If you are looking for mortgage brokers in Dorset, Connect Experts makes the process simple. We help you connect with advisers who understand local property markets and lender criteria. Every mortgage is different. That is why choosing the right broker matters. Our platform allows you to search for advisers based on your needs. This includes first-time buyers, remortgages, buy-to-let, and more.

Mortgage advice should feel clear and personal. With Connect Experts, you can quickly find a broker who matches your situation.

All advisers listed are FCA-authorised. This ensures you receive regulated and professional mortgage support.

Dorset offers a mix of coastal homes, rural properties, and growing towns.

A local mortgage broker can help you understand which lenders may suit your purchase.

Whether you are buying in Bournemouth, Poole, or Dorchester, area-specific advice can be valuable. If you need support in nearby areas, you may also want to view mortgage brokers in:

- mortgage advisers in Hampshire

- mortgage brokers in Somerset

- mortgage advisers in Devon

You can also explore our wider network if you want to find a mortgage adviser across the UK.

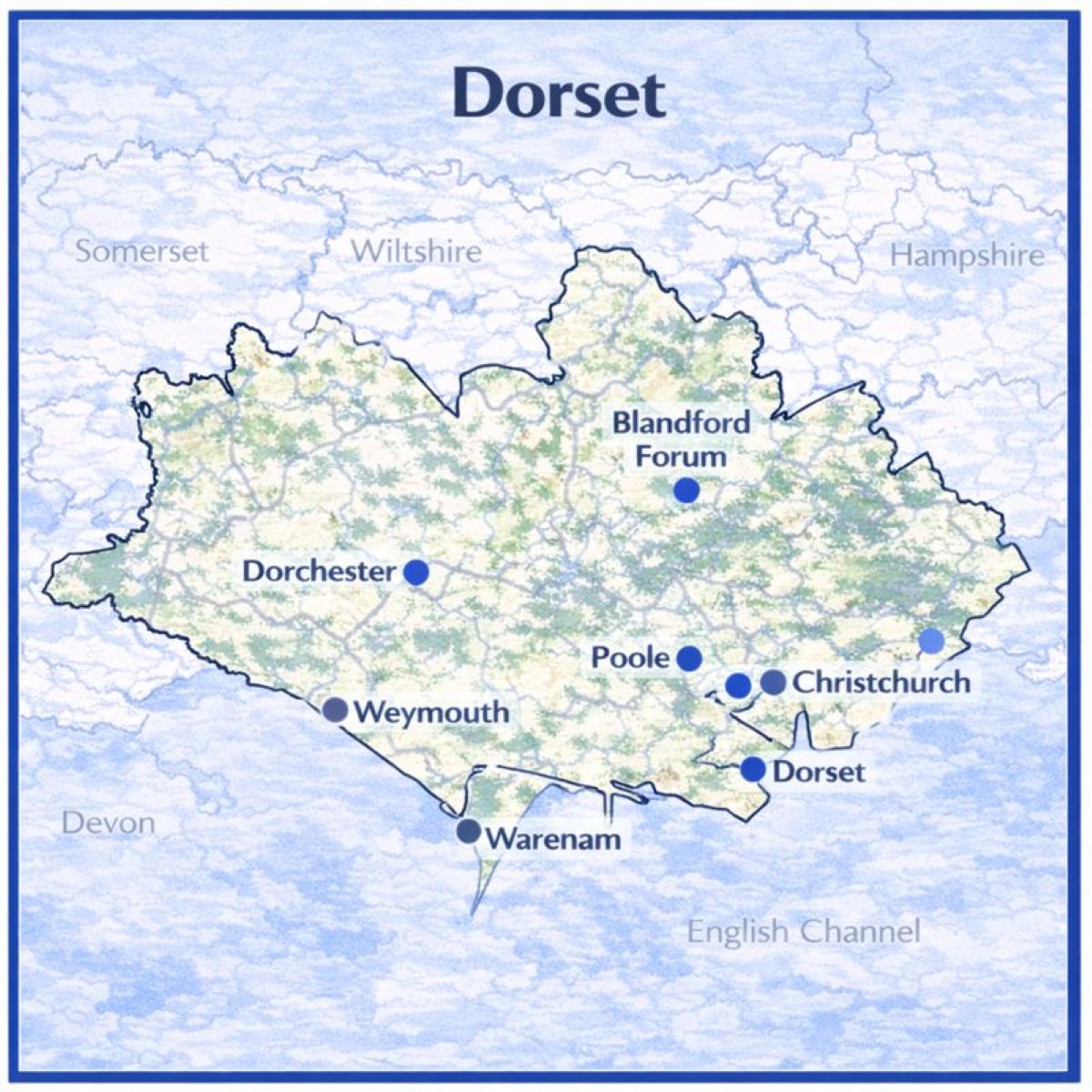

Map with Our Mortgage Brokers in Devon

Mortgage Advice in Dorset That Reflects Local Property Needs

Purchasing or refinancing a home in Dorset often involves factors that reflect the county’s coastal appeal and diverse property mix. Dorset includes sought-after seaside towns, historic villages, and countryside locations, all of which can influence lending decisions and valuation outcomes.

