Find Trusted UK Mortgage Brokers to Secure a Better Mortgage Deal. Buying a property is a major financial step. Whether you’re a first-time buyer, moving home, or building a rental portfolio, working with trusted mortgage brokers in the UK can help you secure the most suitable deal based on your circumstances.

At Connect Experts, we connect you with fully regulated advisers who understand the UK mortgage market. Their knowledge can make your journey faster, clearer, and more cost-effective.

Why UK Mortgage Brokers Are Worth Your Time

Going it alone can be slow, complicated, and costly. UK mortgage brokers work on your behalf to make the process easier and more reliable.

Access to Better Mortgage Rates

Independent mortgage brokers often have access to exclusive products not available directly from lenders. This could save you thousands over your mortgage term.

Advice That Fits Your Situation

Your employment type, income structure, and credit history all matter. Brokers match your needs to lenders most likely to accept your application.

Less Stress and Paperwork

Brokers handle the application, liaise with lenders, and sort out the documents so that you can focus on your move or investment.

Support for All Scenarios

Self-employed, property investor, complex income, or previous credit issues? A broker can find a lender that understands your case.

Confidence With Regulated Advice

Every adviser we work with is authorised by the Financial Conduct Authority (FCA). This ensures professional conduct and consumer protection.

How Connect Experts Helps You Choose the Right UK Mortgage Brokers

Connect Experts is a free-to-use comparison platform, not a lender. We make it simple to find an adviser that suits your goals, preferences, and location.

Search by Location

Use our tool to find mortgage brokers near you who understand your local property market and lender criteria.

Filter by Language or Adviser Gender

Speak to someone who makes communication easy. Choose advisers based on spoken languages or gender preference.

Choose Based on Specialist Knowledge

Looking for a buy-to-let expert or someone who understands contractor income? Filter by experience to match your situation.

FCA Registered and GDPR Compliant

All brokers listed are authorised in the UK and meet strict data privacy standards. Your information stays safe.

Free Service With No Commission Charges

We do not charge you for access so that you can search, compare, and contact mortgage brokers without any fees.

Find the Right UK Mortgage Broker Today

Securing a mortgage shouldn’t be harder than it needs to be. With the help of a qualified UK broker, you can reduce stress, improve your chances of approval, and save on long-term costs.

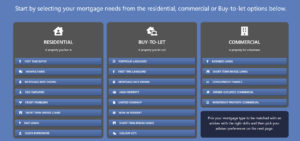

Why We Ask These Questions Before Matching You With a Mortgage Adviser

To help match you with the most suitable mortgage adviser, we ask a few essential questions about your situation and preferences.

You’ll be asked what kind of mortgage or advice you’re looking for, and how soon you need help.

We also ask if you currently own a property, your employment status, and whether you’ve had any credit issues in the last five years.

To help us tailor the advice, we also ask your preferred language and whether you would like a male or female adviser.

You’ll confirm if you live in the UK, and how you’d like to receive advice—whether online, by phone, or face to face.

If you choose to meet in person, we’ll ask for your location to help arrange a local adviser.

Or visit Connect Mortgages to discover more about our nationwide adviser support network.

Thank you for reading our “UK Mortgage Brokers | Find a Broker Near You” publication. Stay “Connect“-ed for more updates soon!