Mortgage Brokers in Suffolk: If you are searching for mortgage brokers in Suffolk, Connect Experts makes it easier to connect with the right adviser. Choosing a mortgage can feel complex, but professional guidance can help you understand your options clearly.

Our platform allows you to find advisers who support buyers, landlords, and homeowners across Suffolk. All advisers are qualified and provide support based on your personal circumstances.

Whether you are buying your first home or planning a remortgage, you can find a mortgage adviser near you through our trusted search tool. Suffolk has advisers with experience in residential mortgages, buy-to-let cases, and specialist lending.

You can explore advisers based on:

- Your local area in Suffolk

- Your mortgage requirements

- Language preferences

- Expertise in complex applications

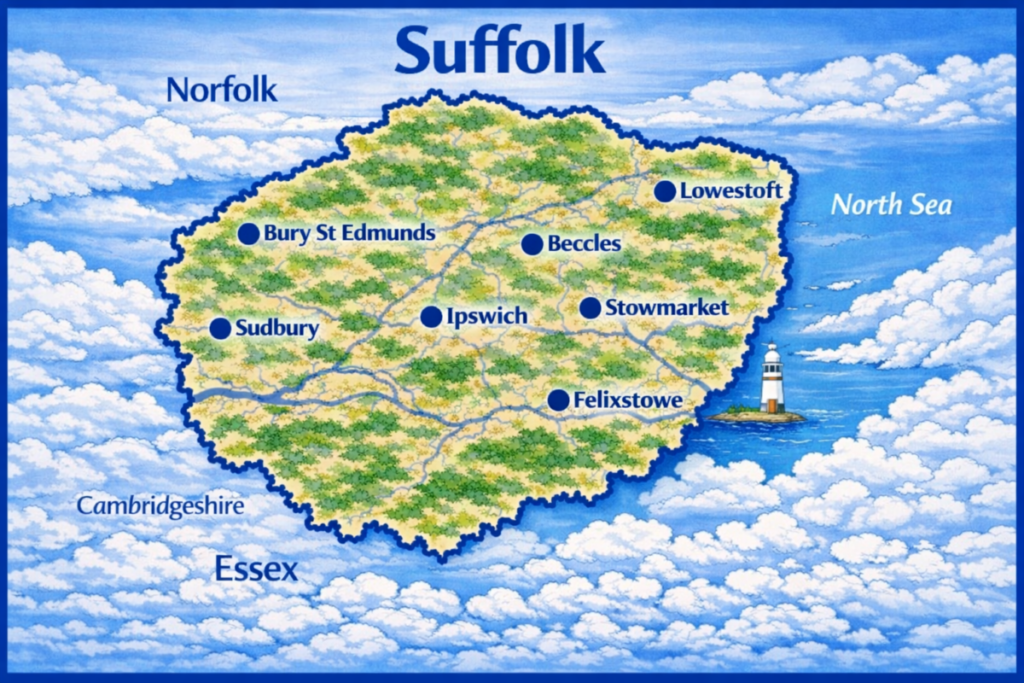

Map with Our Mortgage Brokers in Suffolk

Mortgage Advice in Suffolk that Reflects Local Property Needs

Suffolk’s housing market combines historic towns, coastal communities, and rural villages. From Ipswich commuter areas to market centres such as Bury St Edmunds, mortgage applications in Suffolk often depend on property character, local valuation trends, and the borrower’s financial profile.

Connect Experts helps individuals connect with advisers who understand how Suffolk’s regional property mix can influence lender decisions, surveys, and affordability checks under UK regulation.

Property Types Common Across Suffolk

Suffolk includes a wide variety of homes, and lenders may assess each differently. Buyers in the county may encounter:

- Period cottages in villages near Framlingham and Lavenham

- Victorian streets in Ipswich and Lowestoft

- New-build estates around Felixstowe and Stowmarket

- Coastal properties where exposure and insurance factors apply

- Larger rural homes with land or complex boundaries

Some mortgage lenders apply additional review when homes are listed, are non-standard in construction, or are located in areas with limited comparable sales. A local adviser can help identify potential issues early.

