Mortgage Broker in Farnborough, Hampshire | Sheila Blacklaw. Securing the right mortgage takes more than basic knowledge—it requires understanding how lenders assess risk and how local property markets influence borrowing. Based in Farnborough, Hampshire, Sheila Blacklaw offers practical, mortgage-focused advice for landlords, investors, and limited companies.

Mortgage Broker in Farnborough, Hampshire | Sheila Blacklaw. Securing the right mortgage takes more than basic knowledge—it requires understanding how lenders assess risk and how local property markets influence borrowing. Based in Farnborough, Hampshire, Sheila Blacklaw offers practical, mortgage-focused advice for landlords, investors, and limited companies.

With a strong background in specialist lending, Sheila combines national access with Farnborough-specific insight. Whether you’re financing a buy-to-let flat, expanding a portfolio, or acquiring a semi-commercial building, Sheila ensures your application meets lender criteria.

Mortgage Broker in Farnborough | What Sheila Offers

Sheila works directly with clients throughout Farnborough and the surrounding area. She handles the process from start to finish—ensuring your mortgage application runs smoothly, meets compliance standards, and is matched to lenders who understand your goals.

She offers support on:

-

Buy-to-let mortgages for individuals and limited companies

-

HMO financing, including refurbishment options

-

Commercial and semi-commercial loans, for a range of trading or mixed-use properties

-

Bridging finance to assist with purchases requiring speed

-

Second charge loans for property improvements or releasing funds

-

General insurance reviews to protect rental income and property value

All advice is delivered in plain English, with clear steps from initial fact-find to lender submission.

Mortgage Broker in Farnborough | Trusted by Property Investors Across Hampshire

Sheila provides direct advice shaped by real market conditions. She understands how lenders assess affordability, rental cover, and applicant profiles—whether you’re borrowing personally or through a company. Her approach is always structured, compliant, and responsive.

Clients rely on Sheila for advice on:

-

Switching lenders for better terms

-

Expanding a portfolio tax-efficiently

-

Purchasing flats, houses, or commercial units

-

Meeting lender stress tests and document requirements

Farnborough Property Market Insight

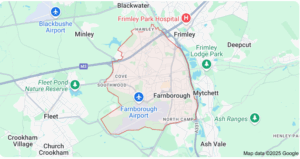

Farnborough is popular with landlords and buyers due to its transport links and growing economy. The area supports a broad mix of property types, from modern flats near the station to commercial premises on the outskirts.

Transport Access

-

By Road: The M3 and A331 connect Farnborough to London, Basingstoke, and beyond.

-

By Rail: Direct services to London Waterloo, Guildford, and Reading make it ideal for commuters.

-

By Air: Farnborough Airport brings significant business travel to the area.

Local Amenities

-

Schools: Farnborough Hill and The Sixth Form College Farnborough are among several strong educational options.

-

Retail: High-street shops sit alongside independent stores and cafés.

-

Leisure: From Queen Elizabeth Park to aviation exhibitions, the town offers a wide range of recreational choices.

Areas Covered Beyond Farnborough

Sheila also supports clients in nearby Hampshire locations:

-

Fleet – Known for family housing and easy rail access. Sheila advises on buy-to-let and remortgages.

-

Aldershot – A growing rental hub. Sheila assists homebuyers and landlords alike.

-

Camberley – With demand for both housing and business finance, Sheila provides tailored solutions.

-

Frimley & Mytchett – Ideal for first-time buyers and shared ownership. Sheila helps with new purchase and equity release planning.

FAQs About Mortgage Brokers in Farnborough, Hampshire

What does a mortgage broker do?

A mortgage broker like Sheila Blacklaw helps you find the most suitable mortgage by comparing deals from a wide range of lenders. She takes care of the application process, communicates with lenders on your behalf, and guides you every step of the way.

Why should I choose Sheila Blacklaw?

Sheila has extensive knowledge of the Farnborough property market and a proven track record of helping clients secure competitive mortgage deals. Her personalised, client-focused approach means you receive expert advice tailored to your circumstances.

How do I contact Sheila Blacklaw?

You can contact Sheila for a no-obligation consultation to explore your mortgage options and get expert guidance.

How much does a mortgage broker charge?

Fees can vary depending on the type of service, but Sheila is always upfront about costs and ensures full transparency—no hidden fees.

Can a mortgage broker help me if I have bad credit?

Absolutely. Sheila specialises in finding mortgage solutions for people from all financial backgrounds, including those with less-than-perfect credit histories.

Do I need a mortgage broker, or can I go directly to a bank?

While it’s possible to approach banks directly, Sheila can access exclusive deals not available to the public, compare multiple lenders, and find a mortgage that truly fits your needs and goals.

Mortgage Broker in Farnborough | Speak to Sheila Blacklaw Today

Whether you’re planning your first buy-to-let, refinancing a commercial loan, or growing your property portfolio, Sheila provides expert guidance based on lender policy and market experience.

Contact Sheila Blacklaw to discuss your mortgage options in Farnborough or the wider Hampshire region.

Thank you for reading our “Mortgage Broker in Farnborough | Find Adviser in Farnborough” publication. Stay “Connect“-ed for more updates soon!