Mandarin Speaking Brokers

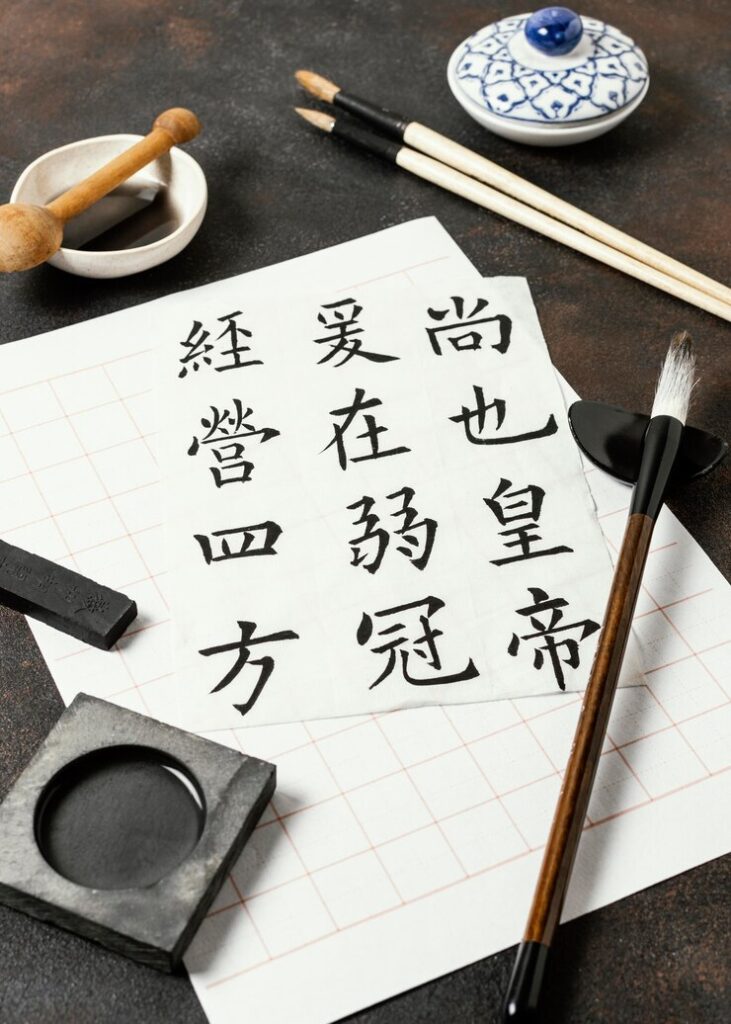

金融经纪人

Mandarin speaking brokers play a vital role in supporting the UK’s growing Chinese community by providing expert mortgage advice in their native language. This assistance is particularly valuable when dealing with the complexities of the UK mortgage market, where financial jargon, regulatory requirements, and lender criteria can be difficult—even for native English speakers.

Mandarin is the most spoken language in the world by native speakers, with over 920 million people using it as their first language. It is the official language of China and Taiwan and one of the official languages of Singapore. In England and Wales, approximately 30,820 individuals report Mandarin as their main language, according to census data. However, the number of Mandarin speakers is likely to be higher when including those who speak it as a second language.

For many Chinese nationals and British-Chinese residents, English may not be their first language or their preferred language when making important financial decisions. Understanding loan types, interest rates, affordability assessments, and legal requirements can be difficult without clear communication. A Mandarin-speaking mortgage broker removes these barriers, ensuring clients fully understand their options and can make informed decisions with confidence.

Although English is widely spoken, communicating in Mandarin provides greater clarity, trust, and efficiency throughout the mortgage process. Lenders also benefit, as this approach reassures them that customers receive advice tailored to their needs, reducing the risk of misunderstandings.

As the UK’s Chinese community continues to grow, the need for Mandarin-speaking financial professionals—including mortgage brokers—will increase. Offering services in Mandarin improves accessibility while strengthening client relationships and supporting long-term financial success within this demographic.

The Importance of Mandarin Speaking Brokers in the UK

Understanding the UK mortgage process can be difficult, especially for those who are more fluent in Mandarin than English. The process involves complex terms, detailed procedures, and legal requirements that may cause confusion or costly mistakes. Without clear communication, securing the right mortgage can become stressful.

Mandarin-speaking mortgage brokers help remove these barriers. They explain key details such as interest rates, repayment structures, lender requirements, and legal responsibilities in a way that is easy to understand. By ensuring clients fully grasp their choices, these brokers help them make well-informed financial decisions and secure mortgages suited to their needs.

Cultural awareness is just as important as language skills. Mandarin-speaking brokers provide tailored advice that considers each client’s concerns and preferences. Whether supporting first-time buyers, landlords, or business owners, their expertise makes the mortgage process more straightforward.

Expat Mortgages for Mandarin Speaking Clients

For Mandarin speaking expat investing in UK property, securing a mortgage can be complex due to strict regulations and lender requirements. Seeking guidance from a mortgage adviser fluent in Mandarin ensures clear communication and expert support throughout the process.

Specialist advisers provide tailored advice on various mortgage options, including residential home loans and buy-to-let investments. They explain eligibility criteria, required documents, and potential challenges to help clients prepare. With extensive knowledge of UK mortgage lending, these advisers provide accurate guidance to help Mandarin-speaking expats secure suitable mortgage deals.

Benefits of Using Mandarin Speaking Brokers

Cultural Understanding

A Mandarin-speaking mortgage broker understands cultural nuances, making it easier to address specific needs and preferences.

Personalised Advice

Clients receive mortgage advice tailored to their financial situation and long-term goals.

Clear Communication

Discussing mortgage terms in Mandarin helps prevent misunderstandings and supports informed decision-making.

Finding Mandarin Speaking Broker in the UK

Several UK mortgage firms provide services in Mandarin. Connect, for example, offers mortgage advice for residential and commercial lending, with advisers fluent in Mandarin and Cantonese. Platforms such as Connect Experts enable users to search for advisers by language, making it easier to connect with Mandarin-speaking professionals.

Interesting Fact

Mandarin is one of the most difficult languages for English speakers to learn due to its tonal structure and complex writing system. Despite this, its global significance continues to grow, with more students worldwide choosing to study the language.

Work with Our Expert Mandarin Speaking Brokers

Securing a mortgage can be straightforward with the right support. Our fully qualified brokers offer expert advice in Mandarin, ensuring you understand every option clearly.

- Speak to a specialist in your preferred language

- Receive mortgage advice tailored to your needs

- Secure the most suitable deal for your financial future

Whether you are a first-time buyer, remortgaging, or investing in buy-to-let properties, we will help you find the right mortgage.