Working with a mortgage broker who understands Dorset can help ensure advice is appropriate for local housing types and current lender expectations. Connect Experts helps users locate advisers familiar with Dorset’s market conditions.

Dorset’s Housing Landscape and Lending Considerations

Dorset’s property market includes a wide range of homes, from Georgian terraces in Dorchester to waterfront apartments in Poole and Bournemouth. The county is also known for traditional stone cottages, holiday homes, and properties close to protected landscapes.

Some homes in Dorset may be in conservation areas or near the Jurassic Coast. These features can sometimes affect mortgage valuation, insurance requirements, or lender criteria.

Local mortgage advisers are often better placed to understand how these characteristics may shape mortgage options.

Tailored Advice Based on Dorset Buyer Needs

Mortgage advice in Dorset should reflect both the property and the borrower’s circumstances. Advisers support clients with varied needs, including:

First-time buyers entering higher-demand coastal areas

Home movers relocating within the county

Landlords purchasing buy-to-let properties

Homeowners reviewing deals at the end of a fixed term

All recommendations are based on affordability checks, income review, and UK mortgage regulations.

Access to a Broad Range of UK Mortgage Products

Mortgage brokers listed through Connect Experts can source deals from across the UK lending market, including mainstream banks and specialist providers.

This can be especially helpful for applicants such as:

- Self-employed borrowers with variable earnings

- Buyers purchasing older properties or non-standard homes

- Clients needing lending on flats near the seafront

- Homeowners seeking to refinance for renovations

Advisers assess suitability using deposit levels, term requirements, and long-term affordability.

Mortgage Support Across Towns and Villages in Dorset

Mortgage advice may differ depending on where you are buying in Dorset. The county includes distinct local markets such as:

- Bournemouth and Poole, with higher property values and apartment lending

- Weymouth, with a strong mix of residential and holiday housing

- Sherborne and Blandford Forum, where period homes are common

- Rural villages, where access and property type may affect valuations

A broker familiar with Dorset can help explain how lenders approach these regional differences.

Help Throughout the Full Mortgage Process

Mortgage brokers provide structured support from the early stages through to completion. This includes:

- Reviewing eligibility and deposit requirements

- Preparing lender documentation

- Managing communication during underwriting

- Supporting queries raised during property valuation

This guidance can reduce delays and ensure applications align with lender expectations.

All advice is delivered in accordance with regulated UK mortgage standards.

Why Dorset Knowledge Can Make a Difference

Dorset’s combination of coastline, countryside, and historic housing creates a market that differs from major urban centres. Local expertise helps ensure that national lending rules are applied appropriately to Dorset property features and buyer circumstances.

All advisers listed on Connect Experts are authorised and regulated by the Financial Conduct Authority.

Fun Fact

Dorset is home to the Jurassic Coast, England’s first natural UNESCO World Heritage Site. The coastline spans around 95 miles and is internationally recognised for its geological history and rare fossil discoveries.

Why Work With Mortgage Brokers in Dorset

Dorset is known for its coastal towns, historic villages, and desirable countryside locations. From property purchases in Bournemouth to rural moves near Dorchester or Bridport, buyers across Dorset often face different lending considerations depending on where and what they are buying.

Working with a mortgage broker in Dorset can help you understand lender expectations and receive advice tailored to your circumstances, delivered under FCA-regulated standards.

Dorset Property Markets Require Local Understanding

Dorset includes a wide mix of housing areas, from seaside destinations to quieter inland communities. Property prices and lender appetite can vary depending on factors such as location, demand, and property type.

A mortgage broker with Dorset experience can explain how lenders may view:

- Coastal flats in towns such as Weymouth or Swanage

- Period cottages in villages within the Dorset Area of Outstanding Natural Beauty

- New build developments around Poole and Christchurch

- Rural homes with larger land boundaries

- Second home and holiday let considerations in tourist regions

Local insight supports more accurate planning and helps avoid reliance on national assumptions.

Brokers Provide Support Through the Full Mortgage Process

Mortgage applications involve more than choosing an interest rate. Many borrowers benefit from support throughout the journey, particularly when documentation or lender requirements become more detailed.

A broker can help by:

- Checking your application readiness before submission

- Advising on affordability and suitable mortgage options

- Responding to lender underwriting questions

- Supporting you through valuation and offer stages

This guidance can reduce delays and help borrowers feel more confident.

