Do I Need a Mortgage Broker? Emma had spent weeks searching for her first home. She found a property she loved, but when it came to the mortgage, the options felt overwhelming. Fixed rates, variable rates, affordability checks, and lender criteria. The process seemed more complex than expected. She paused and asked herself a simple question. Do I need a mortgage broker?

It is a question many borrowers ask. The UK mortgage market offers thousands of products, each with different rates, fees, and lending criteria. Understanding which option suits your circumstances can feel challenging without guidance.

A mortgage broker provides professional advice to help you secure a mortgage that meets your needs and affordability. Brokers compare products from a range of lenders and explain how each option works. Their role is to help you make an informed decision based on clear information.

Unlike approaching a single bank directly, a broker can assess multiple mortgage products across different lenders. This does not mean one route is better than another. It means you receive a broader comparison before deciding how to proceed.

Brokers support many types of borrowers, including first-time buyers, home movers, and those looking to remortgage. They can also help if your situation is more complex, such as being self-employed or having a variable income.

The UK mortgage market is regulated and subject to change. Lender criteria, affordability rules, and interest rates can shift frequently. A broker keeps up to date with these developments and explains how they may affect your application. This can help reduce avoidable delays or declined applications.

If you are unsure where to begin, speaking with a qualified mortgage broker can provide clarity on your options and the steps involved.

Understanding the Role of a Mortgage Broker

A mortgage broker acts as an intermediary between borrowers and lenders. They review your financial circumstances and help identify mortgage products that may suit your needs and objectives. Unlike applying directly to a single bank, a broker may compare options from multiple lenders, depending on whether they operate on a whole-of-market or limited-panel basis.

Brokers assess factors such as income, credit history, deposit size, and affordability. They explain how lenders carry out affordability checks and credit assessments, helping you understand what may influence your application. This supports informed decision-making based on clear and balanced information.

A broker can also assist with preparing and submitting your application. They help ensure documents are accurate and complete before submission, thereby reducing delays caused by missing information. However, mortgage approval is always subject to lender criteria, affordability assessment, and credit status.

For those exploring residential mortgages, professional guidance may help clarify the different stages involved, from agreement in principle through to completion. If you are purchasing an investment property, you may wish to review options for buy-to-let mortgages to understand lender requirements and rental stress testing criteria.

Some borrowers require more specialist solutions. For example, commercial mortgages may be appropriate for business property purchases. Short-term funding needs might involve bridging finance, depending on your circumstances and risk profile. Homeowners exploring additional borrowing may also consider second charge mortgages as an alternative to remortgaging.

You are not required to use a mortgage broker. Some borrowers apply directly with a lender, while others prefer structured support to compare products and understand eligibility criteria more clearly. The appropriate route depends on your personal situation and the level of guidance you want.

Benefits of Using a Mortgage Broker

A mortgage broker provides regulated advice based on your individual financial circumstances. They assess your income, expenditure, credit profile, and future plans before recommending suitable mortgage products. Recommendations must meet affordability and lending criteria.

A broker can compare products across multiple lenders, depending on their panel or market access. This can help you review interest rates, product fees, incentives, and repayment options in one place. It allows you to make an informed decision based on suitability rather than just headline rates.

Using a broker may also save time. Instead of approaching several lenders individually, you receive structured comparisons and clear explanations of available options. This can be particularly helpful if your circumstances are complex or time-sensitive.

Brokers support you throughout the application process. They help ensure documents are accurate and complete before submission. This reduces avoidable delays and helps your application progress smoothly, subject to lender assessment.

They also explain mortgage terms in plain language. You should understand key details such as interest rate types, early repayment charges, arrangement fees, and total repayment costs over the term. Clear explanations support informed decision-making and fair customer outcomes.

A broker may liaise with lenders, solicitors, and other parties involved in the transaction. However, mortgage approval always depends on lender criteria, affordability checks, and your credit status.

Working with a mortgage broker does not guarantee approval or access to exclusive products. However, regulated advice can provide clarity, structure, and professional guidance when arranging a mortgage.

You can also explore related services such as residential mortgages, buy-to-let mortgages, commercial mortgages, bridging finance, second-charge mortgages, and protection insurance to ensure your wider borrowing and protection needs are considered.

While mortgage brokers offer many benefits, they also have potential disadvantages. Some brokers charge fees for their services, so it is important to understand these costs upfront.

Additionally, not all brokers provide access to the whole market. Some work with a limited number of lenders, which could restrict your options. To get the best advice, it is essential to choose a broker who has access to a broad selection of mortgage products.

Connect Experts: Helping You Find a Suitable Mortgage Adviser

Choosing a mortgage is a significant financial commitment. Before proceeding, it is important to understand your options, the costs involved, and the type of advice available to you.

If you are asking whether you need a mortgage broker, the answer depends on your circumstances. Some borrowers prefer to approach a lender directly. Others value regulated advice and support throughout the process. Understanding the differences can help you make an informed decision.

