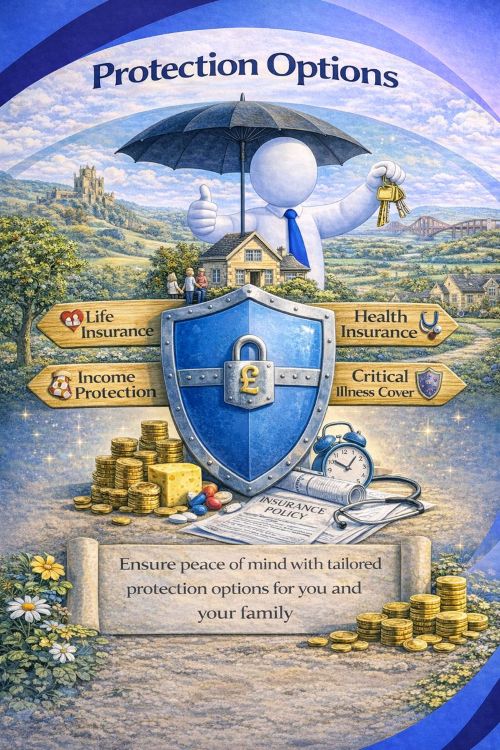

Protection Options – Safeguarding Your Financial Future. When taking out a residential mortgage, protection options play an important role in safeguarding your financial position. Choosing the right mortgage is only part of the process. It is equally important to consider how you would continue to meet repayments if your circumstances change.

You are here because you are seeking clear, reliable guidance on mortgage protection. That is where Connect Experts can help.

Connect Experts is a platform designed to help you find a mortgage adviser based on expertise, location, language, and personal preference. These factors often matter when discussing sensitive financial decisions such as protection planning.

Understanding Insurance: Protecting What Matters Most

Insurance provides a financial safety net that helps protect you, your family, and your assets from unexpected events. These may include property damage, theft, illness, or accidents that could otherwise cause financial strain.

Insurance policies are provided by regulated insurance companies and are designed to reduce the financial impact of unforeseen losses. In return for regular premiums, coverage may help with repair costs, replacement expenses, or financial support, depending on the policy in place.

Having the right insurance in place can support long-term financial stability and give you confidence as you plan for the future. Many people choose to review their cover alongside mortgage advice, as protection can play an important role when buying a home or refinancing. You can speak to a qualified adviser via our Find a Mortgage Adviser service to discuss how insurance and mortgage planning can work together.

Insurance products and eligibility vary based on personal circumstances. Terms, conditions, exclusions, and limits apply.

Add Your Heading Text Here

A mortgage is a long-term financial commitment. The right protection helps reduce the risk if your circumstances change. Without suitable cover, unexpected events could affect your ability to keep up with repayments.

Mortgage protection is designed to support you if illness, injury, or loss of income impacts your finances. The aim is to help protect your home and provide financial stability during difficult periods. Life insurance can help repay your mortgage if you pass away. This reduces the financial burden on your family and helps them remain in the property. Many homeowners choose cover that aligns with the outstanding mortgage balance.

Critical illness cover provides a lump sum if you are diagnosed with a serious medical condition. This money can be used to support mortgage payments, cover household costs, or make lifestyle adjustments during recovery. Income protection pays a regular monthly income if you are unable to work due to illness or injury. This helps you continue meeting mortgage repayments without relying on savings. Some people also consider mortgage payment protection insurance, which can provide short-term support following redundancy or illness.

Protection is often overlooked when arranging a mortgage. However, putting the right policies in place can offer reassurance and long-term security. A mortgage adviser can explain the available options and help you choose cover that suits your personal circumstances.

Why Do You Need Protection Options?

Some types of insurance are required by law or by lenders. Car insurance is mandatory if you drive a vehicle on UK roads. Buildings insurance is often required by a lender when you take out a mortgage, as it protects the property used as security.

Other forms of cover are optional but still important. Life insurance can help protect your family financially if your circumstances change. Long-term savings and pension planning can also play a key role in securing your future income.

While it is sensible to avoid paying for cover you do not need, it is equally important to understand the risks of having no protection in place.

