If you are looking for mortgage brokers in Denbighshire, Connect Experts makes it easier to find the right adviser for your needs. Whether you are buying your first home, moving property, or switching deals, expert advice can help you make confident decisions.

All advisers listed on our platform are fully qualified and FCA-regulated. This means you receive guidance that complies with UK mortgage compliance standards and is tailored to your personal circumstances.

Denbighshire includes a wide range of towns and rural communities, and every borrower has different goals. A local mortgage broker can support you with:

- Residential mortgages

- Buy-to-let applications

- Remortgages and rate changes

- Self-employed lending options

- Specialist and complex cases

With Connect Experts, you can connect with advisers who understand the local market and lender criteria.

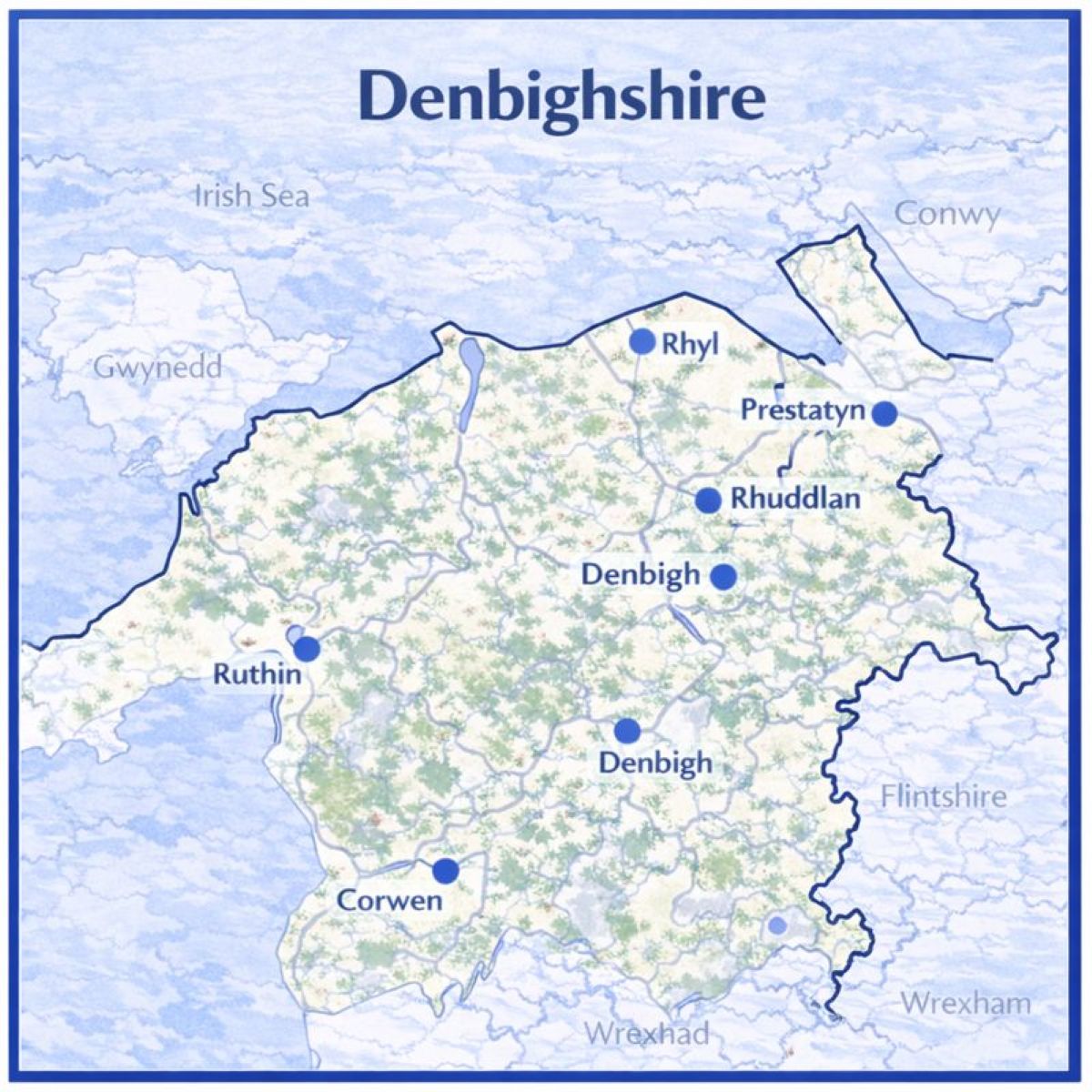

Map with Our Mortgage Brokers in Denbighshire

Mortgage Advice in Denbighshire That Reflects Local Property Needs

Working with a mortgage adviser in Denbighshire can be helpful if you are buying a home, moving within the county, or reviewing your current mortgage deal. Denbighshire combines coastal towns, market communities, and rural areas, so property types and lending considerations can vary by location.

