Mortgage Adviser in Romford, Essex | Local Expertise from Michael O’Brien. Choosing the right mortgage in Romford, Essex, involves more than comparing rates.

Mortgage Adviser in Romford, Essex | Local Expertise from Michael O’Brien. Choosing the right mortgage in Romford, Essex, involves more than comparing rates.

Michael O’Brien, an experienced mortgage adviser in Romford, provides expert advice for buyers, landlords, and investors.

With deep knowledge of the Romford property market, Michael tailors mortgage solutions to match local trends and client goals.

Whether buying your first home, refinancing, or expanding a portfolio, he delivers clear, personalised advice throughout the process.

Reliable Mortgage Advice in Romford from Start to Finish

Michael O’Brien begins by reviewing your income, credit profile, and future plans in detail.

This ensures your mortgage options match UK regulations and lender requirements.

Document Preparation

Michael checks all paperwork for accuracy before submission to avoid processing delays or rejections.

Communication with Lenders

He handles all lender communications directly, resolving issues swiftly to keep applications moving forward.

Application Management

Your mortgage application is submitted with the right documents and monitored for progress at every stage.

Ongoing Guidance

Michael keeps you informed with straightforward updates so you can make decisions confidently and quickly.

Why Choose Michael O’Brien – Mortgage Adviser in Romford, Essex

Michael supports a range of mortgage needs across Romford and surrounding Essex areas.

Residential mortgages

We help first-time buyers take their first step onto the property ladder while also guiding existing homeowners through remortgages or securing second mortgages to meet their evolving needs.

Buy-to-Let & Rental Portfolios

Michael helps landlords structure buy-to-let finance aligned with tax efficiency and long-term growth.

HMO Mortgage Advice

Get expert support for licensing, valuations, and lender rules when financing Houses in Multiple Occupation.

Commercial & Semi-Commercial Mortgages

Michael arranges finance for shops, offices, and mixed-use premises based on tenancy status and income history.

Bridging Loans

Fast finance solutions for urgent cases like auctions, refurbishments, or purchases with tight deadlines.

Romford Property Market Overview

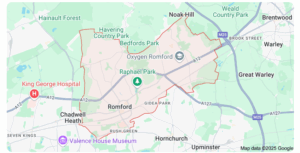

Romford, located in the London Borough of Havering, is a thriving property hotspot that blends urban convenience with suburban charm. Its strategic position on the Elizabeth line (Crossrail), excellent road connections via the A12 and M25, and regular rail services to London Liverpool Street make it especially attractive to both commuters and property investors.

The area features a wide range of property types—from Victorian terraces and 1930s semis to modern apartments and new-build developments—catering to diverse buyer needs. Ongoing regeneration efforts, including upgrades to the town centre, improved leisure facilities, and investment in housing and infrastructure, are enhancing Romford’s long-term value and appeal.

Key Romford Areas

Romford Town Centre

Highly desirable for commuters, the Romford Town Centre benefits from fast trains that can reach London Liverpool Street in under 30 minutes. The area offers a mix of modern flats and period homes, and its vibrant high street, shopping centres, and nightlife make it ideal for young professionals and investors seeking high rental yields.

Gidea Park

Gidea Park is popular with families because of its leafy streets, Edwardian architecture, and access to top-rated schools. The presence of parks, local amenities, and strong community spirit adds to its charm. Excellent rail links and Crossrail services make it a solid choice for commuters looking for a quieter lifestyle.

Collier Row

An affordable alternative to other parts of Romford, Collier Row is well-suited to first-time buyers. The area offers good value for money, with spacious homes, local shops, and nearby green spaces like Hainault Forest Country Park. It’s also seeing steady growth as buyers seek more for their budget.

Harold Wood

Demand in Harold Wood has surged thanks to Crossrail, modern housing developments, and improved local infrastructure. Its appeal lies in its combination of suburban tranquillity, access to good schools, and swift train journeys into Central London. Young families and professionals alike are increasingly favouring it.

Mortgage Expertise in Romford

Michael understands that each Romford neighbourhood has its own lending dynamics and buyer profiles. Whether you’re looking for a high loan-to-value mortgage in Collier Row or a competitive fixed-rate deal in Gidea Park, Michael’s in-depth knowledge of local property trends and lender criteria ensures you’re matched with the right mortgage product for your needs and goals.

Mortgage Adviser in Romford | Staying Compliant with Mortgage Changes

UK mortgage rules change often due to economic shifts and lender policies.

Michael stays updated on all regulations to keep your mortgage application compliant and competitive.

He works with many lenders, including those offering specialist and exclusive intermediary-only mortgage deals.

Useful for:

- First time buyers

-

Self-employed clients

-

SPV limited companies

-

Non-standard property types

-

Remortgages with capital release

Mortgage Adviser in Romford | Why Live or Invest in Romford?

Romford, located in the London Borough of Havering, is a thriving suburban town that offers the perfect mix of affordability, connectivity, and community. Whether you’re a commuter, a family, or a buy-to-let investor, Romford delivers a compelling blend of lifestyle benefits and long-term growth potential.

Transport Links

Romford is exceptionally well-connected, making it ideal for both daily commuters and those who value easy access to London and beyond.

-

Rail: Romford Station is served by the Elizabeth Line (Crossrail), offering direct services to London Liverpool Street in just 30 minutes. With the full launch of the Elizabeth Line, passengers now enjoy fast links to Canary Wharf, Tottenham Court Road, and Heathrow Airport.

-

Road: The town is situated near major road routes including the A12, A127, and M25, providing convenient connections to Essex, East London, and the wider motorway network.

-

Bus: A wide network of frequent London bus routes ensures smooth travel within Romford and to neighbouring areas like Hornchurch, Ilford, and Stratford.

Amenities

Romford boasts a variety of amenities that cater to both modern lifestyles and traditional community values.

-

Shopping: Home to The Liberty Shopping Centre, The Brewery, and an array of high street retailers, independent shops, and the iconic Romford Market, one of the largest street markets in the south of England.

-

Green Spaces: Residents can enjoy the outdoors at Raphael Park, known for its lake and gardens, or Bedfords Park, a nature reserve perfect for walking and wildlife watching.

-

Leisure: Romford offers cinemas, gyms, restaurants, bars, and a thriving nightlife, particularly appealing to younger residents and professionals.

Schools and Education

Romford is well-served by a selection of high-performing primary and secondary schools, both state-funded and independent. Popular choices include St Edward’s C of E Academy, Marshalls Park Academy, and Bower Park Academy, making the area attractive for families prioritising education.

The Romford Advantage

Romford combines the charm of suburban living with the convenience of London commuting. With ongoing regeneration, competitive property prices compared to Central London, and strong rental demand, it’s no surprise the town is increasingly popular among first-time buyers, growing families, and property investors.

Whether you’re looking to settle down or expand your property portfolio, Romford is a location that continues to offer excellent value and long-term potential.

Speak to Michael O’Brien – Mortgage Adviser in Romford

If you’re buying, refinancing, or investing in Romford, Michael O’Brien is ready to help. Get clear, current advice tailored to your financial situation and property goals.

Thank you for reading our “Mortgage Broker in Cambuslang, Glasgow | Pradeep Bera” publication. Stay “Connect“-ed for more updates soon!