Mortgage Brokers in Cumbria | Finding the right mortgage can feel complex, especially when your circumstances are unique. Connect Experts makes it easier to find a mortgage adviser in Cumbria who understands local property markets and your individual needs.

Our platform connects you with experienced, FCA-authorised mortgage brokers across Cumbria. Each adviser is fully qualified and offers advice based on your personal situation. This helps ensure the guidance you receive is suitable, transparent, and compliant with UK mortgage regulations.

Whether you are a first-time buyer, moving home, remortgaging, or investing in property, our mortgage brokers in Cumbria can help you explore suitable options. Advisers work with a wide range of lenders, including high street banks and specialist providers, giving you access to competitive mortgage products.

You can search for advisers based on location, expertise, and language preferences. This allows you to find a mortgage adviser who fits your requirements and communicates clearly throughout the process.

If you are unsure where to start, our find a mortgage adviser tool helps you quickly connect with professionals who can guide you through every step, from initial affordability checks to mortgage completion.

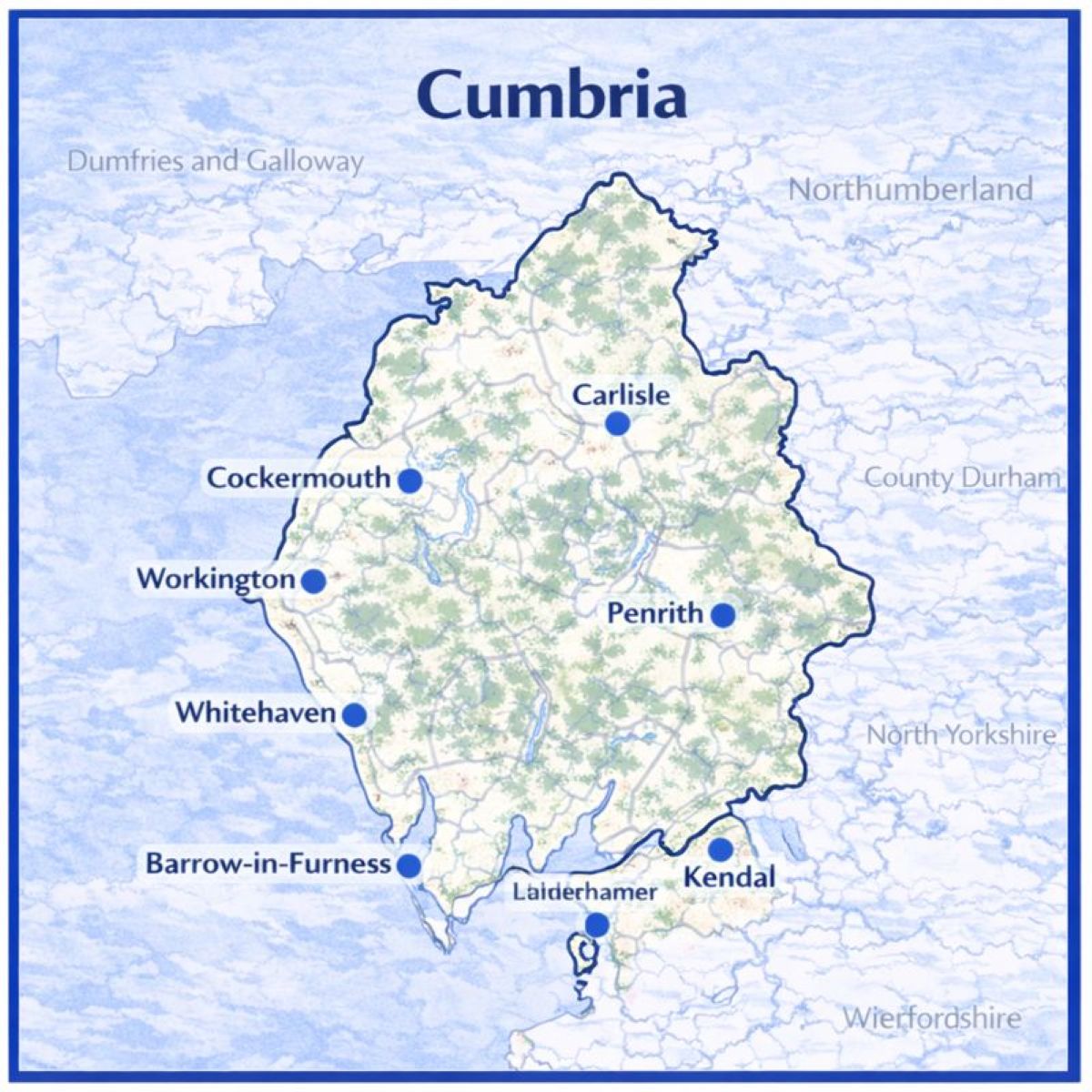

Map with Our Mortgage Brokers in Cumbria

Mortgage Advice in Cumbria That Reflects Local Property Needs

Working with a mortgage adviser in Cumbria can be helpful whether you are buying your first home, relocating within the county, or reviewing an existing mortgage. Cumbria’s property market is shaped by a combination of rural landscapes, coastal towns, national park areas, and historic settlements, all of which can influence mortgage lending decisions.

From market towns and villages to coastal communities and areas affected by conservation rules, Cumbria presents distinct considerations that differ from more urban counties. Mortgage advisers with local understanding are well placed to support buyers and homeowners navigating these factors.

Connect Experts helps you find mortgage advisers in Cumbria who understand how local property characteristics align with UK lender criteria.

Cumbria’s Property Market in Context

Cumbria is known for its large rural footprint and lower population density compared with many other counties. The housing stock includes traditional stone-built homes, farm conversions, cottages, and modern developments around key towns.

Some properties fall within or near protected areas, including the Lake District National Park. This can affect planning restrictions, property valuations, and lender requirements. Mortgage advisers familiar with Cumbria understand how these factors may influence mortgage assessments.