Mortgage Advice for Different Dorset Buyers

Borrowers in Dorset often have different priorities depending on lifestyle, employment, and property goals. A first-time buyer purchasing in Bournemouth may face different affordability challenges than someone remortgaging a rural home near Sherborne.

Mortgage brokers can assist with:

- Residential mortgages for home movers

- Remortgage support when deals expire

- Buy-to-let borrowing in strong rental towns

- Self-employed applications with variable income

- Specialist lending for non-standard circumstances

All advice must remain suitable, regulated, and affordability-based.

Access to More Lending Options

Some mortgage products are not available directly through the high street. Brokers often work with a wide panel of lenders and understand the differences in criteria between providers.

This can be especially valuable for borrowers who are:

- Moving into Dorset from higher-priced regions

- Purchasing countryside or coastal properties

- Adjusting borrowing after income changes

- Seeking solutions for complex financial profiles

A broker helps align lender choice with the borrower’s situation.

Support for a Range of Communities

Dorset includes a growing mix of residents, especially in larger areas like Poole and Bournemouth. Some households may feel more comfortable working with advisers who offer flexible communication styles or language support.

Connect Experts can help match borrowers with advisers who provide culturally aware guidance, including access to multilingual support through our broker network.

Mortgage Confidence Across Dorset

A mortgage broker in Dorset can provide structure, clarity, and reassurance through one of the most important financial decisions you will make. With local understanding and regulated advice, borrowers are better placed to secure mortgage solutions that fit both the property and their personal circumstances.

What Dorset Is Known For Why People Choose to Live Here

Relocating to Dorset offers the chance to enjoy one of England’s most distinctive counties. Known for its coastline, market towns, countryside, and strong sense of community, Dorset appeals to buyers seeking a balanced lifestyle that combines modern convenience with traditional charm.

Whether you are moving for work, retirement, or a change of pace, understanding what Dorset is known for can help you feel confident about settling in the area.

Everyday Living in Dorset

Dorset is well regarded for its quality of life. Many towns offer good local amenities, healthcare services, and access to respected schools. Residents benefit from a slower pace of life compared with larger cities, while still within easy reach of strong transport links to Southampton, Exeter, and London.

The county attracts families, professionals, and downsizers who want a mix of rural surroundings and practical day-to-day infrastructure.

Dorset Food Traditions and Local Produce

Dorset is part of the West Country’s rich food culture. Cream teas are a familiar treat, served in tearooms across villages and coastal towns, often with views of rolling countryside or sea cliffs.

The county also has a long-standing apple-growing heritage. Local cider producers, such as those near Bridport, continue to make traditional Dorset ciders, offering tastings and farm visits that reflect the region’s agricultural roots.

Fresh seafood, artisan cheeses, and seasonal farm produce are widely celebrated in Dorset’s local food scene.

Historic Landmarks and Cultural Heritage

Dorset has a deep historical identity, with landmarks that span centuries. Places such as Corfe Castle highlight the county’s medieval past, while Sherborne Abbey reflects Dorset’s architectural and religious heritage.

Dorchester, the county town, is home to museums that explore archaeology, local art, and Dorset’s literary connections, including Thomas Hardy’s legacy.

For many residents, Dorset’s history adds lasting character to the places they live and explore.

Natural Beauty and Outdoor Lifestyle

Dorset is internationally known for its landscapes. The Jurassic Coast is one of the county’s most famous features, recognised as a UNESCO World Heritage Site. Towns such as Lyme Regis and Charmouth attract visitors and locals alike for fossil hunting, beaches, and coastal walks.

Away from the shoreline, areas like the Dorset Downs and Blackmore Vale provide open countryside, cycling routes, and peaceful hiking trails. Dorset is ideal for people who value outdoor space and nature on their doorstep.

Festivals, Events, and Local Community

Dorset has a strong community spirit and a busy calendar of events throughout the year. Popular highlights include the Dorset County Show, family festivals at Lulworth Castle, and creative celebrations like the Bridport Hat Festival.

These gatherings reflect Dorset’s welcoming atmosphere and help newcomers feel part of local life.

Crafts, Markets, and Coastal Culture

Towns such as Bridport, Shaftesbury, and Beaminster are known for artisan craftsmanship. Local makers produce ceramics, textiles, artwork, and other handmade goods, which are sold in independent shops and markets.

Dorset’s coastal villages also offer a relaxed lifestyle, with farm-to-table cafés, seafood restaurants, and traditional pubs forming an important part of everyday culture.

Why Dorset Appeals to Homebuyers

Dorset offers a rare blend of coastline, countryside, heritage, and modern living. From historic villages to thriving seaside towns, the county provides a lifestyle that feels both peaceful and connected.

For those planning a move, Dorset also benefits from a wide network of experienced property and mortgage professionals who can support buyers through the local housing market with clarity and confidence.

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Dorset, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our Dorset mortgage brokers page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Dorset.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us