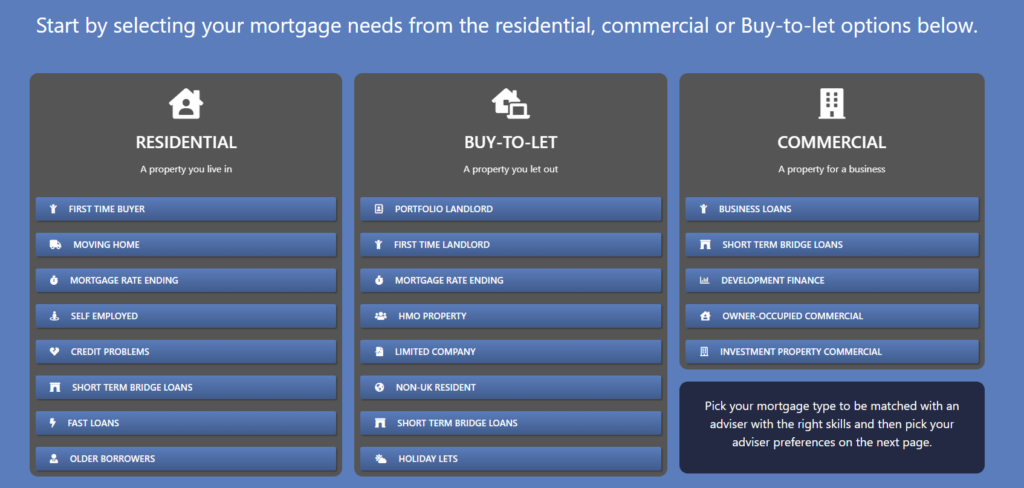

Connect Experts is a platform that helps individuals connect with qualified mortgage advisers across the UK. You can search for advisers by location, language spoken, and area of expertise. This allows you to choose a professional who suits your personal requirements.

Access to a Wide Range of Lenders

Advisers listed on Connect Experts may have access to a broad panel of lenders and providers. This can include high street banks, specialist lenders, and building societies.

Having access to multiple lenders may provide more options, particularly if you:

- Are self-employed

- Have a complex income

- Are you purchasing through a limited company

- Have previous credit issues

- Require specialist lending

The most suitable option will always depend on your individual circumstances.

Finding the Right Adviser for You

Connect Experts allows you to filter advisers by criteria such as:

- Location

- Language

- Experience in residential mortgages

- Experience in buy-to-let mortgages

- Knowledge of commercial mortgages or bridging finance

This does not mean one adviser is better than another. It simply helps you identify professionals who meet your preferences and needs.

Making an Informed Decision

If you are still considering do I need a mortgage broker, arranging an initial conversation can help clarify your options. Many advisers offer introductory discussions without obligation. A mortgage is a long-term financial commitment. Taking time to understand the process, compare options, and seek regulated advice where appropriate can help you proceed with confidence.

Before making such a crucial financial decision, ask yourself: Can I afford to overlook this question and proceed without fully considering the advantages and disadvantages?

Whether you’re looking for mortgage brokers in Essex or in London, Connect Experts makes the search effortless. Our platform lets you find a mortgage broker by location, gender, language, and area of expertise, ensuring you connect with the right professional for your needs.

Still wondering, do I need a mortgage broker? The best way to find out is by speaking to one. Gain insight, ask questions, and explore your options. A simple conversation could make all the difference in securing the best mortgage deal for you.

Is a Mortgage Broker Right for You?

Deciding whether to use a mortgage broker depends on your circumstances, experience, and confidence in arranging finance. You are not required to use a broker. Some borrowers prefer to approach a lender directly, while others value professional guidance.

A mortgage broker provides regulated advice and can compare products from a panel of lenders. This can help you understand which mortgages may be suitable based on your income, credit profile, and long-term plans. Advice must always be based on your needs and objectives, and is subject to lender criteria and affordability checks.

You may find a broker helpful if:

- You are unsure which mortgage type suits your situation

- Your income structure is complex, such as self-employed or multiple sources

- You have experienced credit issues in the past

- You are purchasing through a limited company

- You want support in managing the application process

However, some borrowers are comfortable researching products independently and applying directly to a lender. In straightforward cases, this may be a suitable option. It is important to compare both routes carefully.

Before proceeding, you should consider:

- Whether advice is regulated and tailored to your needs

- Any broker fees and how they are charged

- Whether the broker has access to a broad range of lenders

- The level of support provided from application to completion

If you would like structured, regulated guidance, you can speak to a qualified mortgage broker to discuss your options. You may also wish to review residential mortgages, buy-to-let mortgages, or second-charge mortgages to better understand the types of products available.

Whichever route you choose, ensure the recommendation is suitable for your circumstances. Mortgage approval is subject to status, lender criteria, and affordability assessment.

Thank you for reading our “Do I Need a Mortgage Broker? | Why Not Ask Connect Experts” publication. Stay “Connect“-ed for more updates soon!