If you are looking for mortgage brokers in Denbighshire, Connect Experts makes it easier to find the right adviser for your needs. Whether you are buying your first home, moving property, or switching deals, expert advice can help you make confident decisions.

All advisers listed on our platform are fully qualified and FCA-regulated. This means you receive guidance that complies with UK mortgage compliance standards and is tailored to your personal circumstances.

Denbighshire includes a wide range of towns and rural communities, and every borrower has different goals. A local mortgage broker can support you with:

- Residential mortgages

- Buy-to-let applications

- Remortgages and rate changes

- Self-employed lending options

- Specialist and complex cases

With Connect Experts, you can connect with advisers who understand the local market and lender criteria.

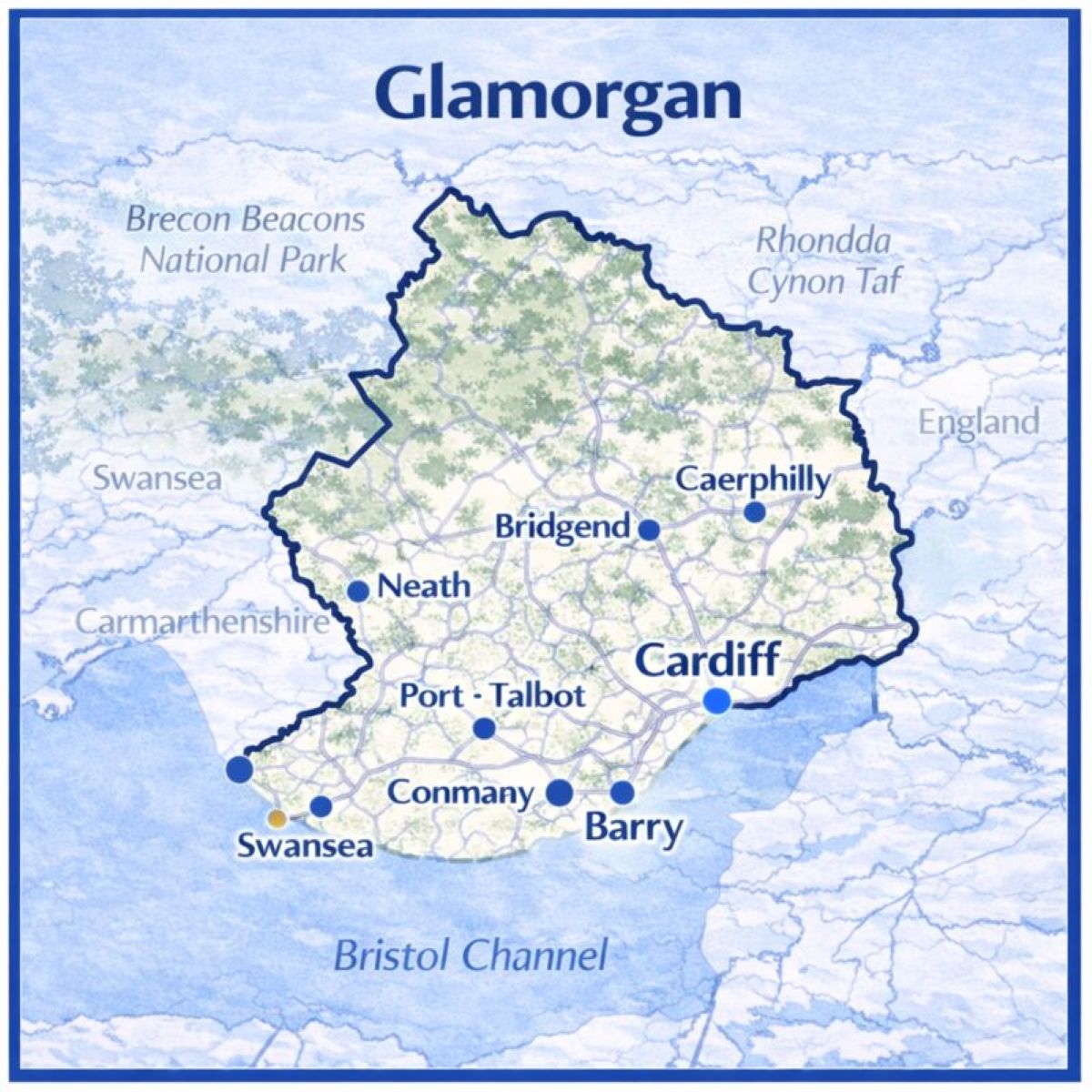

Map with Our Mortgage Brokers in Glamorgan

Mortgage Advice in Glamorgan That Reflects Local Property Needs

Choosing a mortgage broker in Glamorgan can make a meaningful difference when buying, moving, or refinancing a property. Glamorgan includes a mix of coastal areas, former industrial towns, and rural communities, all of which can influence property values and lender decisions.

Connect Experts helps you find mortgage brokers in Glamorgan who understand local housing conditions and current UK lending requirements.

