Mortgage Affordability

Buying a home starts with understanding what you can realistically afford. Your personal budget may not match the amount a lender is willing to offer. Mortgage affordability assessments determine how much you can borrow based on verified financial information.

Lenders review several factors, including:

- Your income, including employed or self-employed earnings

- Regular household expenditure

- Existing credit commitments, such as loans or credit cards

- Dependants and living costs

- The size of your deposit

Affordability is not based on income alone. Lenders assess your full financial position to ensure mortgage repayments remain sustainable over time. Under Financial Conduct Authority guidance, lenders must carry out detailed affordability checks. These rules are designed to promote responsible lending and reduce the risk of borrowers taking on debt they may struggle to manage.

How to Use the Mortgage Affordability Calculator

This tool helps estimate how much you may be able to afford when buying a property based on your financial situation. Follow these steps to use it:

Enter Your Annual Income

- Input your total yearly income before tax in the “Annual Income (£)” field.

Enter Your Monthly Expenses

- Include all regular outgoings like rent, bills, loans, credit card payments, etc.

Enter Your Deposit

- Specify how much money you have saved for a down payment.

Enter the Interest Rate

- Input the expected interest rate on your mortgage (e.g., 5% should be entered as

5).

- Input the expected interest rate on your mortgage (e.g., 5% should be entered as

Enter the Mortgage Term

Enter the length of the mortgage in years (e.g., 25 years).

Mortgage Affordability Calculator

How Much Can You Borrow Based on Your Salary?

As part of the assessment, lenders apply stress testing. This means they calculate whether you could still afford repayments if interest rates were to rise. Even if you choose a fixed rate, your application may be assessed against a higher notional rate to reflect potential future increases.

Understanding how mortgage affordability works can help you:

- Set realistic property expectations

- Avoid rejected applications

- Strengthen your position before applying

- Plan for changes in interest rates

Before submitting a full application, reviewing your mortgage affordability with an experienced adviser can provide clarity and help you prepare supporting documentation. All applications remain subject to status, lender criteria, and full affordability assessment.

One of the key factors in assessing mortgage affordability is your income. Lenders typically limit borrowing to around 4.5 times your salary. However, some may extend this to five or even six times if you meet specific criteria, such as earning a high salary or working in certain professions.

For instance, if your annual salary is £50,000, a standard lender might approve a £225,000 mortgage. If you earn £75,000 or more, some lenders may consider increasing this to £375,000 or higher, depending on your financial history and stability.

What If You Are Self-Employed or Have Variable Income?

If you are self employed or receive income from commission, bonuses, or overtime, lenders will usually assess your earnings over a set period rather than relying on one strong year.

Most lenders calculate an average over the last two or three years. This helps them understand whether your income is stable and sustainable. Some lenders may also apply different rules to variable income, depending on their criteria.

For example, if you receive a £10,000 annual bonus, one lender may accept only 50 percent of that amount and use £5,000 in their affordability calculation. Another lender may average your bonus over two years. If you consistently earned £10,000 in each of those years, they may still use £5,000 to reflect potential fluctuations.

Each lender has its own approach to assessing complex or variable income. Speaking to a qualified mortgage adviser can help you identify lenders whose criteria align with your income structure and improve your chances of a successful application.

What Happens If Your Mortgage Term Extends Into Retirement?

If your mortgage term runs beyond your planned retirement age, lenders will assess whether you can afford the repayments after you stop working.

This means you may need to provide evidence of your expected retirement income. This could include:

- Workplace or private pensions

- State Pension

- Investment income

- Rental income

- Other regular, provable income sources

Lenders will review whether this income is sufficient to maintain repayments alongside your expected living costs. They may also consider outstanding debts and future financial commitments. If your projected retirement income does not meet affordability requirements, the lender may:

- Reduce the maximum loan amount

- Shorten the mortgage term

- Decline the requested term

- Suggest alternative options

For example, if you are 45 and apply for a 30-year mortgage, the term would run until age 75. If you plan to retire at 67, the lender will assess how you will afford repayments from age 67 to 75 using retirement income rather than employment income. This assessment can affect the amount you can borrow or the term offered.

If you expect your mortgage to extend into retirement, it is important to:

- Review your pension forecasts

- Understand your projected income

- Consider whether overpayments could reduce the term

- Seek advice before submitting an application

All applications are subject to status, affordability checks, and lender criteria. Speaking to a qualified mortgage adviser can help you understand how different lenders assess retirement income and mortgage term limits.