Local advisers also consider employment patterns linked to tourism, public services, manufacturing, agriculture, and small business ownership when reviewing affordability.

Guidance Throughout the Mortgage Process

Mortgage advisers support clients from the early planning stage through to mortgage completion. This includes reviewing income, deposit levels, credit history, and overall affordability before recommending suitable lenders.

They help prepare applications, manage supporting documents, and respond to lender queries. Advisers also coordinate with solicitors and estate agents to help keep the process moving.

All advice is provided in line with UK mortgage regulations and responsible lending standards.

The Importance of Local Knowledge in Cumbria

Although mortgage rules apply nationally, local property conditions can influence how lenders assess risk. Advisers who understand Cumbria’s housing market are familiar with how property type, location, and demand vary across the county.

This insight helps ensure advice reflects both lender expectations and the practical realities of buying or owning property in Cumbria.

Local advisers also stay informed about changes to lender criteria that may affect rural, coastal, or non-standard properties.

Cumbria Housing and Location Overview

Cumbria includes a mix of urban centres and rural communities. Key areas include Carlisle, Kendal, Penrith, Whitehaven, Workington, Barrow-in-Furness, and surrounding villages.

Some locations attract commuters or long-term residents, while others appeal to buyers seeking lifestyle properties or second homes. Transport links, local employment, and property availability vary widely across the county.

Mortgage advisers with Cumbria experience understand how these regional differences can affect affordability checks and lending decisions.

Mortgage Advice Tailored to Your Situation

Mortgage advisers in Cumbria provide advice based on your individual circumstances. This includes assessing income structure, deposit size, existing commitments, and future plans.

They explain how lenders apply affordability testing, stress rates, and loan-to-value limits under current UK regulations.

Support may include residential purchases, remortgaging, or buy-to-let properties, depending on your objectives and eligibility.

Access to a Broad Range of UK Lenders

Mortgage advisers listed on Connect Experts can access products from a wide range of UK lenders, including high-street banks and specialist providers.

This can support:

- First-time buyers

- Home movers

- Self-employed applicants

- Homeowners reviewing an existing mortgage

Recommendations are based on suitability and affordability rather than generic product matching.

