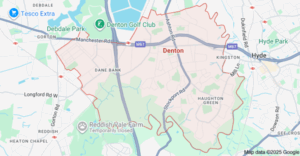

Finding the Right Mortgage Broker in Denton, Manchester | Denton is a thriving town in Greater Manchester, located just five miles east of Manchester city centre. Historically known for its hatting industry, Denton has evolved into a well-connected residential suburb, attracting families, professionals, and first-time buyers alike. With its mix of traditional red-brick terraces, modern housing estates, and easy access to motorways and rail links, Denton offers excellent value and lifestyle opportunities in the North West.

Finding the Right Mortgage Broker in Denton, Manchester | Denton is a thriving town in Greater Manchester, located just five miles east of Manchester city centre. Historically known for its hatting industry, Denton has evolved into a well-connected residential suburb, attracting families, professionals, and first-time buyers alike. With its mix of traditional red-brick terraces, modern housing estates, and easy access to motorways and rail links, Denton offers excellent value and lifestyle opportunities in the North West.

Denton’s local housing market is diverse, featuring a range of properties from historic homes to newly constructed developments perfect for buyers at every stage. Whether you’re stepping onto the property ladder or expanding your investment portfolio, Denton provides strong property value and excellent rental demand.

Meet Kush Kaur – Mortgage Broker in Denton

Kush Kaur is your dedicated Mortgage Broker in Denton, with deep insight into the local and Greater Manchester market. She specialises in:

-

Residential mortgages for homebuyers

-

Buy-to-let and HMO mortgage advice

-

Bridging loans and short-term property finance

-

Limited company and portfolio landlord mortgages

-

Second charge mortgage solutions

-

Protection and general insurance services

Kush provides clear, tailored mortgage advice tailored to your specific circumstances. Whether you’re employed, self-employed, or facing credit challenges, she offers whole-of-market support to find the right mortgage. Kush ensures every client understands their options and feels confident throughout the process, liaising with estate agents, solicitors, and lenders on your behalf.

👉 Find me on the Connect Expert Directory

Exploring Greater Manchester: Denton’s Neighbouring Towns

The Greater Manchester area continues to attract buyers seeking affordable homes, excellent transport links, and access to both urban and suburban lifestyles. Denton’s neighbouring towns each bring their own character, property opportunities, and mortgage potential. Whether you are a first-time buyer, investor, or looking to move up the property ladder, these nearby locations offer strong value and convenience.

Hyde

Property Snapshot:

Located south-east of Denton, Hyde is a popular commuter town offering a great balance of affordability and accessibility. The town has a well-established shopping centre, market hall, and a variety of retail and leisure options. Excellent road links via the M67 and frequent rail services to Manchester Piccadilly make it ideal for professionals and families alike. The area features a mix of traditional terraced homes, semi-detached houses, and new-build developments, appealing to a broad range of buyers.

Mortgage Tips:

-

First-time buyers: Hyde offers excellent opportunities for Help to Buy and shared ownership mortgages, helping buyers step onto the property ladder.

-

Commuters: Consider fixed-rate mortgages for predictable repayments while benefiting from Hyde’s growing commuter appeal.

-

Families: If you are planning long-term residency, a five-year fixed deal can provide rate stability as your household needs evolve.

Ashton-under-Lyne

Property Snapshot:

Ashton-under-Lyne is one of Tameside’s key commercial and residential hubs. The town benefits from the Metrolink tram system, connecting residents directly to Manchester city centre. It is also known for its large market, shopping precinct, and the Ashton Moss leisure complex, which includes restaurants, cinemas, and gyms. With well-rated schools and a range of affordable housing options, Ashton-under-Lyne continues to attract growing families and professionals seeking convenience and a diverse lifestyle.

Mortgage Tips:

-

Remortgages: Homeowners can take advantage of competitive fixed-rate deals to reduce monthly payments or fund home improvements.

-

Upsizing buyers: With a range of larger family homes available, a home mover mortgage can help you secure your next property with flexible repayment options.

-

Investors: The strong rental market and student population nearby make buy-to-let mortgages an appealing choice.