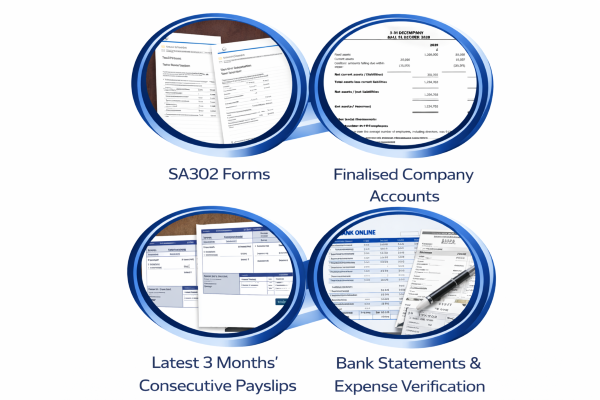

Income Verification and Documentation Requirements

When applying for a mortgage, lenders will ask for clear evidence of your income. This usually includes recent payslips, bank statements, or tax calculations if you are self employed. The information you declare must match the documents provided. Any discrepancies can affect how much you are able to borrow.

Lenders typically start by reviewing your gross income. They then consider deductions such as income tax, National Insurance, existing credit commitments, and pension contributions to assess your disposable income. This helps determine what you can reasonably afford each month.

Providing accurate and up-to-date documents reduces the risk of delays or changes to your mortgage offer. It also ensures your borrowing level reflects your true financial position and meets lender affordability criteria.

How Do Lenders Calculate Your Monthly Mortgage Affordability?

Lenders assess mortgage affordability by reviewing your income and essential monthly outgoings. Their aim is to ensure you can manage repayments both now and in the future. They look at the income you receive and subtract your committed and essential expenses. The remaining amount helps determine how much you may be able to borrow.

Existing Credit Commitments

Lenders review any outstanding borrowing, including:

- Personal loans

- Credit cards

- Car finance agreements

- Store cards

- Buy now pay later arrangements

They check your credit file to confirm balances and minimum monthly payments. Higher existing commitments can reduce the amount you may be eligible to borrow.

Making repayments on time is important, as missed payments may affect lenders’ decisions.

Household Living Costs

Lenders estimate your essential living expenses. These typically include:

- Utility bills

- Council tax

- Food and groceries

- Travel and fuel

- Insurance

Many lenders use statistical data, including information published by the Office for National Statistics and inflation measures such as the Consumer Price Index. This ensures affordability assessments are consistent and reflect general living costs. Even if your personal spending is lower, lenders may apply standardised cost models as part of their checks.

Personal Financial Commitments

Regular financial responsibilities are factored into affordability calculations. These may include:

- Childcare costs

- School fees

- Maintenance payments

- Long-term contractual obligations

Higher fixed commitments reduce disposable income and may limit borrowing capacity.

Expected Future Changes

Affordability is not assessed on current circumstances alone. Lenders may ask whether you expect changes that could affect your finances, such as:

- Planned parental leave

- Career changes

- Retirement

- Reduction in working hours

If income is likely to decrease, or expenses are expected to increase, lenders may adjust their calculations accordingly.

How Does a Lender’s Affordability Assessment Work?

Mortgage lenders must follow strict UK regulations designed to promote responsible lending. Before approving a mortgage, they assess whether the loan remains affordable both now and in the future.

Income Assessment

Lenders review your income in detail. This may include:

- Basic salary

- Bonuses or commission

- Self-employed income

- Rental or additional income

They usually require payslips, tax calculations, or company accounts. Income must be sustainable and evidenced.

Expenditure Review

Lenders also assess your regular spending. This includes:

- Credit commitments such as loans or credit cards

- Childcare costs

- Maintenance payments

- Household bills

- Living expenses

They may use your bank statements to verify spending patterns.

Stress Testing

In addition to reviewing income and expenditure, lenders apply a stress test. This checks whether you could still afford repayments if interest rates rise.

For example, if you apply for a £200,000 mortgage over 25 years at a fixed rate of 5.5%, your monthly payment might be around £1,250. However, the lender may test affordability at a higher rate, such as 8%. If the payment at the higher rate exceeds what your income supports, the lender may reduce the amount you can borrow.

Key Take Away

Mortgage affordability assessments ensure borrowers can sustain repayments both now and in the future. While it may feel frustrating if a lender offers less than expected, these checks protect both you and the lender from financial difficulties.

For more guidance, read our previous article on Mortgage in Principle to understand the first steps in securing a mortgage.

To increase the amount you can borrow, consider:

Reducing existing debt – Paying off loans or credit cards can free up disposable income.

Increasing your deposit – A larger deposit reduces risk, making lenders more willing to approve higher loan amounts.

Extending your mortgage term – A longer term lowers monthly payments, improving affordability.

Applying with a joint borrower – A higher combined income can increase borrowing potential.