From the North Wales coastline to the Clwydian Range, Denbighshire offers a varied housing environment. Mortgage advisers with local knowledge can help you understand how property features align with UK lender requirements and affordability standards.

Connect Experts helps you find mortgage advisers in Denbighshire who can provide guidance based on both local conditions and national mortgage criteria.

Understanding Denbighshire’s Housing Landscape

Denbighshire includes a mix of property settings, from seaside areas such as Rhyl and Prestatyn to historic inland towns like Ruthin and Denbigh.

Housing across the county may include:

- Traditional stone cottages and older terraces

- Modern residential developments near transport routes

- Rural properties with land or non-standard construction

- Coastal homes influenced by tourism and seasonal demand

Mortgage advisers familiar with Denbighshire understand how factors such as property age, construction type, and location may affect lender appetite.

Support Through Each Stage of the Mortgage Process

Mortgage advisers guide borrowers through the full mortgage journey. This often starts with an assessment of income, deposit size, credit history, and long-term plans.

They can support with:

- Comparing lender criteria

- Preparing documents for underwriting

- Submitting mortgage applications

- Responding to lender queries

- Coordinating with solicitors and estate agents

Advice is provided in line with UK mortgage regulations and affordability standards.

Why Denbighshire Local Knowledge Matters

While mortgage rules apply across the UK, local market conditions can still influence how lenders view certain applications.

Denbighshire includes areas where demand may differ between coastal towns, rural communities, and commuter accessible regions. Advisers with experience in the county understand these variations and how they may impact pricing, lending limits, and property valuation outcomes.

Local insight helps ensure mortgage advice is both practical and compliant.

FCA Regulation and Consumer Protection

All mortgage advisers listed on Connect Experts are authorised and regulated by the Financial Conduct Authority.

Mortgage advice is provided in line with UK regulatory standards.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Denbighshire Property Market Overview

Denbighshire benefits from regional connections through key routes such as the A55 along the north coast, linking towns to nearby Flintshire, Conwy, and wider North Wales.

Different areas attract different buyers:

- Rhyl and Prestatyn may appeal to coastal purchasers

- Ruthin offers a historic market town setting

- Llangollen attracts buyers seeking countryside living

- Smaller villages suit those looking for rural family homes

Mortgage advisers in Denbighshire understand how these local differences can affect affordability checks and loan-to-value considerations.

Mortgage Advice Tailored to Your Situation

Mortgage advisers provide support based on your individual circumstances, not generic assumptions.

This includes:

- Income structure, including self-employed cases

- Deposit availability and gifting considerations

- Existing credit commitments

- Mortgage term planning and future budgeting

They explain how lenders apply stress testing and affordability rules under current UK standards.

Support may cover residential purchases, remortgages, or buy-to-let applications, depending on your goals.

Access to UK Mortgage Lenders

Mortgage advisers listed through Connect Experts can access products from a wide range of UK lenders, including both mainstream banks and specialist providers.

This may help:

- First-time buyers

- Home movers

- Applicants with complex income

- Borrowers reviewing an existing mortgage deal

Recommendations are based on suitability, affordability, and lender criteria, not a one-size-fits-all approach.

Fun Fact

Denbighshire is home to the Clwydian Range, an Area of Outstanding Natural Beauty, known for its hilltop forts, walking routes, and panoramic views across North Wales.

Why Work With Mortgage Brokers in Denbighshire

Denbighshire is a diverse county in North Wales, shaped by a mix of coastal towns, rural landscapes, and historic market centres. From the communities along the North Wales coast to the scenic areas near the Clwydian Range, property choices in Denbighshire can vary widely, and mortgage requirements often depend on location, property type, and lender criteria.

Working with a mortgage broker familiar with Denbighshire can help borrowers understand local market conditions and receive advice based on affordability, suitability, and FCA-regulated standards.

Understanding Denbighshire’s Range of Property Types

Housing across Denbighshire includes everything from traditional Welsh stone cottages to newer developments in growing towns. Buyers may come across:

- Seaside homes near Rhyl and Prestatyn

- Period terraces in Denbigh and Ruthin

- Rural properties in hillside villages

- Family housing around St Asaph

- Character homes close to the Clwydian Range

Some properties may require additional lender consideration, such as:

- Older buildings with non-standard construction

- Valuation differences between coastal and inland areas

- Homes in conservation zones or historic settings

- Rural properties with access or land attached

A mortgage broker can explain how these factors may affect lending decisions before an application is submitted.

Practical Help Through the Mortgage Process

Mortgage applications involve more than choosing an interest rate. Brokers provide structured support throughout the process, which can be especially helpful when properties or finances fall outside straightforward criteria.

Support may include:

- Reviewing documents before submission

- Advising on affordability checks

- Responding to lender underwriting questions

- Helping borrowers prepare for valuation stages

This can reduce delays and ensure applications are presented clearly and accurately.