Without the right insurance, unexpected events could place significant financial pressure on you or your household.

If you are unsure what level of cover is appropriate, speaking with a regulated adviser can help you make informed decisions based on your personal situation.

Types of Protection Options and Their Benefits

Mortgage Protection Insurance

This insurance ensures that your mortgage repayments are covered in case of job loss, illness, or death. Knowing that your home is safeguarded if unexpected financial difficulties arise gives you peace of mind.

Buildings and Contents Insurance

Your home is likely your most valuable asset. Buildings insurance protects the structure of your property against damage from fires, floods, and other disasters. Contents insurance ensures that your belongings are covered in case of theft, damage, or loss.

Critical Illness Cover

If you are diagnosed with a serious illness, critical illness cover provides a lump sum payout to help with mortgage repayments, medical expenses, or any other financial obligations. This means you can focus on recovery without added financial stress.

Income Protection Insurance

If you’re unable to work due to illness or injury, income protection insurance provides a regular income to cover essential expenses, including mortgage payments. This ensures financial stability during difficult times.

Life Insurance

Life insurance provides financial support to your family in the event of your passing. It ensures that your mortgage can be paid off, preventing your loved ones from facing financial hardship.

Other Services we provide

Finding the Right Protection Options Adviser

Choosing the right protection plan can be complex, especially as your financial needs evolve. Expert advice helps simplify the process and ensures the cover you choose is suitable for your circumstances. Whether you are a first-time buyer, a homeowner, or reviewing existing cover, working with a qualified adviser helps protect you and your family financially. A protection specialist can explain your options clearly and recommend cover based on your income, commitments, and long-term goals.

Connect Experts makes it easier to find the right adviser. Our platform allows you to find a mortgage adviser or protection specialist based on expertise, location, language, and gender. This ensures you receive guidance that is relevant, clear, and tailored to your needs. Rather than relying on generic solutions, you can connect with experienced protection advisers who offer regulated advice and access to suitable products from across the market.

Start your search with Connect Experts today and take a confident step towards securing your financial future.

People Also Browse These Titles

FAQ: Protection Options

| Question | Answer |

|---|---|

| What are protection options in mortgage advice? | Protection options are financial products that help you, your family, or your property stay secure if something unexpected happens. These can include life cover, critical illness cover, income protection, and mortgage payment protection. |

| Why should I consider protection when taking a mortgage? | Protection ensures your mortgage and household bills are covered if your income stops due to illness, injury, or death. It gives peace of mind that your family or dependents won’t face financial hardship. |

| What types of protection policies are available? | Common options include life insurance, critical illness cover, income protection, and family income benefit. Your adviser will recommend the most suitable plan based on your needs and circumstances. |

| Can I take protection even if I already have a mortgage? | Yes. You can arrange protection at any time, whether you are applying for a new mortgage or already have one. It’s always worth reviewing your existing policies to make sure they still meet your needs. |

| Is mortgage protection the same as life insurance? | No. Mortgage protection is designed specifically to cover your outstanding mortgage balance if you pass away, while life insurance can provide a lump sum for your loved ones for other financial needs. |

| How does income protection work? | Income protection replaces a portion of your income if you can’t work due to illness or injury. Payments continue until you return to work or reach the end of the benefit period agreed in your policy. |

| Can I protect my partner and family under the same plan? | Yes. Joint policies or family protection plans can be arranged so your household is financially secure if one partner becomes unable to work or passes away. |

| How much does protection cost? | Costs depend on your age, health, lifestyle, cover amount, and policy type. Your adviser will compare quotes across multiple insurers to find the best value for your budget. |

| Do I need a medical examination to apply? | Some insurers require basic health information, but many policies can be arranged with only a few questions. Your adviser will guide you through the requirements. |

| How do I review or update my protection plan? | You can review your protection policy at any time with your adviser, especially after major life changes such as a new job, marriage, or property purchase. |

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, the Chief Executive Officer and founder of Connect Mortgages and Connect for Intermediaries. If you are a mortgage broker in Rutland wanting to join a network, we welcome you to join our!

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us