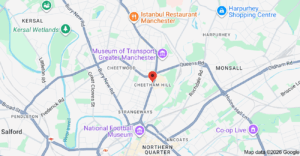

Finding the Right Mortgage Broker in Cheetham, Greater London | Cheetham is a well-established and diverse area of Greater London, located just north of Manchester city centre and within easy reach of key employment hubs, transport links, and local amenities. Known for its mix of traditional terraces, modern apartments, and family housing, Cheetham attracts first-time buyers, home movers, professionals, and property investors.

The local property market offers a broad range of price points compared to many other parts of Greater London, making it appealing to buyers looking for value while remaining close to the city. Strong rental demand also makes Cheetham a popular choice for landlords and portfolio investors.

The local property market offers a broad range of price points compared to many other parts of Greater London, making it appealing to buyers looking for value while remaining close to the city. Strong rental demand also makes Cheetham a popular choice for landlords and portfolio investors.

Whether you are purchasing your first home, moving property, remortgaging, or investing, working with a mortgage broker in Cheetham can help you navigate lender criteria and secure a suitable mortgage solution.

Meet Aatif Fazal: Mortgage Broker in Cheetham

Aatif Fazal is a mortgage broker serving clients in Cheetham and across Greater London. He provides tailored mortgage advice based on individual circumstances and has access to a wide range of lenders across the market.

Through his role as a Connect Experts adviser, Aatif supports clients with:

- Residential mortgages for first-time buyers and home movers

- Buy-to-let mortgages for new and experienced landlords

- Remortgages for rate reviews, term changes, or capital raising

- Limited company and portfolio landlord mortgages

- Bridging finance and short-term property finance

- Supporting Foreign Nationals and Visa Holders in Worcester

- Protection and general insurance advice

Aatif works closely with lenders, solicitors, and estate agents to help ensure a smooth mortgage process from initial enquiry through to completion. He supports employed, self-employed, and complex income clients, offering clear guidance and practical mortgage solutions tailored to both personal and investment goals. Available through the Connect Mortgage Adviser Directory.

Cheetham Property Market Overview 2025

Cheetham continues to benefit from steady housing demand driven by its proximity to Manchester city centre, transport links, and ongoing local regeneration.

Property prices in Cheetham generally remain more accessible than those in many surrounding areas, attracting buyers seeking value and long-term growth potential. Market activity has stabilised following interest rate changes, with affordability and lender criteria playing a key role in buyer decision-making.

Rental demand remains strong, particularly for well-located properties close to transport links and local amenities. This supports consistent interest from buy-to-let investors and landlords.

Mortgage Insight: With mortgage rates remaining higher than pre-2022 levels, many buyers and homeowners are choosing fixed-rate mortgages for budgeting certainty. A mortgage broker can help assess affordability, stress test repayments, and identify lenders offering flexible features.

Exploring Cheetham and Nearby Areas

Cheetham Hill

Property Snapshot: Cheetham Hill offers a mix of period terraces, apartments, and family homes. It is popular with first-time buyers, investors, and professionals seeking access to the city centre.

Mortgage Tips:

- First-time buyers may benefit from shared ownership or low deposit options

- Buy-to-let investors should assess rental yields carefully

- Remortgage clients may explore fixed-rate stability

Crumpsall

Property Snapshot: Crumpsall, located nearby, is popular with families and professionals due to its schools, parks, and tram connections.

Mortgage Tips:

- Families may prefer longer-term fixed rates

- Home movers should review affordability under current stress testing rules

Prestwich

Property Snapshot: Prestwich attracts buyers seeking larger homes, green spaces, and strong transport links while remaining close to Cheetham.

Mortgage Tips:

- Higher value purchases may require specialist lender options

- Buyers should consider overpayment flexibility

Living in Cheetham, Greater London

Transport Links

Cheetham benefits from strong public transport connections, including bus routes, nearby tram stops, and easy access to major road networks. Manchester city centre is easily accessible, supporting commuting and rental demand.

Mortgage Insight: Well-connected locations often remain attractive to lenders and investors, particularly for buy-to-let mortgages.

Local Amenities

The area offers a wide range of shops, places of worship, schools, healthcare facilities, and leisure options. Proximity to the city centre also provides access to universities and major employers.

Mortgage Insight: Areas with strong employment access and local infrastructure often support long term property demand.

Lifestyle and Green Spaces

Residents benefit from nearby parks and open spaces, supporting family living and long-term owner-occupier appeal.

Mortgage Insight: Properties near green spaces often attract stronger buyer interest and tenant demand.

Why Use a Mortgage Broker in Cheetham

Using a local mortgage broker offers several benefits:

- Access to a wide range of lenders and mortgage products

- Support for self-employed or complex income cases

- Guidance on affordability and lender criteria

- Assistance with remortgages and rate reviews

- Ongoing support throughout the application process

A mortgage broker with local knowledge can provide advice tailored to Cheetham’s property market and your personal circumstances.

Ready to Secure Your Mortgage in Cheetham?

Whether you are buying your first home, moving house, remortgaging, or investing in property, Aatif Fazal can help. With whole-of-market access and a client-focused approach, he provides clear, practical mortgage advice at every stage.

If you are looking for a mortgage broker in Cheetham, Greater London, Aatif Fazal can support you with residential, buy-to-let, remortgage, and property finance solutions.

Thank you for reading our “Mortgage broker in Cheetham, Manchester | Contact Aatif” publication. Stay “Connect“-ed for more updates soon!