Mortgage Adviser in Sale, Cheshire | Local Knowledge from Rupali Paul. Securing the right mortgage in Sale, Cheshire, involves more than simply comparing interest rates. It requires careful consideration of your long-term financial plans—whether you’re buying your first property, expanding a buy-to-let portfolio, or sourcing funding for commercial use. Rupali Paul, a well-regarded mortgage broker based in Sale, offers reliable, tailored advice to homebuyers, investors, and business owners across Cheshire and Greater Manchester.

Mortgage Adviser in Sale, Cheshire | Local Knowledge from Rupali Paul. Securing the right mortgage in Sale, Cheshire, involves more than simply comparing interest rates. It requires careful consideration of your long-term financial plans—whether you’re buying your first property, expanding a buy-to-let portfolio, or sourcing funding for commercial use. Rupali Paul, a well-regarded mortgage broker based in Sale, offers reliable, tailored advice to homebuyers, investors, and business owners across Cheshire and Greater Manchester.

Rupali provides informed, practical recommendations based on in-depth knowledge of the local property market and access to a broad panel of UK lenders. Whether you’re purchasing a residential home, reviewing your existing borrowing, or arranging finance for a commercial unit, she ensures the mortgage process remains straightforward and aligned with both your financial objectives and the latest UK mortgage regulations.

Personal Mortgage Advice in Sale, Cheshire | End-to-End Guidance

Rupali begins by reviewing your financial position, including income, outgoings, credit status, and future plans. This process ensures your mortgage application meets lender affordability criteria and complies with regulatory expectations set out by the Financial Conduct Authority.

Document Preparation

Rupali oversees the preparation and review of all required documents—from income verification and tax returns to identity checks and property details. This attention to accuracy helps to reduce processing delays and improves your approval chances.

Communication with Lenders

She maintains direct contact with mortgage lenders throughout the process, addressing queries promptly to keep your application moving forward. This approach removes unnecessary pressure and ensures consistent progress.

Full Application Management

From start to finish, Rupali manages the entire application process—ensuring that each document is submitted correctly and within lender deadlines. She keeps you informed with regular updates so you always know the status of your case.

Straightforward, Clear Advice

At every stage, Rupali provides direct, jargon-free explanations of your options. Whether you’re new to the housing market or have years of property experience, the advice is easy to follow and relevant to your specific circumstances.

Why Choose Rupali Paul – Mortgage Broker in Sale, Cheshire

Rupali works with individuals and investors across Sale and the surrounding Trafford area, offering clear, responsible mortgage solutions across a wide range of requirements:

Buy-to-Let Mortgages and Portfolio Growth

For those purchasing their first rental property or remortgaging a portfolio under an SPV (Special Purpose Vehicle), Rupali recommends suitable products based on rental yield expectations, tax planning, and long-term income goals.

HMO Finance Options

Purchasing or remortgaging a House in Multiple Occupation? Rupali ensures you understand licensing requirements, lender expectations, and the valuation processes unique to HMOs.

Commercial and Mixed-Use Mortgages

Whether you’re financing a shop unit, office premises, or a mixed-use building, Rupali takes tenancy agreements, business income, and rental forecasts into account when presenting lending options.

Bridging Finance

When short-term funding is required—for auction purchases, refurbishment, or chain breaks—Rupali sources bridging loans that match your timeframe and planned exit route, such as a future sale or remortgage.

Multilingual Mortgage Advice

Getting a mortgage can feel difficult—especially if English is not your first language. I provide advice in English, Hindi, Bengali, and Marathi, helping you stay informed and confident at every step.

Clear communication matters whether you’re buying your first home, investing in property, or switching your mortgage deal. If you prefer to speak in your own language, I will make sure every detail is explained clearly and without jargon.

This service is ideal if you are:

-

New to the UK mortgage system and unsure how it works.

-

Looking for advice that respects your cultural needs and preferences.

-

Wanting peace of mind when reviewing documents or making decisions.

Everyone deserves clear, accurate advice. Language should never stop you from securing the right mortgage for your circumstances.

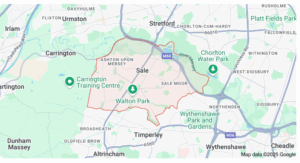

Local Property Insights – Buying and Investing in Sale, Cheshire

Sale, situated in the borough of Trafford, is a highly desirable area known for its schools, community feel, and excellent transport links. This combination appeals to families, professionals, and landlords looking to invest in stable and growing areas.

Notable Neighbourhoods

-

Brooklands – Known for its good schools and Metrolink access.

-

Ashton upon Mersey – A characterful village setting with Victorian and Edwardian properties.

-

Sale Moor – Increasingly popular with first-time buyers due to its affordability.

-

Timperley Border – Offers larger homes ideal for growing families.

With local knowledge, Rupali introduces you to lenders who understand property values and housing types specific to these locations.

Keeping Up with UK Mortgage Standards – 2025 and Beyond

The UK mortgage market continues to change, with updates to stress testing, affordability thresholds, and rules for portfolio landlords. Rupali keeps on top of all changes to ensure that the advice you receive meets current UK lending criteria.

This is especially relevant for:

-

Self-employed applicants

-

Freelancers and contract workers

-

Landlords with SPV limited companies

-

Non-standard properties, such as flats above commercial units

-

Clients looking to release equity through remortgaging

Access to both high street and intermediary-only lenders allows Rupali to present a broad range of suitable solutions.

Why People Choose Sale, Cheshire

Transport and Accessibility

-

Metrolink – Regular trams to Manchester city centre, Altrincham, and MediaCity.

-

Motorways – Close to the M60 and M56 for access to Greater Manchester and beyond.

-

Manchester Airport – Just 15 minutes by car, ideal for frequent flyers.

Schools and Lifestyle

-

Excellent educational options include Sale Grammar School and Ashton on Mersey School.

-

A lively town centre with independent shops, restaurants, and cafés.

-

Green spaces include Worthington Park, Walkden Gardens, and the Bridgewater Canal.

Sale continues to be one of the top choices in Greater Manchester for both residential buyers and property investors due to its blend of convenience, community, and growth potential.

Speak with Rupali Paul – Mortgage Adviser in Sale

If you are looking to purchase, refinance, or invest in property in Sale or the wider Cheshire region, Rupali Paul provides trustworthy mortgage advice shaped by your financial circumstances. Her knowledge of the Sale market and access to UK mortgage lenders ensures a smooth process from enquiry through to completion.

Contact Rupali today to begin your mortgage journey with expert guidance you can rely on.

Thank you for reading our “Mortgage Adviser in Sale | Find a Mortgage Broker in Sale” publication. Stay “Connect“-ed for more updates soon!