Find your Mortgage Adviser

Find your mortgage broker and not your regret | Connect instantly with 350+ trusted and verified mortgage brokers across the UK. Whether you’re a first-time buyer, property investor, or business owner, you’ll get:

Expert mortgage advice tailored to your goals.

Access to competitive rates from leading lenders.

Personalised, one-to-one service that puts your needs first.

Support with residential, buy-to-let, commercial, and specialist mortgages.

Guidance on insurance and protection products to safeguard your future.

Finding the right broker shouldn’t be complicated. With our network, you can match with a professional who understands your situation and works hard to secure the best deal for you.

How It Works

How to Find a Mortgage Adviser via Connect Mortgages

Here’s how their process appears to work (based on their website):

- Visit https://connectexperts.co.uk/

Select your mortgage need/type

On their homepage, you can pick from categories such as:Residential (e.g. first time buyer, moving home, self-employed, credit problems)

Buy-to-let (e.g. first-time landlord, portfolio landlord, HMO, non-UK resident)

Commercial (e.g. business loans, development finance)

Specify adviser preferences

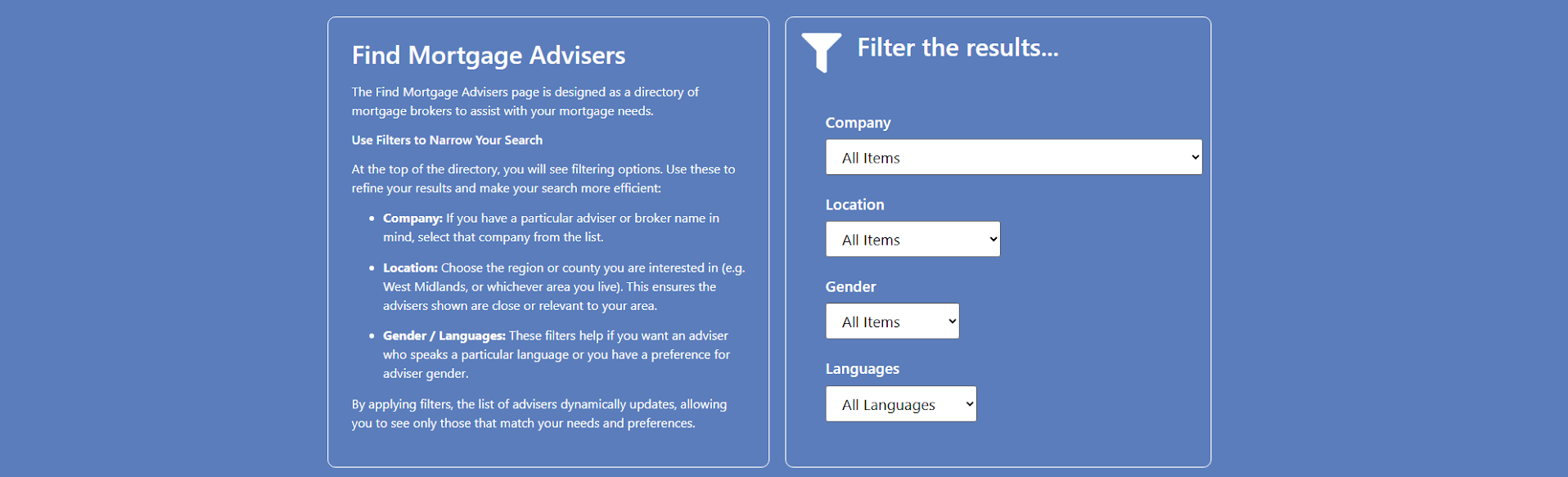

After selecting your mortgage need, you can filter or choose adviser preferences (for example by location, language, gender, or specialist expertise) so you can be connected to someone suited to your situation.Matching & recommendation

The platform matches you with one or more advisers from their network who meet your criteria.Advice & proposal

The adviser will assess your financial circumstances, needs and goals, and then recommend suitable mortgage products/lenders. Because they are a broker, they have access to a wide range of lenders, not just those of one bank.

