritise a cleaner environment or a strong community. Finding the right mortgage support makes buying in the UK’s healthiest areas both straightforward and financially secure.