Regulation and Consumer Protection

All mortgage advisers listed on Connect Experts are authorised and regulated by the Financial Conduct Authority.

Mortgage advice is provided in accordance with UK regulatory requirements.

Your home may be repossessed if you do not keep up with your mortgage repayments.

Did You Know

Cumbria is home to England’s largest national park by area. The Lake District National Park influences local planning rules and property availability, making local mortgage knowledge particularly valuable for buyers in the region.

Why Work With Mortgage Brokers in Cumbria

Cumbria offers one of the most distinctive property markets in England, shaped by its national park landscapes, rural communities, and popular market towns. From Kendal and Penrith to coastal areas such as Whitehaven, borrowing needs across the county often depend on location, property type, and lender appetite.

Working with a mortgage broker in Cumbria can help you make sense of these local factors while ensuring advice remains suitable, affordable, and FCA-regulated.

Understanding Cumbria’s Unique Housing Market

Cumbria includes a wide mix of housing, from traditional stone cottages in the Lake District to modern developments in growing towns. Property values and lending requirements can vary sharply between areas.

A broker with regional experience can explain how lenders may assess:

- Rural homes in remote villages

- Properties within national park boundaries

- Coastal housing near Workington or Barrow-in-Furness

- Older buildings with non-standard construction

- Valuation differences between tourist hotspots and commuter towns

This local insight can help buyers avoid unexpected delays during the mortgage process.

Practical Support Throughout the Application Journey

Mortgage brokers provide more than product comparisons. They guide borrowers through each stage, helping applications meet lender expectations.

Support may include:

- Reviewing income and documentation before submission

- Advising on affordability requirements

- Managing underwriting queries from lenders

- Assisting during valuation and legal stages

This structured guidance is especially helpful in Cumbria, where some purchases involve rural or specialist property considerations.

Mortgage Advice for Different Types of Buyers in Cumbria

Borrowers in Cumbria have a wide range of needs. Someone buying a first home in Carlisle may face different challenges compared with a buyer purchasing a countryside property near Windermere.

Mortgage brokers can assist with:

- Residential mortgages for home movers

- Remortgage planning when fixed rates end

- Buy-to-let options in high-demand rental areas

- Support for self-employed or seasonal income

- Specialist lending for complex credit histories

All recommendations must reflect suitability and affordability based on individual circumstances.

Access to Lenders for Rural and Coastal Purchases

Some mortgage products are not available directly from high street lenders. Brokers often have access to a broader range of criteria, which can be useful for Cumbria buyers looking to purchase unusual properties.

This can benefit households who are:

- Moving into rural parts of the county

- Buying homes with land or outbuildings

- Purchasing holiday let or second home properties

- Adjusting borrowing after career or lifestyle changes

A broker helps match the right lender approach to the property and borrower profile.

Confidence Through Clear Communication

Cumbria is home to a mix of long-established communities and growing diversity in towns such as Carlisle and Kendal. Some borrowers may prefer mortgage guidance that reflects language needs or cultural understanding.

Connect Experts provides access to advisers through our network of Bilingual Mortgage Brokers, supporting clients who feel more comfortable receiving advice in another language.

Finding the Right Broker in Cumbria

A mortgage broker in Cumbria can provide clarity, structure, and reassurance in a market shaped by rural conditions, tourism demand, and unique housing types.

For wider browsing beyond Cumbria, explore the A-Z mortgage adviser directory to compare advisers across the UK.

What Cumbia Is Known For Why People Choose to Live Here

Cumbria is best known for its dramatic landscapes, deep-rooted history, and strong sense of place. For people considering a move, the county offers a lifestyle shaped by nature, heritage, and space, alongside established towns and modern employment centres. These qualities influence not only day-to-day living but also property demand, planning rules, and long-term housing decisions.

A Landscape That Shapes Daily Life

The Lake District National Park dominates much of Cumbria and defines what it feels like to live in the county. As England’s largest national park, it brings lakes, mountains, and valleys into close reach of many communities. This access to open countryside is a major draw for buyers seeking outdoor lifestyles, quieter surroundings, or a slower pace of life.

