Mortgage Protection Broker in Stockport, Cheshire – Paul Griffiths | Protecting your future is just as important as choosing the right mortgage. Based in Stockport and covering Cheshire, Paul Griffiths provides clear, practical advice on life insurance, income protection, and critical illness cover. Whether you’re buying a home, starting a family, or protecting your income, Paul ensures you have suitable protection in place.

Mortgage Protection Broker in Stockport, Cheshire – Paul Griffiths | Protecting your future is just as important as choosing the right mortgage. Based in Stockport and covering Cheshire, Paul Griffiths provides clear, practical advice on life insurance, income protection, and critical illness cover. Whether you’re buying a home, starting a family, or protecting your income, Paul ensures you have suitable protection in place.

He helps you select cover that meets your needs and fits your financial circumstances. Paul takes the time to understand your situation and explain your options in simple, clear terms.

His advice is based on current UK protection policies and insurer criteria. You’ll receive guidance that reflects your goals, budget, and lifestyle.

Why Choose Paul Griffiths as Your Mortgage Protection Broker in Stockport?

Paul Griffiths is more than just a mortgage adviser—he is a dedicated protection specialist who ensures your home, income, and loved ones are financially safeguarded. Based in Stockport and serving the wider Cheshire region, Paul offers expert guidance on the full range of mortgage protection options, including:

-

Life Insurance

-

Critical Illness Cover

-

Income Protection

-

Family Income Benefit

-

Mortgage Payment Protection Insurance (MPPI)

Whether you’re a first-time buyer, remortgaging, or a landlord, Paul helps you choose the right protection plan to suit your circumstances—so you’re covered no matter what life throws at you.

Making Family Protection Simple and Stress-Free

When life changes—whether you’re buying a home, growing your family, or changing careers—protecting what matters most becomes a priority. But understanding the difference between life insurance, critical illness cover, and income protection can be overwhelming.

Paul Griffiths makes protection planning clear and practical by:

-

Explaining the purpose of each type of cover in plain English

-

Reviewing your circumstances, dependents, and financial obligations

-

Recommending the right level of cover for your budget and lifestyle

-

Ensuring your protection aligns with your mortgage and long-term goals

-

Helping with policy setup, trust arrangements, and insurer paperwork

From ensuring your family could stay in the home if the unexpected happened, to protecting your income in case of illness, Paul helps you put the right safeguards in place—with no pressure and full transparency.

Mortgage Protection Broker in Stockport | Why Protection Matters More Than Ever

-

🛡️ Life Insurance – Provides a lump sum to your loved ones to pay off the mortgage or cover living costs if you pass away unexpectedly.

-

💼 Income Protection – Replaces a portion of your income if illness or injury stops you from working.

-

❤️ Critical Illness Cover – Pays out if you’re diagnosed with a serious illness like cancer, stroke, or heart disease.

-

👪 Family Cover – Tailored plans to protect both parents and children, including school fees, household bills, and future expenses.

Paul will help you find the right provider and policy for your needs, comparing terms and benefits across the market.

Support with Protection and General Insurance

If you’re looking specifically for a broker who specialises in protection and general insurance, Paul Griffiths is a reliable choice.

He offers expert advice on:

-

Life insurance

-

Critical illness cover

-

Income protection

-

Family income benefit

-

Buildings and contents insurance

-

Landlord and tenant insurance

Paul helps clients understand what they’re covered for, recommends affordable policies, and ensures financial stability for families and landlords alike.

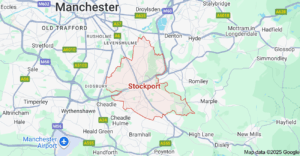

Local Knowledge of Stockport Property Market

Stockport is a thriving town in Greater Manchester with strong ties to Cheshire. It offers a mix of Victorian terraces, modern flats, family homes, and new-build estates.

With easy access to Manchester, a growing economy, and popular school catchments, Stockport attracts a wide range of homebuyers and investors. Paul’s local insight means he knows which lenders favour certain property types or postcode areas, helping you avoid unnecessary delays.