Borrower Circumstances Seen in Suffolk

Suffolk’s economy reflects a mix of agriculture, port-related employment, public services, and commuter links to London and Cambridge. Advisers often assist applicants with:

- Self-employed income from trades or rural businesses

- Defence and public sector employment near key sites

- Households relocating for lifestyle or affordability reasons

- Applicants with variable pay, overtime, or multiple incomes

National affordability rules apply everywhere, but applications are often stronger when income is presented clearly and accurately.

Mortgage Support Beyond Product Comparison

A mortgage adviser’s role includes more than sourcing a rate. Guidance may involve:

- Reviewing deposit expectations and credit status

- Matching lender criteria to Suffolk property features

- Responding to underwriting questions efficiently

- Supporting communication with solicitors and agents

- Explaining decisions in a clear and responsible way

This is especially important in counties like Suffolk, where valuation outcomes can vary significantly between towns and rural areas.

Local Market Differences Within Suffolk

Mortgage conditions may differ depending on where you are purchasing. Suffolk includes several distinct housing zones, such as:

- Ipswich commuter demand and family suburbs

- Coastal markets near Aldeburgh and Southwold

- Bury St Edmunds growth linked to regional employment

- Smaller villages where housing supply is limited

- Rural properties that may require specialist lender approval

An adviser with knowledge of Suffolk can help anticipate how lenders and surveyors may view different parts of the county.

Clear Guidance for Multilingual Households

Mortgage terminology can be difficult, particularly for borrowers unfamiliar with the UK system. Some clients benefit from advisers who can explain processes in a more accessible way.

Connect Experts supports this through its multilingual mortgage adviser network, helping households who prefer mortgage conversations in their first language or need added clarity when navigating complex terms.

Understanding is essential for responsible borrowing.

Explore Mortgage Support Across the UK

If you want to compare advisers beyond Suffolk, you can browse the full mortgage broker directory through Connect Experts.

You may also find helpful guidance through the multilingual mortgage adviser network if language support is important during the process.

Regulation and Consumer Protection

All advisers listed through Connect Experts are authorised and regulated by the Financial Conduct Authority. Mortgage advice is delivered in line with UK rules designed to ensure suitability, affordability, and responsible lending.

Your home may be repossessed if you do not keep up with repayments on your mortgage.

Did You Know?

Suffolk includes both high-demand coastal property areas and inland rural markets where comparable valuations can be harder to establish. This can affect survey results, which is why local mortgage insight can be valuable when lenders assess risk.

Why Work With Mortgage Brokers in Suffolk

If you are considering a move to Suffolk, arranging the right mortgage will likely be one of the most important financial steps. Suffolk offers a varied mix of coastal towns, rural villages, and growing market centres, so mortgage needs can differ depending on where you buy and the type of property you choose.

From family homes in Ipswich to countryside properties near Bury St Edmunds or Lowestoft, working with experienced mortgage brokers in Suffolk can help you approach the mortgage process with more clarity and confidence.

Connect Experts helps buyers connect with advisers who understand lender expectations and local property considerations. This ensures mortgage recommendations remain aligned with affordability rules and responsible lending standards across the UK.

When Mortgage Brokers in Suffolk Can Add the Most Value

Many buyers begin by speaking directly with their bank. However, mortgage decisions are based on detailed affordability checks, credit scoring, and property-related criteria.

A broker can be especially helpful if your circumstances involve:

- Self-employed or variable income

- Remortgaging under updated lender affordability models

- Buy-to-let mortgage applications

- Specialist lending for non-standard property types

- Mortgage support after previous credit concerns

Rather than being restricted to one lender, advisers can review a broader range of providers across the market.

Local Property Factors Across Suffolk

Suffolk includes housing stock that ranges from older character homes to newer developments. Certain property features may require additional attention during underwriting.