Audenshaw

Property Snapshot:

Nestled between Denton and Manchester city centre, Audenshaw provides a quieter, more residential atmosphere while maintaining excellent connectivity. Its close proximity to the M60 motorway and nearby tram stops ensures easy access to Manchester and Stockport. The area is known for its tree-lined streets, family homes, and modern housing developments. Audenshaw’s peaceful surroundings appeal to professionals and young families who value both convenience and community.

Mortgage Tips:

-

Residential buyers: Consider flexible mortgage products that allow for overpayments as property values continue to grow.

-

Professionals: Shorter-term fixed deals may suit those planning to move or refinance as their careers progress.

-

Self-employed buyers: Look for lenders who assess affordability based on two years of accounts or SA302 forms, as Audenshaw attracts many independent professionals.

Gorton and Reddish

Property Snapshot:

Gorton and Reddish are neighbouring districts with distinctive identities and strong housing demand. Gorton offers a variety of affordable terraced and semi-detached homes, alongside ongoing regeneration projects and new-build developments. Reddish, part of Stockport borough, combines traditional housing with a friendly community atmosphere and good local amenities. Both areas provide easy access to central Manchester, nearby retail parks, and reputable schools, making them appealing to first-time buyers and landlords.

Mortgage Tips:

-

Buy-to-let investors: These areas present strong rental yields, particularly around transport corridors serving central Manchester.

-

New-build buyers: Look for lenders offering incentives for new-build mortgages or lower deposit requirements.

-

First-time buyers: Gorton’s affordability makes it ideal for low-deposit or government-backed mortgage schemes.

Property Market Overview – Greater Manchester (2025)

| Metric | Latest estimate/status | Key insight for buyers & mortgage advisers |

|---|---|---|

| Average property price (Greater Manchester) | ~ £249,000 as per early 2025 regional estimates. | Advisers can use this figure as a realistic benchmark for affordability discussions and regional lending comparisons. |

| Growth since 2019 | ~ +21% increase in average prices between 2019 and late 2024. | Reflects stronger-than-average performance compared to many Northern regions, showing healthy equity potential for homeowners. |

| Forecast price growth 2025 | ~ +2.8% projected growth for 2025 across Greater Manchester. | Suggests steady market momentum, suitable for medium-term investment and mortgage planning. |

| Recent annual price change | +0.9% nominal / −2.5% real (after inflation) over the last 12 months. | Indicates modest real returns, but market resilience; useful for advising clients on realistic appreciation expectations. |

| Sales/turnover indicator | Around 1 in 27 properties changed hands in 2024 across Greater Manchester. | Shows an active market with consistent transaction levels, helpful for assessing liquidity and resale timelines. |

| Buyer demand & market sentiment | Buyer confidence improving as inflation cools; activity picking up in Q1 2025, particularly for first-time buyers. | Advisers should highlight improved affordability and rate stability as opportunities for clients re-entering the market. |

| Key demand drivers | Strong employment hubs, improving transport links (e.g., Metrolink, HS2 alignment), growing rental sector, and university-driven demand. | Emphasise these fundamentals when discussing long-term value, especially for clients targeting urban growth zones. |

| Risk/consideration factors | Mortgage rates remain above pre-2022 levels; competition for affordable homes remains high; rental yields narrowing slightly. | Advisers should help clients stress-test affordability and explore flexible mortgage options for rate resilience. |

| Investor focus / buy-to-let | Manchester city centre, Salford Quays, and Stockport remain key investment zones with yields between 5% and 6.5%. | Advisers should explore limited company and portfolio BTL products for clients seeking income-based or capital-growth strategies. |

Denton’s Property Market Insights

Denton remains one of Greater Manchester’s hidden gems for homebuyers and investors. Here’s why:

-

More space for your money than inner-Manchester suburbs.

-

A healthy mix of older homes and new developments.

-

Rental yields are attractive due to local employment and commuter demand.

-

Ideal for families, young professionals, and those seeking a space to grow.

In 2025, Denton continues to see steady growth in property values while retaining affordability compared to areas like Didsbury or Chorlton. Whether buying to live in or invest, it’s a strong long-term choice.