Choosing a lender with flexible affordability criteria – Different lenders assess affordability differently; consulting a mortgage broker can help find the best fit.

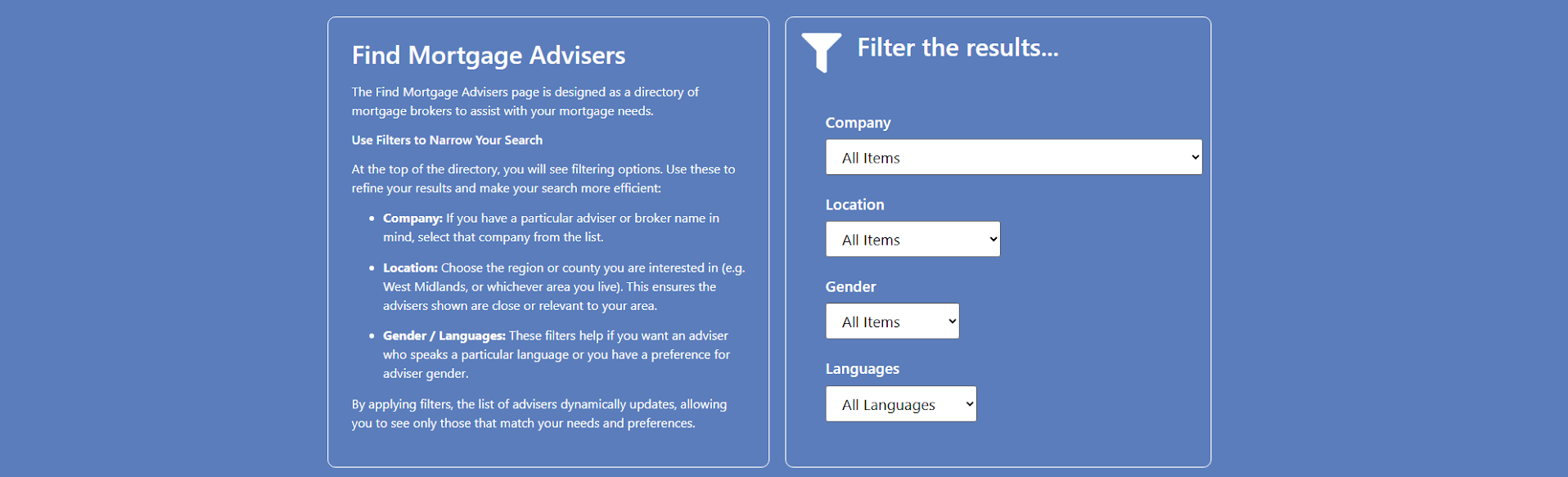

Search for a Mortgage Broker

People who found this page helpful also explored these related topics

FAQ: Mortgage Affordability

| Question | Answer |

|---|---|

| What is mortgage affordability? | Mortgage affordability refers to the amount you can comfortably borrow based on your income, expenses, and credit profile. Lenders assess affordability to ensure you can repay your mortgage without financial strain. |

| How do lenders calculate affordability? | Lenders review your annual income, regular outgoings, credit commitments, and living costs. They also apply a stress test to check whether you could still afford repayments if interest rates increase. |

| What affects how much I can borrow? | Your salary, employment type, monthly expenses, and credit score all play a major role. Other factors include any existing debts, dependents, and the size of your deposit. |

| Can I improve my mortgage affordability? | Yes. Paying down debts, improving your credit score, reducing regular outgoings, and saving for a larger deposit can all increase the amount you may be able to borrow. |

| Do lenders include bonuses or overtime in affordability checks? | Some lenders include bonuses and overtime, but they usually average these over the past one or two years. Evidence from payslips or tax returns will be required. |

| Does my credit score impact affordability? | Yes. A higher credit score can lead to better mortgage terms and higher borrowing limits, while a lower score can reduce the amount you can borrow or limit your lender options. |

| How does joint mortgage affordability work? | For joint applications, lenders combine both incomes and review both applicants’ debts and credit records. This often allows for a higher borrowing amount. |

| Can self-employed applicants pass affordability checks easily? | Self-employed borrowers can pass affordability assessments by providing two or more years of tax returns, SA302s, or accountant statements to prove consistent income. |

| What tools can help me check affordability? | Many lenders and brokers offer online mortgage affordability calculators. Connect Experts also provides a free calculator to estimate how much you might be able to borrow based on your details. |

| What should I do if I fail an affordability check? | If your initial application is declined, consider adjusting your loan amount, increasing your deposit, or reviewing your credit file. A specialist mortgage adviser can help you find a lender with more flexible criteria. |