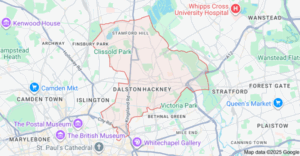

Finding the Right Mortgage Broker in Hackney, UK | Hackney is one of East London’s most dynamic and diverse boroughs, known for its strong transport links, growing property market, and vibrant cultural scene. Located just a few miles from the City of London, Hackney continues to attract first-time buyers, families, professionals, and investors who value community, connectivity, and a diverse lifestyle. Hackney benefits from excellent transport links to Central London and neighbouring boroughs. Key Overground stations include Hackney Central, Hackney Downs, Dalston Junction, Dalston Kingsland, Homerton, and Hoxton. These routes provide quick access to Liverpool Street, Stratford, Highbury and Islington, and Canary Wharf via interchanges.

Finding the Right Mortgage Broker in Hackney, UK | Hackney is one of East London’s most dynamic and diverse boroughs, known for its strong transport links, growing property market, and vibrant cultural scene. Located just a few miles from the City of London, Hackney continues to attract first-time buyers, families, professionals, and investors who value community, connectivity, and a diverse lifestyle. Hackney benefits from excellent transport links to Central London and neighbouring boroughs. Key Overground stations include Hackney Central, Hackney Downs, Dalston Junction, Dalston Kingsland, Homerton, and Hoxton. These routes provide quick access to Liverpool Street, Stratford, Highbury and Islington, and Canary Wharf via interchanges.

Although Hackney does not currently have a Tube station, its comprehensive bus network and proximity to key lines ensure efficient travel across the capital. Major roads such as the A10 and A12 connect Hackney to the City, North London, and East London business districts.

Why Hackney works

-

The average house price in Hackney was approximately £636,000 in August 2025, up around 3.3% year-on-year.

-

Rental demand is strong: average monthly private rent was around £2,567 in September 2025, up about 7.6%.

-

A variety of property types exists: flats and maisonettes, terraced houses, semi-detached and detached homes.

-

Excellent transport links via the London Overground, the London Underground, and major roads make commuting into Central London feasible.

Meet Chaim Mandel – Mortgage Broker in Hackney

Chaim Mandel is your local mortgage broker based in Hackney, with comprehensive knowledge of the East London area. He specialises in:

- Buy-to-let and HMO mortgage advice for landlords and investors

-

Bridging loans and short-term property finance

-

Commercial and development finance

-

Protection and general insurance services

Chaim provides whole-of-market advice tailored to your personal circumstances, whether you are employed, self-employed or dealing with credit issues. He guides you through the entire process: from initial consultation, lender selection, liaising with estate agents and solicitors, to completion. 👉 Available through the Connect Expert Directory

Exploring East London: Hackney’s Neighbouring Areas

Here are some nearby locations offering additional opportunities for mortgage clients:

Shoreditch & Hoxton Property Snapshot

Mortgage Tips:

-

First-time buyers: consider low-deposit schemes in rising areas

-

Investors: check yield after service charges and strong rental demand

-

Home-movers: fixed-rate deals may offer peace of mind amid city-centre volatility

Stoke Newington Property Snapshot

Mortgage Tips:

-

Residential buyers: look for products that allow overpayments as values continue to grow

-

Families: opt for five-year fixed rates for stability as household needs change

-

Self-employed buyers: ensure you choose lenders comfortable with two years of accounts or SA302s

Hackney Wick & Fish Island Property Snapshot

Mortgage Tips:

-

Buy-to-let investors: new build incentives and growing rental demand make these areas appealing

-

Investors: check service charges, leasehold terms and rental yields

-

Buyers: new build mortgages may require lower deposits or specialist lenders

Hackney’s Property Market Insights

Key takeaways for buyers and investors

-

Hackney remains a strong long-term choice because of its connectivity, lifestyle offering and consistent rental demand.

-

While price growth is modest (for example +2.97% year-on-year in June 2025), the market remains resilient.

-

Rental prices are rising faster than sales prices in many cases, making buy-to-let potentially more yield-driven.

-

For first-time buyers, the average paid was around £578,000 in August 2025.

Lifestyle and Amenities

Hackney offers a blend of urban living, independent culture, and green open spaces. Popular neighbourhoods include:

Dalston

A lively cultural hotspot known for nightlife, food markets, and independent retailers.

