Places to Retire

Choosing the best places to retire in the UK: Retirement should be a time for relaxation and enjoyment. Finding the right location involves more than just beautiful surroundings.

Access to healthcare, leisure activities, affordability, and a supportive community all play a vital role. Downsizing, moving to the coast, or using equity release can help improve financial stability.

Selecting the perfect location ensures a comfortable and secure retirement. Our expert mortgage brokers specialise in later-life mortgages, offering tailored advice for a smooth transition. Whether you need equity release or a new mortgage, we provide the best financial solutions.

Top Places to Retire in The UK

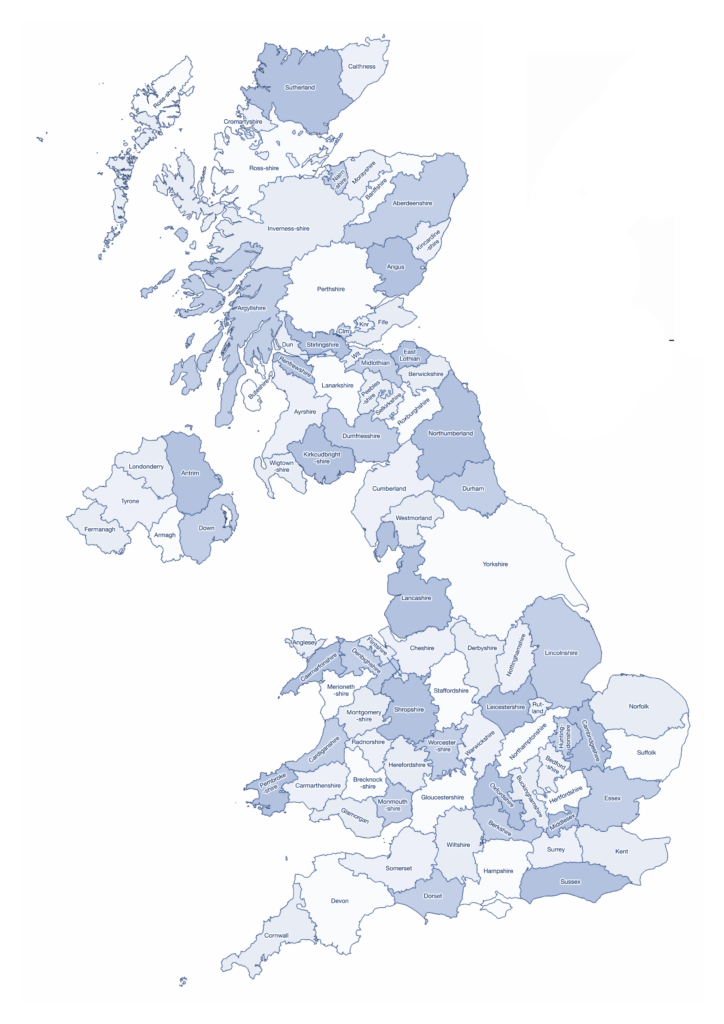

The UK has many retirement spots, ranging from peaceful coastal areas to lively countryside villages. These locations remain popular among retirees due to their affordability, healthcare access, lifestyle choices, and high quality of life.

Bournemouth, Dorset

Bournemouth remains a top choice for retirees due to its stunning coastline, mild weather, and welcoming community. The award-winning beaches and numerous leisure activities make it an appealing destination.

Average House Price: £368,000

Why It’s Popular: Excellent healthcare access, a picturesque seafront, and a lively town centre attract many retirees.

Mortgage & Equity Release Consideration:

Homeowners in Bournemouth may release equity to fund a more comfortable retirement while remaining in a sought-after coastal location. Speaking with an equity release broker in Bournemouth can help explore the best options.

York, North Yorkshire

York is ideal for retirees who enjoy history and culture. The city offers historic landmarks, cultural events, and excellent healthcare services.

Average House Price: £340,000

Why It’s Popular: York has strong transport links, a thriving cultural scene, and high-quality healthcare services.

Mortgage & Equity Release Consideration: Many retirees choose later-life mortgages to downsize or move into suitable retirement-friendly homes. Speaking with an equity release broker in York can provide expert advice on available options.

Southport, Merseyside

Southport offers Victorian charm, a stunning coastline, and a peaceful environment, making it popular among retirees seeking comfort and convenience.

Average House Price: £240,000

Why It’s Popular: Beautiful gardens, multiple golf courses, and a relaxed pace of life.

Mortgage & Equity Release Considerations: Downsizing in Southport can free up cash for retirement. A lifetime mortgage may be an option. Speaking with an equity release broker in Southport can help you explore the best options.

The Cotswolds, Gloucestershire & Oxfordshire

Retirees seeking scenic countryside and a peaceful lifestyle often choose the Cotswolds. This area features charming villages, stone cottages, and beautiful walking trails.

Average House Price: £450,000

Why It’s Popular: The region boasts stunning landscapes, a strong sense of community, and convenient access to healthcare services.

Mortgage & Equity Release Considerations:

Equity release could help retirees unlock funds while staying in their ideal countryside home. Consulting a broker covering the Cotswolds, Gloucestershire, and Oxfordshire is advisable. A specialist can provide tailored advice on suitable products and potential financial benefits.

Edinburgh, Scotland

Scotland’s capital is a top retirement choice, offering city conveniences alongside scenic green spaces. It boasts a rich history and diverse cultural attractions.

Average House Price: £315,000

Why It’s Popular: Excellent healthcare, a lively arts scene, and picturesque parks make it attractive for retirees.

Mortgage & Equity Release Consideration: Later-life mortgages can help retirees move or remain in this historic city. Speaking to an equity release broker in Edinburgh is advisable.

Mortgage Options for Retirees

Buying or financing a home in retirement demands careful financial planning. Our experienced mortgage brokers provide tailored solutions to help retirees maximise their assets.

Equity Release – Access tax-free cash from your home to support retirement expenses or fund home improvements.

Later-Life Mortgages – Flexible options for those over 55 who want to move home or remortgage for better financial stability.

Downsizing Support – Assistance in selling your current home and purchasing a smaller, more manageable property suited to your needs.

Our expert team ensures you find the right mortgage, giving you peace of mind in later life.

When deciding where to retire, consider healthcare access, social opportunities, living costs, and local amenities. Each factor plays a crucial role.

Whether you prefer a seaside escape, a historic town, or a peaceful countryside setting, the UK offers many great choices.

If you are planning retirement and need a mortgage solution to support your future, expert brokers can guide you. Contact our team today to explore your options and secure the retirement lifestyle you deserve.

For more details on equity release, explore our guide on Equity Release Brokers Near Me!