Mortgage applications can involve extra checks when purchasing:

- Period homes with unique construction

- Coastal properties where lender criteria may vary

- New builds with developer-specific lending rules

- Leasehold flats with complex terms

- Rural homes where comparable valuations are limited

A broker with local awareness can highlight potential issues early and reduce delays later in the process.

Tailored Support for Buyers Relocating to Suffolk

Relocating often brings changes in employment, commuting, and household finances. Mortgage advice helps present your circumstances clearly to lenders while ensuring borrowing remains affordable and suitable.

This support can be valuable for:

- First-time buyers entering the Suffolk property market

- Families upsizing in commuter-friendly areas

- Home movers relocating for lifestyle or work reasons

- Buyers purchasing investment or rental properties

Using Connect Experts also allows you to search for advisers based on what matters most to you. You can choose a broker by location, expertise, communication style, or even gender for added comfort.

You may also want to explore our A-Z mortgage broker directory for wider options across the UK.

Access to Lenders Beyond Standard High Street Options

One key advantage of working with a broker is access to lenders that do not always deal directly with the public.

Mortgage brokers often work with specialist providers who may consider applications outside standard criteria, including borrowers who:

- Have been declined by mainstream lenders

- Need manual underwriting rather than automated scoring

- Have multiple income sources

- Are buying property types that fall outside standard construction rules

All mortgage recommendations must always be based on suitability and affordability, not generic product matching.

Support From Enquiry Through Completion

Mortgage brokers provide guidance throughout the full process, not only at the point of choosing a deal.

Advisers can assist with:

- Preparing documentation and evidence

- Responding to lender underwriting questions

- Liaising with solicitors, estate agents, and valuers

- Supporting buyers through completion timelines

All advisers listed through Connect Experts are authorised and regulated by the Financial Conduct Authority and provide advice in line with UK mortgage standards.

Your home may be repossessed if you do not keep up with your mortgage repayments.

Find a Broker by Language

Mortgage decisions feel more manageable when communication is clear and comfortable. If you would prefer advice in another language, Connect Experts provides multilingual support through our specialist service.

Explore the network and Find a Broker by Language to make the mortgage process in Suffolk more accessible and supportive.

What Suffolk is Known for Why People Choose to Live Here

Suffolk is one of England’s most distinctive counties, known for its historic market towns, beautiful countryside, and long North Sea coastline. Located in East Anglia, Suffolk offers a quieter pace of life while still providing access to major centres such as London and Cambridge through strong rail connections.

Many people are drawn to Suffolk for its rural landscapes, traditional villages, and popular coastal communities. Whether you are relocating for lifestyle reasons, family needs, or work flexibility, understanding what Suffolk has to offer can help you plan your move and prepare for the mortgage process.

You can begin by exploring our page of mortgage brokers in Suffolk.

Towns and Local Living Across Suffolk

Suffolk includes a wide variety of towns and communities, each offering different housing styles and local character.

Key areas include:

- Ipswich, the county’s largest town, is known for its waterfront development and commuter links

- Bury St Edmunds, a historic market town with strong residential demand

- Lowestoft, a coastal town offering access to the Suffolk seaside

- Felixstowe, home to one of the UK’s largest container ports and popular family neighbourhoods

- Sudbury, located in the Stour Valley, known for its traditional town setting

Housing across Suffolk ranges from period cottages and Victorian terraces to modern developments in growing commuter areas.

Famous Landmarks and Heritage in Suffolk

Suffolk is home to some of England’s most recognisable cultural and historic landmarks, attracting visitors throughout the year.

Notable places include:

- Sutton Hoo, an internationally significant Anglo-Saxon burial site near Woodbridge

- Framlingham Castle, one of the county’s best-known medieval landmarks

- The town of Aldeburgh, famous for its coastal charm and cultural festivals

- The Suffolk Coast and Heaths Area of Outstanding Natural Beauty, offering protected landscapes and countryside living

- Christchurch Mansion in Ipswich, a historic house and museum in the town centre

Homes near conservation areas or historic buildings may involve additional lender checks, particularly for older or listed properties.