Living near protected landscapes often comes with considerations such as planning restrictions, conservation rules, and increased demand for certain property types. Buyers are often drawn to villages and towns near Windermere, Keswick, and Grasmere due to their scenery and amenities.

Mountains, Lakes, and Outdoor Culture

Cumbria is home to England’s highest mountain, Scafell Pike, and its deepest and largest lakes. These natural features support a strong outdoor culture centred around walking, cycling, boating, and nature tourism.

For residents, this means year-round access to outdoor activities and seasonal changes that shape local life. It also affects transport patterns, visitor numbers, and property demand in popular areas, especially during peak months.

Heritage That Influences Property and Planning

Cumbria’s history stretches back thousands of years, from Roman Britain to medieval border conflicts. Hadrian’s Wall runs across the north of the county, while landmarks such as Carlisle Castle reflect Cumbria’s historic role as a border region.

These heritage assets enhance the character of many towns and villages but can also influence building regulations and development rules. Buyers often need to consider listed status, conservation areas, or archaeological sensitivity when purchasing older homes.

A Strong Walking and Community Culture

Walking is central to Cumbrian life. The famous Wainwright fells attract visitors and residents alike, creating a shared culture of outdoor activity. Many communities are shaped around footpaths, local pubs, and village centres rather than large retail hubs.

This culture appeals to buyers seeking community-focused living and contributes to steady demand for homes close to accessible walking routes and open land.

Wildlife, Conservation, and Environmental Awareness

Cumbria is closely associated with wildlife conservation and traditional farming. Native species such as red squirrels and Herdwick sheep are part of the county’s identity, and many areas prioritise land stewardship.

Environmental awareness also affects housing decisions. Buyers may encounter discussions around water quality, land use, and sustainable development, particularly near lakes and protected areas.

Dark Skies and Low Light Pollution

Many parts of Cumbria experience low light pollution, making stargazing a regular feature of rural life. Areas such as Ennerdale, Wasdale, and parts of the Eden Valley are valued for their night skies.

For buyers, this often correlates with quieter locations, lower housing density, and stronger connections to nature, though it can also mean fewer local services and longer travel times.

Transport, Rail Heritage, and Connectivity

Cumbria is served by historic and scenic rail routes, including the Settle-Carlisle line. While some areas are remote, towns such as Carlisle, Penrith, Kendal, and Barrow-in-Furness provide transport links to the rest of the UK.

Connectivity varies widely across the county, which is an important consideration for commuters, remote workers, and families. Buyers often balance scenic locations with practical access to services and employment.

Local Food and Regional Identity

Cumbria has a strong food identity, known for traditional products such as Cumberland sausage, Kendal Mint Cake, and Cartmel’s desserts. Local markets, independent producers, and village shops remain important to daily life in many areas.

This regional identity contributes to Cumbria’s appeal as a place rooted in tradition rather than rapid development.

Literature, Creativity, and Cultural Influence

Writers and artists such as William Wordsworth and Beatrix Potter helped shape how Cumbria is viewed worldwide. Their influence still shapes tourism, conservation, and cultural life.

This legacy contributes to Cumbria’s appeal for buyers seeking a location with depth, history, and a strong cultural narrative rather than purely commercial growth.

Modern Industry and Employment

Alongside tourism and agriculture, Cumbria supports advanced engineering and energy-related industries. Barrow-in-Furness plays a key role in submarine construction, while West Cumbria is linked to nuclear decommissioning and specialist skills.

These industries provide stable employment and influence housing demand in specific areas, particularly in West and South Cumbria.

Why This Matters When Buying Property in Cumbria

Cumbria’s character directly affects property choice, pricing, and long-term suitability. Buyers often need to consider:

- Rural access and transport links

- Planning restrictions near protected landscapes

- Seasonal visitor impact on towns and villages

- Employment patterns and local economies

- Property age and construction type

Understanding what Cumbria is known for helps buyers make informed decisions about where and how they want to live.

If you are Looking for a Mortgage Network

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Cumbria, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in Cumbria page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Cumbria.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us