Cantonese Speaking Brokers

Cantonese speaking brokers play a key role in helping the UK’s growing Chinese community by offering mortgage advice in their native language. Cantonese, one of the most widely spoken Chinese languages, is commonly used in Hong Kong, Macau, and Guangdong province. In the UK, the Chinese population has more than doubled over the past two decades, increasing from 220,681 in 2001 to 445,619 in 2021. Among them, approximately 55,555 people identify Cantonese as their main language—highlighting a strong demand for mortgage services in this dialect.

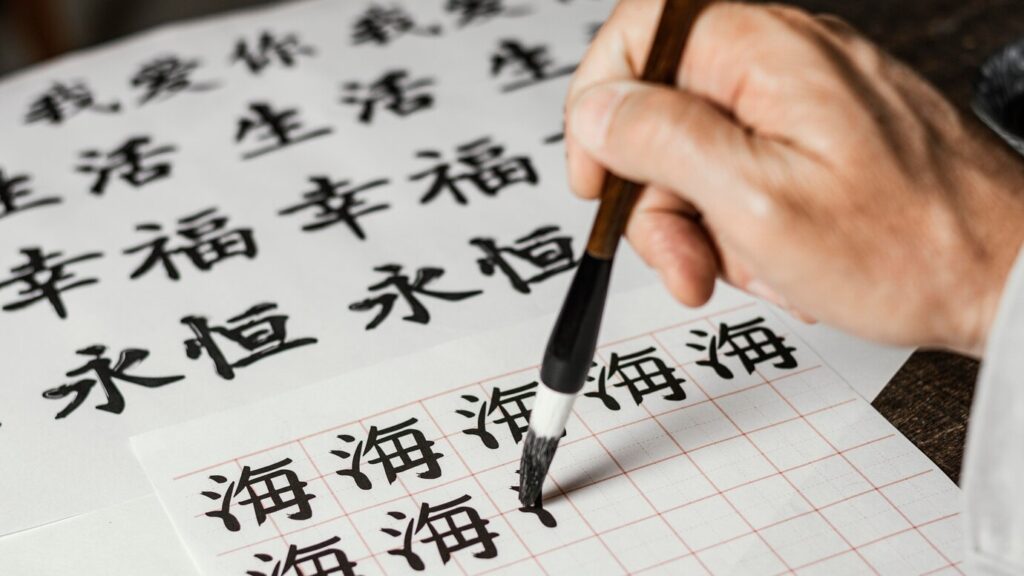

Cantonese is the most widely spoken language for business across Southeast Asia. Originating from Guangzhou (formerly Canton) in China, it remains the primary language of Hong Kong and is spoken by over 55 million people worldwide. Unlike Mandarin, which uses simplified Chinese characters and the Pinyin romanisation system, Cantonese retains traditional Chinese characters and follows the Jyutping romanisation system.

With a significant Cantonese speaking population in the UK, mortgage advisers fluent in the language provide clearer financial guidance, build trust, and make the home-buying process easier for clients.

The Importance of Cantonese Speaking Brokers in the UK

Understanding the UK mortgage process can be difficult, especially for those who feel more comfortable speaking Cantonese than English. The industry involves complex terms, detailed procedures, and legal requirements that can cause confusion or expensive mistakes. Without clear communication, finding the right mortgage can be stressful.

Cantonese speaking mortgage brokers help remove these barriers. They explain key details such as interest rates, repayment structures, lender requirements, and legal responsibilities in a clear and accessible way. By ensuring clients fully understand their options, these brokers help them make informed financial decisions and secure a mortgage suited to their needs.

Cultural understanding is just as important as language. Cantonese speaking brokers provide tailored advice that respects clients’ concerns and preferences. Whether assisting first-time buyers, landlords, or business owners, their expertise makes the mortgage process smoother and more straightforward.

Expat Mortgages for Cantonese Speaking Clients

For Cantonese speaking expatriates investing in UK property, securing a mortgage can be complex due to strict regulations and lender requirements. Working with a mortgage adviser fluent in Cantonese ensures clear communication and expert support throughout the process.

Specialist advisers offer tailored guidance on various mortgage options, including residential home loans and buy-to-let investments. They explain eligibility criteria, required documentation, and potential challenges to help clients prepare effectively. With in-depth knowledge of UK mortgage lending, these advisers provide accurate advice to help Cantonese speaking expats secure the most suitable mortgage deals.

Benefits of Using a Cantonese Speaking Broker

Cultural Understanding: Cantonese speaking brokers often share cultural backgrounds with clients, making it easier to address their specific needs.

Tailored Advice: Clients receive mortgage guidance that suits their financial goals and circumstances.

Clear Communication: Discussing mortgage terms in Cantonese reduces misunderstandings and improves decision-making.

Finding Cantonese Speaking Mortgage Advisors in the UK

Several UK mortgage firms offer services in Cantonese. For example, Connect provides mortgage solutions for residential and commercial lending, with advisors fluent in Cantonese and Mandarin. Platforms like Connect Experts allow users to search for brokers by language, making it easier to connect with Cantonese speaking professionals.

Work with Our Expert Cantonese Speaking Brokers

Getting a mortgage does not need to be complicated when you have the right support. Our team of fully qualified brokers provides expert mortgage advice in Cantonese, ensuring you have a clear understanding of your options.

Whether you are a first-time buyer, remortgaging, or investing in buy-to-let properties, we can help you secure the best mortgage for your needs.

Speak to an expert in your preferred language

Get tailored mortgage advice with confidence

Secure the best deal for your financial future