What Suffolk is Famous For

Suffolk is widely recognised for its blend of rural heritage, coastline, and traditional English character. The county is especially known for:

- It’s scenic coastal towns and beaches along the North Sea

- Historic villages and countryside settings across East Anglia

- Cultural destinations such as Aldeburgh and the Snape Maltings music venue

- Agriculture and open landscapes that shape much of the county’s identity

- A slower-paced lifestyle while still maintaining commuter access to London

These features make Suffolk appealing to buyers seeking space, community, and long-term lifestyle value.

Buying a Home in Suffolk and Mortgage Considerations

Although mortgage rules apply nationally, Suffolk buyers may face local property factors that require careful lender matching, such as:

- Period homes in rural villages with non-standard construction

- Coastal properties where lender criteria may vary

- New build estates around Ipswich with specific lending requirements

- Listed buildings or homes in protected areas

- Leasehold flats in town centres and waterfront developments

Connect Experts allows buyers to search for advisers by expertise, location, and personal preference, including the option to choose brokers by gender or specialist knowledge.

Find a Broker by Language

Mortgage advice is easier when communication feels clear and natural. If you would prefer guidance in another language, Connect Experts provides multilingual support through our specialist service.

Start with our page of mortgage brokers in Suffolk, to make the mortgage process more accessible and supportive.

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Suffolk, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our Suffolk mortgage brokers page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Suffolk.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us

| Question | Answer | Location Focus |

|---|---|---|

| 1. Why should I use a mortgage broker in Suffolk? | Suffolk’s property market is diverse — from seaside homes in Felixstowe to rural properties near Bury St Edmunds. A local broker understands regional lenders, valuation trends, and property types, giving you tailored advice and faster decisions. | Suffolk – Felixstowe, Bury St Edmunds |

| 2. Are your Suffolk mortgage advisers FCA regulated? | Yes. Every adviser featured through Connect Experts is FCA-authorised and qualified to provide mortgage advice across England. You’ll always work with a trusted professional who follows strict regulatory standards. | Suffolk – Ipswich, Woodbridge |

| 3. Can I get advice for a holiday home or coastal property? | Absolutely. Our brokers regularly arrange mortgages for coastal homes in Aldeburgh, Southwold, and Felixstowe, including buy-to-let and second-home lending options. | Coastal Suffolk |

| 4. Do your brokers offer face-to-face appointments? | Many advisers in Suffolk offer in-person meetings as well as video consultations. You can choose whichever suits your schedule and comfort level. | County-wide |

| 5. What mortgage types can I access in Suffolk? | Local brokers cover residential, buy-to-let, remortgage, bridging, and commercial finance. Whether you’re purchasing farmland near Framlingham or an apartment in Ipswich, they can find a product that fits. | Framlingham, Ipswich |

| 6. Can I find an adviser who speaks another language? | Yes. Connect Experts has multilingual brokers across the UK, including advisers in Suffolk who speak Punjabi, Hindi, and Urdu, ensuring you receive advice in your preferred language. | Suffolk & East Anglia |

| 7. How quickly can I connect with a broker? | Once you submit your preferences, we’ll match you with a qualified adviser in minutes. Most clients receive a same-day introduction to a local broker. | Suffolk & Surrounding Counties |

| 8. What documents will my broker need? | Typically, brokers will ask for proof of ID, income, and address, plus details of existing loans. Having these ready helps your adviser secure an Agreement in Principle faster. | Suffolk – All Districts |

| 9. Can your brokers help with self-employed or contractor mortgages? | Yes. Suffolk has many self-employed professionals, and our brokers specialise in complex income and contractor mortgage applications. | Ipswich, Stowmarket |

| 10. How do I start the process? | Simply click “Find an Adviser”, enter your Suffolk location, and choose your preferences. You’ll be matched with a local mortgage expert who can start your application today. | Suffolk – UK-wide Coverage |