Attractions, Transport & Amenities in Stockport

Stockport is a thriving town in Greater Manchester, blending rich heritage with modern convenience. Whether you’re looking to relocate, invest in property, or simply explore, the area offers excellent value, connectivity, and lifestyle benefits.

Top Attractions in Stockport

Stockport boasts a variety of local landmarks, green spaces, and cultural gems. Popular places to visit include:

-

The Hat Works Museum – A unique museum dedicated to the town’s famous hat-making industry, offering interactive exhibits and historic collections.

-

Stockport Plaza Theatre – An Art Deco masterpiece hosting live theatre, comedy, music, and film screenings.

-

Reddish Vale Country Park – A stunning nature reserve with woodlands, trails, picnic areas, and wildlife, perfect for families and dog walkers.

-

Vernon Park – Known as Stockport’s oldest public park, this beautifully landscaped space features fountains, flower beds, and a Victorian-style conservatory.

-

Staircase House – A Grade II* listed medieval townhouse where visitors can explore over 500 years of Stockport history.

These attractions make Stockport a culturally rich and family-friendly place to live, drawing residents and tourists alike.

Excellent Transport Links

Stockport’s exceptional transport connections are a key reason it continues to grow in popularity among commuters, landlords, and homebuyers.

-

🚆 Stockport Train Station offers frequent direct services to major UK cities:

-

Manchester Piccadilly (approx. 10 minutes)

-

London Euston (approx. 2 hours)

-

Liverpool, Birmingham, and Sheffield

-

-

🚗 Road access is excellent, with the M60 and M56 motorways providing quick links to Manchester Airport, the Peak District, and the North West.

-

✈️ Manchester Airport is just 20 minutes by car, offering global connectivity for business and leisure.

-

🚌 Regular bus services connect Stockport with surrounding towns such as Didsbury, Cheadle, Altrincham, and beyond.

These travel options make Stockport ideal for professionals, families, and remote workers looking for a well-connected yet affordable location.

Local Amenities and Lifestyle

Stockport is more than just a commuter town — it’s a vibrant community with everything you need for everyday living.

-

🛍️ Shopping: Explore the Merseyway Shopping Centre, Redrock Leisure Complex, and historic Market Place for a mix of high-street brands, independent retailers, and dining.

-

🏋️ Fitness & Health: There are numerous gyms (PureGym, The Gym Group, JD Gyms), yoga studios, leisure centres, and wellness facilities throughout the town.

-

🛒 Supermarkets: Tesco Extra, Sainsbury’s, Aldi, Lidl, and Asda are easily accessible, along with local Asian and European grocery stores.

-

🍽️ Restaurants & Cafés: From family-run eateries to international cuisine, Stockport offers diverse food options, with new restaurants opening regularly in areas like Edgeley, Heaton Moor and the Underbanks.

-

🎬 Entertainment: Redrock also hosts a multi-screen cinema, bowling alley, and cocktail bars, ideal for families and young professionals alike.

Whether you’re a first-time buyer, investor or downsizer, Stockport’s mix of heritage charm and modern convenience makes it one of Greater Manchester’s most appealing places to live.

Mortgage Protection Broker in Stockport| Serving Cheshire and Its Neighbouring Towns

Paul Griffiths is not just a trusted mortgage adviser in Stockport—he also provides expert mortgage advice across Cheshire, helping clients in a range of nearby towns secure the right financial solution for their property goals. His local knowledge, whole-of-market access, and experience working with clients from all backgrounds make him the ideal adviser for buyers, landlords, and remortgagers throughout the region.

Whether you’re a first-time buyer, moving up the property ladder, investing in buy-to-let, or looking to remortgage, Paul delivers bespoke advice with a local touch.

Protection Advice in Altrincham

Altrincham is a vibrant and well-connected town in Cheshire, popular with professionals, families, and commuters. With its excellent schools, transport links, and thriving property market, many local residents are building futures worth protecting—and that’s where Paul Griffiths steps in.

As a local protection adviser, Paul helps individuals and families in Altrincham secure tailored financial protection solutions to safeguard their lifestyle, income, and loved ones.

