Mortgage Broker Qualifications- When someone applies for a mortgage, they are often making one of the biggest financial commitments of their life. Behind every piece of regulated advice is a professional who has met strict standards. Understanding mortgage broker qualifications helps borrowers feel confident that advice is given responsibly, ethically, and in line with UK regulation.

In the UK, mortgage advice is regulated by the Financial Conduct Authority. Advisers must hold recognised mortgage broker qualifications and meet ongoing professional standards before they can provide regulated advice.

What Qualifications Should a Mortgage Broker Have?

To provide regulated mortgage advice in the UK, an adviser must hold appropriate mortgage broker qualifications recognised under the Regulated Qualifications Framework. The Financial Conduct Authority requires advisers to demonstrate the knowledge and competence needed to advise customers fairly and responsibly.

A mortgage broker must either be authorised by the Financial Conduct Authority or operate as an appointed representative of an authorised firm. In addition to holding a recognised qualification, advisers must meet ongoing training and competence standards.

Minimum Level 3 Qualifications

At a minimum, a mortgage broker must hold one of the following Level 3 qualifications approved by the Financial Conduct Authority:

Certificate in Mortgage Advice and Practice CeMAP

Awarded by The London Institute of Banking and Finance, CeMAP is one of the most widely held mortgage qualifications in the UK.

Certificate in Regulated Mortgage Advice CII CertRMA

Provided by the Chartered Insurance Institute, this qualification meets FCA requirements for advising on regulated mortgage contracts.

Mortgage Advice and Practice Certificate MAPC

A recognised qualification that satisfies the regulatory standards for mortgage advice.

Diploma for Financial Advisers DipFA

Although broader in scope, this diploma includes regulated mortgage advice modules and meets qualification requirements where appropriate.

Why These Qualifications Matter

Recognised mortgage broker qualifications confirm that an adviser understands:

- FCA rules and regulatory responsibilities

- The principles of Treating Customers Fairly

- Mortgage products and lending criteria

- Affordability and risk assessment

- Ethical standards and professional conduct

Holding a qualification alone is not sufficient. Advisers must also complete ongoing Continuing Professional Development to maintain competence and stay current with regulatory changes.

If you are considering entering the profession, you can explore how to become a mortgage broker with Connect Experts and understand the standards required to provide regulated advice. Firms that operate within an FCA-authorised mortgage network must ensure that advisers meet qualification, supervision, and compliance requirements at all times.

Do Mortgage Brokers Need a Statement of Professional Standing

Mortgage brokers in the UK are not required to hold a Statement of Professional Standing. An SPS applies to certain financial advisers who provide retail investment advice. Mortgage advisers are regulated under different Financial Conduct Authority requirements.

To give regulated mortgage advice, a broker must be authorised by the Financial Conduct Authority or act as an appointed representative of an authorised firm. They must also meet qualification and competence standards set out in the FCA Handbook.

What Is Required Instead of an SPS

Although an SPS is not mandatory, mortgage advisers must meet strict regulatory standards. These include holding an FCA-approved qualification and maintaining ongoing competence.

A regulated mortgage broker must:

- Hold an FCA-approved mortgage qualification, such as CeMAP or an equivalent

- Be authorised by the Financial Conduct Authority or operate under an authorised firm

- Complete appropriate Continuing Professional Development each year

- Follow FCA rules on conduct, disclosure, and treating customers fairly

Continuing Professional Development helps advisers keep their knowledge current. This includes staying informed about regulatory updates, changes in lender criteria, and evolving market conditions.

What to Do Once You Find a Mortgage Broker

Once you have identified a qualified mortgage broker, take time to prepare for your initial consultation. This helps ensure you receive clear, appropriate advice tailored to your circumstances.

Before proceeding, you should:

- Check the adviser’s Financial Conduct Authority registration on the FCA Register

- Confirm their qualifications, such as CeMAP or an equivalent recognised certification

- Ask for a clear explanation of their fee structure and when fees are payable

- Discuss your financial goals, budget, and preferred mortgage term

- Understand whether they provide whole of market advice or represent a limited lender panel

A professional mortgage broker should explain their recommendation clearly, outline any risks, and provide a written illustration before you make a decision. This supports informed choices and aligns with the principles of treating customers fairly.

If you are still researching your options, read our guide on “How to Choose the Right Mortgage Broker in the UK“.

Connect Experts Mortgage Broker Directory

The Connect Experts Mortgage Broker Directory helps individuals find qualified mortgage advisers across the UK. Each adviser profile clearly outlines their professional qualifications, regulatory status, and areas of expertise. This supports transparency and informed decision-making.

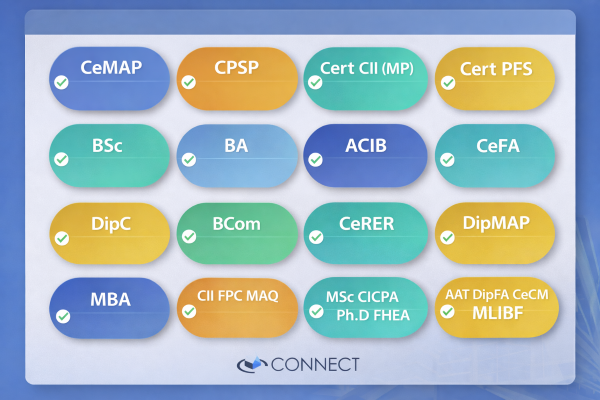

All advisers listed in the directory hold recognised mortgage broker qualifications, such as CeMAP, and operate under the Financial Conduct Authority’s regulation. This means they are either directly authorised or act as appointed representatives of an authorised firm. Clients can review an adviser’s credentials before contacting them.

For example, a profile may confirm that an adviser holds CeMAP certification and has experience arranging residential, buy-to-let, or specialist mortgages. Displaying qualifications helps ensure clients understand the adviser’s professional background and regulatory standing.

For example, a profile may confirm that an adviser holds CeMAP certification and has experience arranging residential, buy-to-let, or specialist mortgages. Displaying qualifications helps ensure clients understand the adviser’s professional background and regulatory standing.

The directory allows users to find a mortgage broker near you based on location and service requirements. Adviser listings are presented consistently, without comparison or ranking, so clients can choose the professional that best meets their needs.

If you are exploring career opportunities, you can also learn how to become a mortgage broker with Connect Experts. Our FCA authorised mortgage network provides compliance oversight and structured support for qualified advisers. Those interested in joining can review details about becoming an appointed representative within our network.

Connect Experts is committed to providing clear information about mortgage broker qualifications and maintaining regulatory standards that support fair and transparent customer outcomes.

Interested in Becoming a Mortgage Broker?

If you are considering a career in mortgage advice, obtaining recognised mortgage broker qualifications is an essential first step. In the UK, advisers must hold an approved qualification such as CeMAP and be authorised by the Financial Conduct Authority, or work as an appointed representative of an authorised firm.

Understanding how to become a mortgage broker involves more than passing exams. You must meet regulatory standards, complete ongoing professional development, and follow FCA rules designed to ensure fair customer outcomes.

Our Mortgage Academy provides structured training designed to help individuals prepare for industry qualifications and understand regulatory responsibilities. The programme focuses on exam preparation, compliance awareness, and practical knowledge required for working within a regulated environment.

If you would like to explore how to become a mortgage broker, you can learn more about the qualifications required and the steps involved in entering the profession.

Thank you for reading our guide, “Mortgage Broker Qualifications | Everything You Need to Know.” Stay “Connect“-ed for more updates soon!