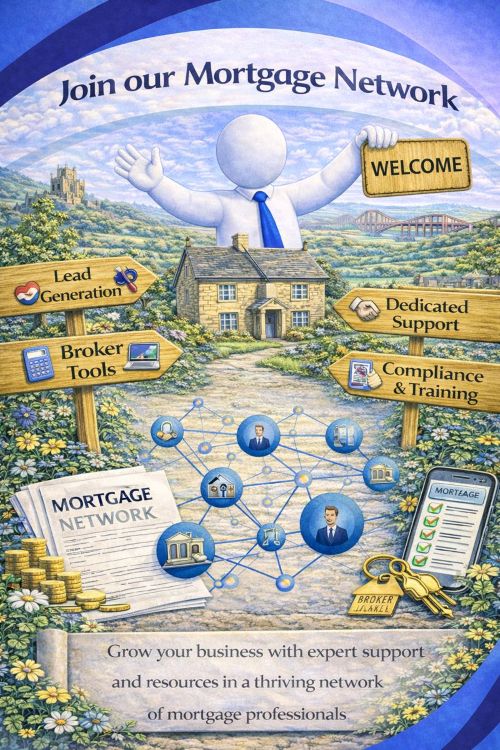

A Simple Question With a Clear Answer – Many advisers ask whether there is a better way to support long-term growth. At Connect, we believe there is, and we have built our mortgage network around that principle.

The Role of Connect for Intermediaries

Connect for Intermediaries is the core of our mortgage network. We act as the Mortgage Network for our appointed representatives across the UK. Our members are experienced mortgage brokers who operate within a connected, compliant network. They benefit from shared resources, structured support, and increased visibility within the market. This structure allows brokers to focus on delivering advice while operating within a clear and regulated framework.

More Than a Broker Network

Our network is supported by a digital platform that showcases broker expertise. Each adviser has a dedicated profile that helps them connect with clients actively seeking professional advice. Through Connect Experts, clients can find a mortgage adviser based on location, language, and area of expertise.

This creates relevant and informed introductions rather than untargeted enquiries. We do not focus on occasional lead distribution. Instead, we support sustainable growth through consistent and long-term lead generation.

A Practical and Proven Approach

Our approach is built around giving advisers the tools they need to grow independently. This includes structured support, training, and ongoing exposure to clients who need advice. Rather than relying on short-term solutions, our members are supported in building a stable pipeline. This allows advisers to develop their business at a pace that suits their goals. Brokers within the network can also benefit from increased visibility through the expert mortgage brokers directory in the UK.

How to Apply & What Happens Next”.

Why Join Our Mortgage Adviser Network?

We do not believe in starting from scratch. Our focus is on strengthening what already works and raising standards across UK mortgage broker networks. We support brokers in staying ahead of market change rather than reacting to it. The mortgage industry continues to evolve at a pace. Advisers must adapt to new technology while meeting higher client expectations to remain competitive.

AI-powered platforms can improve efficiency, but they often lack the personal connection clients value. That is where Connect Experts stands apart. We use intelligent systems to support brokers, streamline daily tasks, and improve accuracy. This enables advisers to deliver faster, more consistent outcomes for their clients. However, technology does not replace people. Human interaction remains central to everything we do. Trust, relationships, and personalised support are fundamental to good mortgage advice. Our systems are designed to enhance those connections, not remove them.

By joining Connect Experts, you gain access to practical tools, ongoing training, and market insight to support long term growth. You are never left to manage on your own. Our business development managers work closely with you and provide direct, hands-on support when you need it. You also receive full marketing support from experienced professionals who understand the mortgage sector. This includes guidance that aligns with your goals, not automated responses. Our approach helps you attract and retain the right clients in a competitive market.

Our member support team delivers clear and timely assistance. Advice is practical, relevant, and focused on helping you move forward with confidence. Support is provided by real people who understand regulatory requirements and the realities of advising clients. The mortgage market is changing rapidly. Brokers who adapt and invest in the right support will continue to grow. Those who do not risk falling behind.

Membership Options for Brokers, Companies & Individuals

Are you looking to grow your mortgage advisory business with the right support in place? Whether you are an established firm, a sole trader, or a trainee entering the industry through our Academy, this guide explains how Connect Network supports your professional development.

The guide provides a clear overview of membership options, lender access, and the training and compliance support available to mortgage advisers. You will also gain insight into how Connect Network helps advisers operate confidently within FCA requirements.

By joining Connect Network, you gain structured compliance support, access to a broad panel of lenders, and ongoing guidance designed to support sustainable business growth. Our approach focuses on helping advisers meet regulatory standards while building long term client relationships.

Connect Network supports mortgage advisers across the UK, including those based in London, Birmingham, Manchester, and surrounding areas. Advisers can also use Connect Experts to find a mortgage adviser or connect with brokers who specialise in specific client needs.

As a UK wide mortgage broker membership programme, Connect Network provides access to more than 200 lenders. This allows advisers to support clients across residential, buy to let, and specialist mortgage scenarios, subject to individual lender criteria.

Our network supports advisers operating throughout England, Scotland, Wales, and Northern Ireland. Members benefit from shared expertise, professional development resources, and access to expert mortgage brokers in the UK through the wider Connect Experts platform.

Explore the guide to learn how joining our mortgage broker network can support your career progression while maintaining high standards of advice and compliance.

People who found this page helpful also explored these related topics

People who found this page helpful also explored these related topics

| Question | Answer |

|---|---|

| Who can join the Connect mortgage network? | We welcome qualified FCA-authorised mortgage advisers and brokers looking to expand their businesses through a trusted network. Whether you are newly appointed or an experienced broker, we provide the tools and support you need to grow. |

| What are the main benefits of joining? | Members gain access to industry-leading support, compliance guidance, technology platforms, marketing tools, and a wide network of mortgage lenders and protection providers. You remain independent while benefiting from the strength of a national brand. |

| Is there a joining fee? | Fees depend on the level of support and services you choose. We offer flexible membership options designed to suit both individual advisers and larger broker firms. Our team can provide a clear breakdown of costs before you sign up. |

| Do I keep my own clients? | Yes. You retain full ownership of your clients. Our network is built on transparency, allowing you to manage your business with autonomy while having access to our resources and guidance. |

| Will I receive compliance and regulatory support? | Absolutely. Our compliance team ensures you stay up to date with FCA requirements, audits, and documentation. We provide regular training and practical advice so you can operate confidently and within regulatory standards. |

| Can I operate anywhere in the UK? | Yes. Our network supports advisers throughout England, Scotland, Wales, and Northern Ireland. You can work from your own office, remotely, or on the road with full access to our systems. |

| Do you offer training for new advisers? | Yes. We offer tailored induction training and ongoing development programmes. These cover compliance, sales techniques, product knowledge, and system navigation to ensure you are fully equipped from day one. |

| How long does the joining process take? | The onboarding process typically takes between two and four weeks. This includes due diligence, FCA checks, and training setup. Our onboarding team keeps you updated throughout the process. |

| What technology support do you provide? | Members receive access to advanced CRM systems, sourcing software, and marketing tools. Our technology is designed to streamline client management and increase efficiency. |

| How do I apply to join the Connect network? | You can start by completing our simple enquiry form on the Join Our Network page. Once we receive your details, one of our regional recruitment managers will contact you for an introductory call. |

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in your location are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across the UK.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us