Local Mortgage Knowledge Across Glamorgan

Glamorgan offers a broad range of property types. Buyers may consider terraced homes in valley towns, family houses in suburban areas, or coastal properties closer to the Bristol Channel.

Mortgage brokers working in Glamorgan understand how lenders assess affordability and risk across different locations. Property demand and pricing can vary between areas such as Cardiff, Bridgend, Barry, Pontypridd, and the surrounding valleys.

Local advisers are familiar with how regional property trends affect mortgage applications and valuations.

Mortgage Advice Based on Personal Circumstances

Mortgage advisers in Glamorgan provide guidance tailored to individual financial situations. This includes assessing income sources, deposit size, credit history, and long-term affordability.

Advisers consider how lenders evaluate borrowing limits and employment stability. This is particularly relevant for applicants with variable income or self-employment, which is common in parts of South Wales.

This personalised approach supports clients seeking residential mortgages, buy-to-let finance, or remortgaging options.

Access to UK Mortgage Products

Mortgage brokers listed on Connect Experts can source mortgage products from across the UK market. This includes high street banks and specialist lenders.

This approach may suit:

- First-time buyers purchasing in Glamorgan

- Home movers relocating within South Wales

- Self employed applicants

- Homeowners reviewing their existing mortgage

Advisers compare products based on loan-to-value ratios, interest rates, and long-term financial objectives.

Area Specific Guidance Within Glamorgan

Glamorgan includes locations with different property profiles and buyer demand. Local mortgage brokers understand how these differences influence lender criteria.

Whether buying in Cardiff, moving to Penarth, or purchasing in a valley town, advisers assess affordability alongside practical considerations such as commuting distance and local amenities.

This insight helps ensure mortgage recommendations reflect both financial and lifestyle factors.

Support Through the Mortgage Application Process

Mortgage brokers assist clients throughout the mortgage journey. This includes preparing documents, submitting applications, and communicating with lenders.

All advice follows UK mortgage regulations and affordability standards. This support can be especially helpful for applicants with complex income or previous credit concerns.

Why Choose a Local Mortgage Adviser in Glamorgan

Working with a Glamorgan-based mortgage adviser offers practical benefits. Local knowledge helps advisers identify lenders whose criteria align with regional property types and buyer profiles.

Advisers stay informed about market conditions across South Wales and provide guidance in line with current lending practices.

All brokers listed on Connect Experts are authorised and regulated by the Financial Conduct Authority.

FCA Regulated Mortgage Advice in South Wales

Mortgage advice provided through Connect Experts is compliant and regulated. Recommendations are based on individual financial circumstances and lender requirements.

This ensures advice is suitable, transparent, and aligned with responsible lending practices.

Did You Know!

Glamorgan has a rich industrial and coastal history and was once one of the world’s most important coal-producing regions. Today, its property market reflects a blend of historic communities, modern developments, and growing urban centres such as Cardiff.

Why Work With Mortgage Brokers in Glamorgan

Glamorgan is one of Wales’s most diverse and active property regions, covering busy urban centres, coastal towns, and countryside communities. From Cardiff’s growing housing market to the quieter areas of the Vale of Glamorgan, mortgage needs across the county often depend on local pricing, property type, and lender expectations.

Working with a mortgage broker in Glamorgan can help you make informed borrowing decisions with advice based on your circumstances and delivered under FCA-regulated standards.

Understanding Glamorgan’s Regional Property Landscape

Glamorgan includes a wide mix of locations, each with its own housing demand and lending considerations. Buyers may be looking at:

- City properties in Cardiff

- Family homes in Bridgend commuter areas

- Coastal housing near Barry and Penarth

- Valleys communities with older terraces

- Rural developments in the Vale of Glamorgan

A broker familiar with the area can explain how lenders may view differences between urban and coastal markets, or how valuations may vary across town and countryside boundaries.

Support Through the Full Mortgage Process

Mortgage applications often involve more than choosing an interest rate. Brokers guide borrowers through every stage, which can be especially helpful in competitive markets like South Wales.

A mortgage broker can support you by:

- Checking documents before submission

- Advising on affordability rules and suitability

- Managing lender underwriting questions

- Supporting the valuation and offer process

This structured guidance can reduce delays and help avoid common application issues.

Tailored Advice for Different Borrowers in Glamorgan

Borrowers across Glamorgan have very different goals. A first-time buyer purchasing in Cardiff Bay may face different affordability pressures compared with someone refinancing a long-term home in the Vale.

Mortgage brokers can help with:

- Residential mortgages for home movers

- Remortgage reviews when fixed terms end

- Buy-to-let options in high-demand rental areas

- Support for self-employed or contract income

- Specialist solutions where credit history is complex

Advice must always be based on individual affordability and lender criteria.

Access to Lending Options Beyond High Street Choices

Some mortgage products are only available through intermediaries. Brokers often have access to a wider lender network, which can be valuable for borrowers whose circumstances do not fit standard requirements.

This can benefit those who are:

- Moving into Glamorgan from other parts of the UK

- Buying coastal or non-standard properties

- Adjusting borrowing after income changes

- Seeking lending solutions for unique situations

A broker helps match the right mortgage product to the borrower’s needs, not just the headline rate.

