Multifaceted Mortgage Advisers

Multifaceted Mortgage Advisers – Comprehensive Mortgage Advice for Every Need

Buying a property can be complex, especially when your financial circumstances are not straightforward. Connect Experts helps you work with multifaceted mortgage advisers across the UK who understand a wide range of mortgage scenarios. Our advisers provide clear, regulated advice across residential, buy-to-let, commercial, and specialist mortgages. This ensures the guidance you receive is tailored to your personal or business needs.

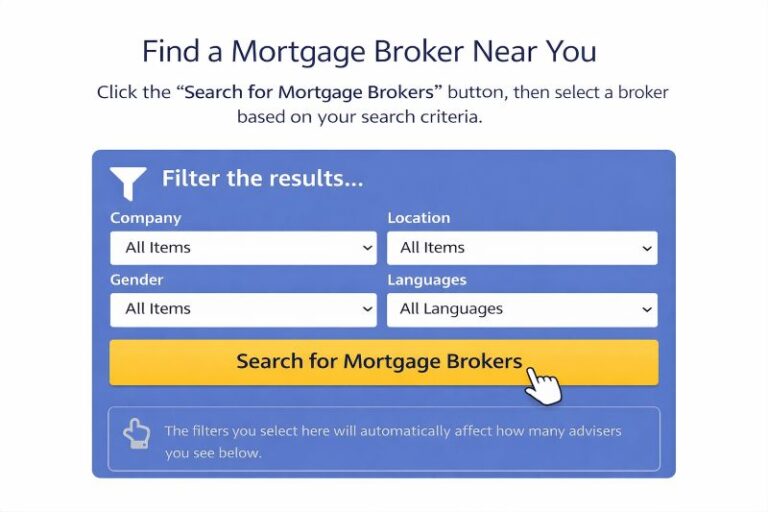

If you are unsure where to start, you can use our find a Mortgage Adviser service to connect with professionals who match your situation.

What Makes a Mortgage Adviser Multifaceted

A multifaceted mortgage adviser has experience across multiple areas of lending. They understand how different mortgage products work and how lender criteria can vary. This allows them to provide practical advice whether you are buying your first home, refinancing an investment property, or arranging finance for a business premises.

Many advisers listed in our A-Z mortgage brokers directory support clients with complex or non-standard requirements.

Key Areas of Expertise

Multifaceted mortgage advisers typically offer:

- Experience across residential, buy-to-let, and commercial mortgages

- Knowledge of personal and business lending structures

- Support for complex cases such as HMOs and portfolio landlords

- Guidance on protection and insurance alongside mortgage advice

Some advisers also work with international clients or offer multilingual support. You can choose bilingual mortgage brokers if clear communication in another language is important to you.

Find Multifaceted Mortgage Advisers Near You

Where Our Advisers Are Located

Connect Experts has multilingual mortgage brokers in every major UK region. You can find advisers who speak your language and understand your local market in the following areas:

| Location | Find Local Advisers |

|---|---|

| London | Mortgage Adviser in London |

| Birmingham | Mortgage Adviser in Birmingham |

| Manchester | Mortgage Adviser in Manchester |

| Glasgow | Mortgage Adviser in Glasgow |

| Bristol | Mortgage Adviser in Bristol |

| Leeds | Mortgage Adviser in Leeds |

| Liverpool | Mortgage Adviser in Liverpool |

| Nottingham | Mortgage Adviser in Nottingham |

| Edinburgh | Mortgage Adviser in Edinburgh |

| Cardiff | Mortgage Adviser in Cardiff |

Every adviser offers flexible appointment options in person, over the phone, or online to suit your schedule.

Expertise Across Every Mortgage Type

Connect Experts advisers are qualified and FCA-authorised, offering guidance in all major areas of lending, including:

- Residential Mortgages – For first-time buyers, movers, and remortgages

- Buy-to-Let Mortgages – For landlords and property investors

- Commercial and Semi-Commercial Mortgages – For business premises and mixed-use properties

- Bridging and Development Finance – For short-term and project-based borrowing

- Second-Charge Mortgages – To release equity without remortgaging

- Protection and Insurance – To secure your income, assets, and family

Whatever your goal, our multifaceted advisers have the insight and flexibility to find solutions that work for you.

Expert Advice, Made Easy

At Connect Experts, we believe that good advice begins with a clear understanding and meaningful communication. By choosing a multifaceted broker, you gain access to an adviser with the skills, knowledge, and flexibility to handle every aspect of your mortgage journey. These advisers combine experience across residential, commercial, and buy-to-let lending with a deep awareness of client needs, ensuring every recommendation is both practical and personalised.

A multifaceted adviser does more than find you a mortgage; they help you see the bigger picture. Whether you’re buying your first home, refinancing, or investing through a limited company, they can guide you through complex financial decisions with confidence and clarity.

Suggestions Inspired By Your Recent Activity

FAQ: Multifaceted Mortgage Advisers

| Question | Answer | Location Reference |

|---|---|---|

| What does a multifaceted mortgage adviser do? | A multifaceted mortgage adviser supports clients with a wide range of property finance needs, including residential, buy-to-let, commercial, and bridging mortgages. They offer guidance across several products to help you find a solution that fits your goals. | UK-wide |

| How are multifaceted advisers different from standard mortgage brokers? | Standard brokers may specialise in one area, while multifaceted advisers are trained and qualified to advise on multiple mortgage types. This allows them to consider your short and long-term financial plans before recommending the most suitable product. | Nationwide coverage including major cities |

| Can a multifaceted adviser help with both personal and business mortgages? | Yes. These advisers are experienced in handling both personal and commercial mortgage enquiries, offering advice to individuals, landlords, and business owners under one service. | London, Manchester, Birmingham, Leeds |

| Do multifaceted mortgage advisers offer protection and insurance advice? | Many do. Alongside mortgage guidance, they often provide advice on protection products such as life insurance, income protection, and critical illness cover to safeguard your financial wellbeing. | Across the UK |

| Are multifaceted advisers FCA authorised? | Yes. Every adviser listed through Connect Experts is FCA authorised and adheres to industry standards for transparent and compliant mortgage advice. | United Kingdom |

| Can I find a multilingual multifaceted adviser? | Absolutely. You can filter advisers by language, ensuring you receive clear advice from someone who speaks your preferred language. | London, Birmingham, Leicester, Glasgow |

| Do multifaceted advisers charge extra for multiple services? | No, the cost structure remains transparent. Fees are either agreed upfront or paid by the lender once the mortgage completes, depending on the adviser. | Nationwide |

| Can I meet a multifaceted mortgage adviser in person? | Yes. Most advisers offer both in-person and online consultations, giving you flexibility based on your schedule and location. | England, Scotland, Wales, Northern Ireland |

| Why should I choose a multifaceted adviser instead of several specialists? | Working with one adviser who understands your full financial picture saves time and ensures all advice aligns with your overall goals. It also prevents conflicting recommendations between specialists. | UK-wide |

| How do I find a multifaceted mortgage adviser near me? | Visit Connect Experts, enter your postcode, and filter by expertise. You will see qualified advisers in your area who specialise in multiple mortgage types. | All UK regions |

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, the Chief Executive Officer and founder of Connect Mortgages and Connect for Intermediaries. If you are a mortgage broker wanting to join a network, we welcome you to join our!

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us