Common Protection Services Offered:

-

Life Insurance Advice in Altrincham

Ensuring your family is financially secure in the event of your death, with policies tailored to your mortgage, income, and dependents. -

Income Protection

Support if you’re unable to work due to illness or injury. Paul helps you compare policies that offer the right cover and waiting periods for your occupation and budget. -

Critical Illness Cover

Lump-sum protection that pays out if you’re diagnosed with a serious condition such as cancer, stroke, or heart disease—giving you the financial freedom to recover without stress. -

Family Income Benefit

A tax-free monthly income for your family in the event of your death, often chosen by parents in Altrincham looking to provide ongoing support for school-age children. -

Mortgage Protection

Policies designed to repay your outstanding mortgage if the unexpected happens, protecting your home and those who live in it.

Protection Advice in Wilmslow

Wilmslow is one of Cheshire’s most affluent areas, with high-income households, executive professionals, and family homeowners. Paul Griffiths offers tailored protection advice in Wilmslow, helping clients:

-

Protect high-value incomes with Income Protection policies

-

Secure Life Insurance to protect family and dependents

-

Set up Critical Illness Cover to safeguard against serious health issues

-

Create family-focused protection plans that align with professional lifestyles

Popular search: “Wilmslow life insurance adviser for professionals”

Personal Protection in Macclesfield

Macclesfield combines rural living with growing business opportunities—many residents are self-employed or run small businesses. Paul supports clients in Macclesfield by offering:

-

Income Protection for self-employed individuals who can’t rely on employer benefits

-

Business Protection policies, including Key Person Cover

-

Joint policies for couples or homeowners starting families

-

Clear, local advice on how to replace lost income due to illness or death

Popular search: “Macclesfield income protection for self-employed”

Protection Planning in Knutsford

Knutsford’s boutique property market attracts professionals, growing families and retirees. Paul provides:

-

Life insurance tailored to older homeowners, with optional estate planning guidance

-

Later-life protection, including over-50s life cover and funeral planning

-

Critical Illness policies for those aged 40+ concerned about future care

-

Assistance in setting up Trusts to ensure payouts go to the right people

Popular search: “Knutsford critical illness cover for families”

Family Protection in Poynton

Poynton is a family-friendly suburb with excellent schools and community links. Paul advises young couples, growing families, and homeowners in Poynton on:

-

Affordable Term Life Insurance to protect mortgages and childcare costs

-

Children’s Critical Illness Cover as an optional policy feature

-

Joint Family Income Benefit plans to provide a tax-free monthly income if the worst happens

-

Navigating protection alongside government benefits

Popular search: “Poynton family life insurance advice”

Protection Support in Cheadle & Bramhall

Cheadle and Bramhall offer premium living for professionals commuting into Manchester. Paul supports these clients by delivering:

-

Tailored Executive Income Protection for high earners

-

Protection plans that complement employer-provided cover

-

Joint cover for dual-income households with children

-

Help understanding how Life and CIC policies can maintain lifestyle and school fees

Popular search: “Cheadle or Bramhall life insurance broker”

Mortgage Protection Broker in Stockport| Making the Mortgage Process Easier

Securing a mortgage can feel overwhelming, especially with ever-changing lender rules. Paul simplifies the process by:

-

Reviewing your deposit, income, and credit score

-

Explaining lender expectations and documentation needs

-

Coordinating with estate agents and solicitors

-

Keeping you informed from the first enquiry to the final completion

His proactive approach helps prevent delays, avoids rejection, and saves you time and stress.

Mortgage Protection Broker in Stockport| Protect What Matters Most

If you’re looking for friendly, professional advice on protecting your family, income, or home, Paul Griffiths is here to help.

Whether you’re just starting a family or simply reviewing your finances, he’ll provide honest, tailored protection advice that gives you confidence and peace of mind.

📞 Book your free consultation today and take the first step toward securing your financial future.

Thank you for reading our publication, “Mortgage Protection Broker in Stockport | Protection Advice.” Stay “Connect“-ed for more updates soon!