Living in Denton: Local Highlights and Amenities

Denton, located in Tameside within Greater Manchester, offers a well-balanced lifestyle for families, professionals, and first-time buyers alike. With excellent transport links, shopping facilities, and green open spaces, the town continues to attract those seeking affordable homes within easy reach of Manchester city centre. Whether you are buying your first property, remortgaging, or investing in a buy-to-let opportunity, Denton provides both convenience and community appeal.

Transport Links

Denton is exceptionally well-connected, making it one of the most convenient commuter areas in Greater Manchester. The town is situated close to the M60 orbital motorway and the A57, providing easy access to neighbouring towns such as Stockport, Ashton-under-Lyne, and Hyde, as well as Manchester city centre. Drivers benefit from short travel times and quick connections to key employment hubs and retail parks across the region.

For those using public transport, Guide Bridge Station and Denton Railway Station provide direct rail services to Manchester Piccadilly and Stockport, making daily commutes efficient and reliable. Local residents also have access to a network of frequent bus routes linking Denton to Hyde, Ashton-under-Lyne, Stockport, and Manchester city centre. These transportation connections are particularly valuable for professionals, students, and families who rely on reliable travel options for work, education, or leisure.

Mortgage Insight:

Buyers seeking property in Denton benefit from the area’s strong commuter appeal. Lenders often view well-connected towns favourably, which can help secure competitive mortgage rates for both first-time buyers and home movers. If you are considering a buy-to-let investment, the town’s transport network supports high rental demand among professionals working in Manchester.

Local Amenities

Denton’s amenities are comprehensive, catering to residents of all ages and lifestyles.

Crown Point North Shopping Park is one of the area’s major retail destinations, hosting popular stores such as TK Maxx, Boots, and M&S Food. The park also includes fashion, homeware, and dining outlets, providing an easy one-stop location for shopping and leisure.

Denton Town Centre complements this with supermarkets, cafés, banks, and essential services. The mix of national retailers and independent shops ensures convenience while maintaining a strong sense of local identity. Weekly markets and community events often take place in the centre, strengthening Denton’s small-town atmosphere.

Leisure facilities in the area are excellent. The Tameside Wellness Centre, located in Denton, offers a modern gym, swimming pool, and spa. The area also features multiple fitness studios, local football pitches, and youth clubs, making it suitable for active families.

Healthcare access is another key advantage. Denton residents can choose from several NHS GP surgeries and private health practices, alongside local dental clinics. Tameside General Hospital, located nearby in Ashton-under-Lyne, provides further medical and emergency services.

Mortgage Insight:

Areas with strong local infrastructure and healthcare options often demonstrate stable long-term property values. For homeowners, this stability can make Denton a solid choice for future remortgaging or equity release opportunities.

Green Spaces and Attractions

Despite its proximity to Manchester, Denton retains a strong connection to nature and outdoor recreation.

Denton Golf Club is a highlight for enthusiasts, offering a well-maintained 18-hole course and clubhouse facilities. It attracts both local residents and visitors from surrounding towns, adding to the area’s social and leisure appeal.

Haughton Dale Nature Reserve provides scenic walking and cycling routes through woodland and riverside landscapes. It is ideal for families and individuals seeking fresh air and relaxation close to home. The reserve also supports local wildlife, creating a tranquil retreat from urban life.

Victoria Park is situated at the heart of Denton, renowned for its landscaped gardens, children’s play area, and year-round community events. From family picnics to outdoor concerts, it is a popular gathering point that enhances the town’s sense of community.

Mortgage Insight:

Proximity to parks and green spaces can positively influence property desirability and long-term value. Buyers seeking family homes or rental properties in areas with recreational amenities often find stronger demand and consistent appreciation.

Ready to Secure Your Mortgage in Denton?

Whether you’re buying your first home, moving up the ladder, or investing in Greater Manchester, Kush Kaur is ready to help. With deep local knowledge, lender access, and a passion for helping people, she’s the expert you want by your side.

📞 Contact Kush Kaur today for a no-obligation mortgage consultation.

Looking for a Mortgage Broker in Denton, Manchester? Kush Kaur offers expert advice on residential, buy-to-let, and bridging finance across Greater Manchester.

Thank you for reading our publication “Mortgage Broker in Denton | Find a Local Mortgage Adviser.” Stay “Connect“-ed for more updates soon!