Supporting Glamorgan’s Diverse Communities

Glamorgan is home to a broad mix of communities, particularly across Cardiff and the surrounding towns. Some households feel more confident receiving advice from an adviser who understands language preferences and cultural context.

Many brokers offer multilingual communication, helping clients who may prefer guidance in another language.

Finding the Right Broker Across Glamorgan

Mortgage decisions are long-term financial commitments, and the right support can make the process clearer and more manageable. A mortgage broker in Glamorgan provides local understanding, structured advice, and access to lenders suited to your circumstances.

What Glamorgan Is Known For Why People Choose to Live Here

Glamorgan is known for its balance of city life, coastline, countryside, and strong transport links. Located in South Wales, it includes the capital city Cardiff, major coastal towns, and former industrial communities that have seen long-term regeneration.

For homebuyers, Glamorgan offers a variety of lifestyles within short travel distances, making it attractive to families, professionals, and retirees.

Cardiff and Major Urban Centres

Glamorgan is home to Cardiff, the capital of Wales and the region’s main economic and cultural centre. Cardiff offers a wide range of employment opportunities, universities, hospitals, retail districts, and entertainment venues.

Other important urban areas include Swansea, Bridgend, Barry, Penarth, and Pontypridd. These towns offer a range of property options, from city apartments to suburban family homes to coastal housing.

Living close to Cardiff provides strong rail connections and access to major employers, while surrounding towns often offer better value for space.

Coastline and Seaside Living

One of Glamorgan’s defining features is its coastline. The Glamorgan Heritage Coast is known for dramatic cliffs, walking routes, and sandy beaches.

Popular coastal locations include Barry Island, Penarth, Ogmore-by-Sea, Southerndown, and Nash Point. These areas appeal to buyers seeking sea views, outdoor lifestyles, or weekend access to beaches without living in a remote area.

Coastal property can attract strong demand, so buyers should factor in local pricing trends and seasonal activity.

Natural Landscapes and Outdoor Access

Glamorgan is known for easy access to green spaces. Residents can reach country parks, coastal paths, and valley landscapes within short travel times.

The nearby Gower Peninsula, historically part of Glamorgan, is recognised for its beaches and coastal scenery. This makes the region appealing to buyers who value outdoor activities such as walking, cycling, and water sports.

Properties near open countryside often attract buyers seeking quieter living while remaining connected to urban centres.

History, Architecture, and Regeneration

Glamorgan has a strong industrial heritage shaped by coal mining, steel production, and dockland trade. Many former industrial areas have undergone regeneration, creating modern housing developments alongside historic buildings.

Cardiff Bay and Swansea SA1 are examples of waterfront regeneration that now offer modern apartments, leisure facilities, and employment hubs.

Buyers interested in character properties will find Victorian terraces, Edwardian homes, and historic town centres throughout the region.

Education, Employment, and Research

Glamorgan is known for its strong education sector. Cardiff University, Swansea University, and the University of South Wales attract students and professionals from across the UK and abroad.

Teaching hospitals and research facilities support employment in healthcare, engineering, and technology. This contributes to steady housing demand in key areas.

Families often consider school catchment areas when choosing where to buy, particularly around Cardiff and suburban towns.

Transport and Connectivity

Transport links are a key reason people choose to live in Glamorgan. The M4 motorway connects the region to England, while direct rail services link Cardiff and Swansea with London and the West of England.

Cardiff Airport, located in the Vale of Glamorgan, provides international travel options. Regular bus and rail services make commuting between towns manageable.

Areas with strong transport access tend to attract higher buyer demand.

Culture, Sport, and Community Life

Glamorgan is known for its sporting culture, particularly rugby and cricket. Major venues include the Principality Stadium and Sophia Gardens.

The region also has a strong arts and cultural scene, with theatres, museums, and festivals held throughout the year. Welsh language and identity remain visible in signage, education, and local events.

For many buyers, this sense of community and cultural pride adds to the appeal of living in South Wales.

Food, Markets, and Local Produce

Glamorgan has a growing food scene, with traditional Welsh produce alongside independent cafes, markets, and farm shops.

Cardiff Central Market, coastal seafood spots, and rural producers in the Vale contribute to the everyday quality of life for residents.

Access to local food markets is often a consideration for buyers moving from larger English cities.

Practical Considerations for Buyers

Property prices in Glamorgan vary by location. Cardiff and coastal towns often command higher prices, while valley areas and inland towns may offer better affordability.

Buyers should consider factors such as commuting needs, flood risk in coastal or riverside areas, and access to local services.

Mortgage advisers familiar with Glamorgan can help buyers understand how lenders assess different property types and locations.

Why Glamorgan Appeals to Homebuyers

Glamorgan is known for offering choice. Buyers can live in a capital city, near the coast, or close to the countryside without sacrificing connectivity.

The mix of history, modern development, and natural landscapes makes it one of the most versatile regions in Wales for property buyers.

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Glamorgan, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in Glamorgan page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Glamorgan.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us