What is Connect Experts / Connect Mortgages?

Connect Mortgages is the trading style of Connect IFA Ltd, which is fully authorised and regulated by the Financial Conduct Authority (FCA). This means the company operates under strict regulatory standards designed to protect consumers.

Credit Broker, Not a Lender

Connect Mortgages acts as a credit broker, not a lender. In practical terms, this means they don’t provide the mortgage funds directly. Instead, they work with a wide panel of banks, building societies, and specialist lenders to help clients find the most suitable mortgage or finance product for their circumstances.

Adviser Network

One of the key features of Connect is its nationwide network of advisers, with around 355 advisers currently listed. These advisers are spread across the UK and bring a wide range of expertise, ensuring that clients can access advice tailored to their unique financial situation.

Expertise and Qualifications

All Connect advisers are required to hold the relevant industry qualifications. They are trained to provide regulated advice across multiple areas of finance, including:

Residential mortgages – for first-time buyers, movers, and remortgages.

Buy-to-let mortgages – for landlords and property investors, including portfolio landlords and limited company structures.

Commercial and semi-commercial finance – for business premises, mixed-use properties, and development finance.

Bridging loans – short-term finance solutions to cover gaps in property transactions.

Protection and insurance – such as life cover, critical illness, and income protection to safeguard clients’ financial security.

Tailored Service

Because the adviser network covers different locations and areas of specialism, clients can be matched with someone who not only understands their mortgage requirements but also has experience with the specific type of finance they need. This helps ensure that the advice is both relevant and personalised.

Our Specialisations

First Time Buyer

Moving Home

Mortgage Rate Ending

Self Employed Mortgages

Self Employed

Adverse Credit Mortgages

Bridging Loans

Lifetime Mortgages

Portfolio Landlord

HMO Mortgages

Limited Company Mortgages

First Time Landlord

Choose a Broker by...

Finding the right mortgage broker often starts with location. Working with a local adviser means they understand your area, the property market, and any regional quirks that might affect your application. Whether you’re buying your first home, investing in buy-to-let, or looking at commercial property, a broker nearby can provide tailored advice with the added benefit of being accessible for in-person or virtual meetings.

At Connect Experts, our search tool makes it easy to find a mortgage broker by location. Simply enter your area and explore advisers who are authorised, regulated, and experienced in helping clients like you. You can check profiles, read reviews, and choose someone who not only knows the mortgage market but also understands the local landscape, so you can move forward with confidence.

Choose a Broker by Location

Applying for a mortgage is a big financial step, but it’s also deeply personal. Comfort, trust, and communication matter—and yet most platforms only let you filter by postcode or service type, not by the kind of adviser you’d actually feel comfortable speaking to. At Connect Experts, we know that choice matters. That’s why we’ve built a tool that allows you to find a broker by gender, language, location, and specialism—so you can choose someone who makes you feel at ease from the very start.

Whether you’re a first-time buyer, a single parent, part of the LGBTQ+ community, or simply someone who values cultural understanding, the right adviser can make all the difference. Every broker on our platform is FCA-authorised, qualified, insured, and vetted, giving you the confidence to have open and honest conversations about your future. Start your journey today with Connect Experts—because your mortgage adviser should feel right from day one.

Applying for a mortgage is a big financial step, but it’s also deeply personal. Comfort, trust, and communication matter—and yet most platforms only let you filter by postcode or service type, not by the kind of adviser you’d actually feel comfortable speaking to. At Connect Experts, we know that choice matters. That’s why we’ve built a tool that allows you to find a broker by gender, language, location, and specialism—so you can choose someone who makes you feel at ease from the very start.

Whether you’re a first-time buyer, a single parent, part of the LGBTQ+ community, or simply someone who values cultural understanding, the right adviser can make all the difference. Every broker on our platform is FCA-authorised, qualified, insured, and vetted, giving you the confidence to have open and honest conversations about your future. Start your journey today with Connect Experts—because your mortgage adviser should feel right from day one.