Tailored Advice for Different Denbighshire Borrowers

Borrowers across Denbighshire often have very different goals depending on where they live and what they are buying. A first time buyer in Rhyl may face different affordability limits compared with someone remortgaging a rural home outside Ruthin.

Mortgage brokers can assist with:

- Residential mortgages for home movers

- Remortgage planning at the end of fixed terms

- Buy-to-let borrowing in rental demand areas

- Support for self-employed applicants

- Specialist lending for complex income or credit history

All recommendations must reflect personal circumstances and lending suitability.

Access to Products Not Always Available Directly

Some mortgage products are not offered through high street channels. Brokers may have access to a wider range of lenders, including those who consider:

- Rural property purchases

- Applicants with multiple income sources

- Borrowers purchasing second homes near the coast

- Households adjusting borrowing after life changes

A broker helps match lender criteria to the borrower’s situation, rather than relying on general comparisons.

Guidance for Communities Across North Wales

Denbighshire includes a mix of Welsh-speaking communities, coastal towns, and areas with growing population movement from nearby regions. Some borrowers feel more confident working with advisers who understand local communication needs and community context.

Connect Experts can connect clients with advisers who offer multilingual guidance through our network of Bilingual Mortgage Brokers, helping clients receive mortgage advice in a way that feels clear and comfortable.

Finding Broker Support in Denbighshire

Mortgage decisions in Denbighshire can depend on local housing types, location factors, and lender criteria. A broker provides clarity and structured guidance during one of the most important financial commitments a household will make.

What Denbighshire Is Known For Why People Choose to Live Here

Denbighshire is one of North Wales’ most appealing counties, offering a rare blend of coastal living, countryside escapes, and historic charm. Stretching from the Irish Sea shoreline down into the Clwydian hills, it has become a popular choice for people who want more space, a stronger sense of community, and a higher quality of life without losing access to major UK cities.

Whether you are looking to relocate, invest in property, or find your forever home, Denbighshire offers something distinctive that continues to attract buyers year after year.

Outstanding Natural Landscapes and Outdoor Living

Denbighshire is best known for its breathtaking scenery and outdoor lifestyle. Much of the county lies within the Clwydian Range and Dee Valley Area of Outstanding Natural Beauty, making it a standout location for walkers, cyclists, and nature lovers.

The region is packed with rolling hills, forest trails, and panoramic viewpoints, including sections of the famous Offa’s Dyke Path, which draws visitors from across the UK.

Living here means having open countryside, rivers, and green spaces right on your doorstep, ideal for families and anyone seeking a calmer pace of life.

Rich Heritage, Castles, and Historic Market Towns

Denbighshire’s heritage is one of its strongest attractions. The county is filled with medieval landmarks, traditional Welsh architecture, and historic market towns that offer character and community.

Buyers are often drawn to towns like:

- Ruthin, known for its preserved town centre

- Denbigh, home to the impressive Denbigh Castle

- Rhuddlan, with its famous Edward I fortress

- St Asaph, one of the smallest cathedral cities in Britain

These areas offer a unique sense of place, with historic streets, independent shops, and local markets adding to their appeal.

Coastal Towns with Regeneration and Investment Potential

Along Denbighshire’s northern edge, the coastline provides a completely different lifestyle. Seaside towns such as Rhyl and Prestatyn offer sandy beaches, long promenades, and a growing tourism sector.

These towns have seen increased regeneration efforts in recent years, making them attractive to both residential buyers and buy-to-let investors seeking future growth opportunities.

Coastal property in this region can offer excellent value compared with other parts of the UK, particularly for those wanting access to the sea without premium pricing.

Affordable Property and Excellent Connectivity

Denbighshire is increasingly recognised for its affordability and location. Property prices often remain lower than in nearby English cities, while still offering strong transport connections.

Many residents commute or travel easily to:

- Chester

- Liverpool

- Manchester

This balance makes Denbighshire a smart option for families, professionals, and retirees seeking greater space and lifestyle value while remaining connected to employment hubs.

Strong Communities and Welsh Cultural Identity

One of Denbighshire’s most defining features is its sense of community. The county is proud of its bilingual culture, where Welsh and English are both widely spoken.

Local life includes farmers’ markets, arts festivals, agricultural shows, and community events that bring towns and villages together throughout the year.

This creates an environment that feels welcoming, grounded, and culturally rich, which is a major draw for people moving from busier urban areas.

Why People Choose to Buy in Denbighshire

Denbighshire appeals to a wide range of buyers, including:

- First-time buyers looking for better affordability

- Families wanting countryside and coastal access

- Landlords seeking strong rental demand in developing towns

- Retirees looking for peace, nature, and community

- Commuters who want value without isolation

It is a county that offers not just property, but a lifestyle built around space, heritage, and natural beauty.

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Denbighshire, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in Denbighshire page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Denbighshire.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us