London Fields

Famous for its green space, swimming lido, artisan cafés, and the weekend Broadway Market.

Stoke Newington

A village-style area with boutique shops, family-friendly parks, and a strong community feel.

Hackney Wick

A rapidly developing creative district with galleries, canalside bars, new-build apartments, and access to the Queen Elizabeth Olympic Park.

Hackney’s amenities include large supermarkets, independent grocers, gyms, fitness studios, health centres, and leisure facilities. The borough is also home to a wide range of schools, both state and independent.

Green Spaces and Outdoor Areas

Despite being close to the City, Hackney provides several notable green spaces:

-

London Fields

-

Clissold Park

-

Hackney Marshes

-

Haggerston Park

-

Springfield Park

These parks offer sports facilities, playgrounds, running routes, and family-friendly recreational areas.

Local Economy and Employment

Hackney’s proximity to the City of London, Shoreditch Tech Corridor, Canary Wharf, and Stratford makes it a popular home for professionals in finance, tech, creative industries, retail, and public services.

The borough’s ongoing regeneration has supported business growth in hospitality, creative arts, digital media, and small independent enterprises.

Why People Choose Hackney

Hackney continues to appeal because it offers:

-

Strong transport links to employment hubs

-

A diverse and growing property market

-

Independent culture and community atmosphere

-

High rental demand and long-term investment potential

-

A mix of traditional homes and modern developments

-

Quality schools and accessible green spaces

Ready to Secure Your Mortgage in Hackney?

Whether you are buying your first home, upgrading your property, investing in buy-to-let, or looking for commercial finance, Chaim Mandel is ready to support you. With deep local market knowledge, full access to lenders and a commitment to guiding clients confidently through the process, he is the expert you want by your side in Hackney.

📞 Contact Chaim Mandel today for a no-obligation mortgage consultation.

Thank you for reading our publication “Mortgage Broker in Hackney | Buy-to-Let & Bridging Advice.” Stay “Connect“-ed for more updates soon!

FAQ | Mortgage Broker in Hackney

| FAQ | Answer Summary |

|---|---|

| Q1: What does a mortgage broker in Hackney do? | A broker assesses your income, deposit, credit profile, and circumstances. They search the market for suitable mortgage products, manage the application, liaise with lenders, estate agents, and solicitors, and guide you through the Hackney property market. |

| Q2: Why should I use a mortgage broker instead of going directly to a bank? | A broker has access to multiple lenders, offering whole-of-market advice rather than one bank’s products. They can secure more suitable deals and understand Hackney’s complex property landscape, including leasehold issues and varied pricing. |

| Q3: What types of mortgages can a Hackney broker help with? | Residential mortgages, remortgages, buy-to-let mortgages, HMO finance, self-employed applications, complex-income cases, bridging loans and second-charge mortgages. |

| Q4: What are the criteria for getting a mortgage in Hackney? | Lenders typically require a good credit history, a 10%–25% deposit, proof of income, a supportive property valuation, and affordability checks based on London living costs. |

| Q5: How much does it cost to use a mortgage broker in Hackney? | Fees vary. Some brokers charge clients a fee, while the lender pays others. A reputable broker will explain all costs clearly up front. |

| Q6: When is the best time to contact a mortgage broker in Hackney? | Before viewing properties or making an offer, if your current mortgage deal is ending, if you have non-standard circumstances, or if you’re unsure how much you can borrow in Hackney. |

| Q7: Can a broker help if I’m self-employed or have non-standard income? | Yes. Many brokers work with lenders who accept income from self-employment, limited companies, contractors, freelancers, or those with variable income. |

| Q8: What if I am buying in Hackney as a buy-to-let investor? | A broker can assess rental yield, check lender criteria, and advise whether to buy personally or through a limited company. Hackney’s high rental demand makes product selection important. |

| Q9: What property-market factors should I consider in Hackney? | Property type, service charges, lease length, ground rent, building condition, local transport links, and value differences across areas such as Dalston, London Fields, and Stoke Newington. |

| Q10: How long will the mortgage process take in Hackney? | Many applications are approved within a few weeks. Timelines depend on valuations, solicitor work, lender speed, and the complexity of your circumstances. Brokers help streamline the process. |