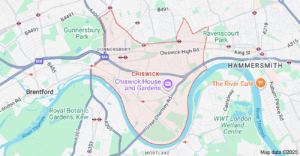

Finding the Right Mortgage Adviser in Chiswick | Chiswick is a charming and affluent West London suburb nestled along the River Thames. With leafy streets, period homes, independent boutiques, and a village-like feel, it’s one of London’s most desirable residential areas. Families, professionals, and investors are drawn to its blend of historic charm, excellent schools, and direct connections to Central London.

Finding the Right Mortgage Adviser in Chiswick | Chiswick is a charming and affluent West London suburb nestled along the River Thames. With leafy streets, period homes, independent boutiques, and a village-like feel, it’s one of London’s most desirable residential areas. Families, professionals, and investors are drawn to its blend of historic charm, excellent schools, and direct connections to Central London.

Whether you’re a first-time buyer, remortgaging, or investing in property, Chiswick offers a wide range of opportunities. As a local expert, Mark Miller provides trusted mortgage advice rooted in local market knowledge to help you secure the right mortgage for your needs.

Meet Mark Miller – Mortgage Broker in Chiswick

Mark Miller is a trusted Mortgage Broker in Chiswick, offering personalised advice for all types of borrowers. He brings expert knowledge of the Chiswick and West London property markets and works with clients from all walks of life.

Mark supports clients with:

- Buy-to-let and HMOs – For landlords seeking new investments or portfolio expansion, he provides expert buy-to-let solutions, including limited company mortgages.

-

Bridging loans and short-term finance – Ideal for chain breaks, auction purchases, or property refurbishment.

-

Second charge mortgages – Unlock additional equity without remortgaging your existing deal.

With whole-of-market access, Mark helps you navigate complex criteria, from self-employed income to adverse credit. He handles everything—from lender communication to liaising with solicitors—making your mortgage journey seamless. Find me on the Connect Expert Directory.

Exploring Neighbouring Towns in West London

If you’re considering buying a home or investment property beyond Chiswick, several West London neighbourhoods offer exceptional mortgage potential. Each area has a distinct appeal, whether you’re a first-time buyer, an investor, or remortgaging. Working with a local, whole-of-market mortgage adviser through ConnectExperts ensures you receive tailored support that fits both your financial goals and your location.

Below, we explore four key areas —Hammersmith, Ealing, Acton, and Shepherd’s Bush —highlighting what makes them attractive and which mortgage strategies to consider in each.

Hammersmith: Urban Living with a Prime Riverside Location

Hammersmith is a dynamic area known for its blend of city connectivity, leafy riverside walks, and bustling commercial centre. With top-rated schools, cultural venues, and fast links via the District, Piccadilly and Hammersmith & City lines, the area remains popular among professionals, corporate tenants, and families.

Why Consider Hammersmith for a Mortgage?

-

High concentration of new-build riverfront apartments

-

Strong rental market due to proximity to central London

-

Popular with corporate renters and relocating professionals

Mortgage Insight:

Many buyers in Hammersmith have variable income, such as bonuses, commissions, or contractor earnings. A flexible mortgage structure, such as an interest-only mortgage or a mortgage with income multiple exceptions, may be suitable. ConnectExperts can match you with advisers who understand non-salaried income and can access lenders offering custom affordability assessments.

Ealing: Green, Family-Friendly, and on the Rise

Ealing combines leafy parks, top schools, and Edwardian houses with the transport advantages of the Elizabeth Line (Crossrail), which now connects to Central London in under 20 minutes. It’s ideal for buyers who want suburban calm without sacrificing commute convenience.

Why Choose Ealing for Your Home Purchase?

-

Ideal for families looking for long-term homes

-

Growth in new-build developments near Ealing Broadway and West Ealing

-

Anticipated value uplift due to full Crossrail connectivity

Mortgage Insight:

Ealing offers strong opportunities for first-time buyers, self-employed professionals, and those using Help to Buy or Shared Ownership. Mortgage brokers at ConnectExperts can guide you through these schemes and help secure lenders with enhanced criteria for freelancers, contractors, or part-time earners.

Acton: Regeneration Hub with High Growth Potential

Acton has transformed dramatically in recent years, thanks to the Elizabeth Line and extensive regeneration projects. With property values still catching up to neighbouring districts, it remains a high-potential area for buyers who want strong value today with excellent growth prospects for the future.

What Makes Acton a Hotspot?

-

Excellent Crossrail access via Acton Main Line

-

Significant investment in infrastructure and housing

-

Strong appeal to younger buyers and professionals

Mortgage Insight:

Many lenders offer preferential mortgage rates for homes near Crossrail stations. If you’re buying near Acton Main Line, an adviser from ConnectExperts can help you access location-specific mortgage deals and secure high loan-to-value options for minimal deposit purchases.

Shepherd’s Bush: High Rental Demand in a Cultural Hotspot

Shepherd’s Bush is one of West London’s most vibrant and diverse neighbourhoods. Anchored by Westfield London, it combines shopping, entertainment, and residential options in a single, high-demand locale. This area appeals equally to young professionals, students, and seasoned property investors.

Why Investors and Landlords Target Shepherd’s Bush

-

Excellent rental demand due to proximity to universities and Westfield

-

Multicultural community with long-term rental tenants

-

Access to Overground and Underground networks (Central and Hammersmith & City Lines)

Mortgage Insight:

If you’re looking for a buy-to-let mortgage, Shepherd’s Bush offers some of the best yield potential in West London. ConnectExperts’ mortgage advisers can help you:

-

Navigate limited company buy-to-let structures

-

Compare high-yield rental calculations

-

Understand minimum income and stress test requirements

Here’s a concise overview of the West London property market, presented as a table for easy comparison and scanning.

| Metric | Current Position | Implications for Buyers / Investors |

|---|---|---|

| Average values | Greater London average ~ £546,000 as of Q2 2025. | Helps benchmark West London neighbourhoods — you should expect values around or possibly above this figure depending on zone and property type. |

| Sales market activity | Market stabilising with modest growth; London growth ~ 1.6% y/y. | For buyers: less aggressive competition. For sellers: realistic pricing is key. |

| Rental market | Rental demand remains strong, though some supply is increasing. | For investors: rental income remains viable; yields may improve in outer sub‑markets. |

| Growth outlook | Two‑speed market: central areas slower, outer/transport hubs stronger. | Favour areas with good transport links (e.g., Elizabeth Line zones) for future growth. |

| Risk areas | Affordability stretched, prime central zones have slower movement. | Buyers may face higher barriers; investors should evaluate yield vs entry cost carefully. |

| Use for mortgage strategy | Good time to work with advisers who understand local dynamics. | Advised to seek whole‑of‑market access and adviser who knows West London micro‑markets. |

Living in Chiswick: A Desirable West London Address

Chiswick is one of West London’s most sought-after neighbourhoods, known for its elegant blend of riverside charm, period architecture, and vibrant local life. Nestled along the River Thames and just a short distance from Central London, Chiswick offers a rare mix of tranquillity and connectivity that appeals to professionals, families, and retirees alike.

If you’re considering buying a home or investing in property in Chiswick, working with a mortgage broker who understands the local housing market and lender preferences can make a significant difference. At Connect Experts, we help clients access competitive mortgages that align with their goals, budgets, and long-term plans—backed by local expertise from brokers like Mark Miller.

Property Market in Chiswick: Character and Long-Term Value

The Chiswick property market is renowned for its architectural variety and enduring value. From leafy terraces to modern riverside flats, the area offers something for every buyer.

Property Types Common in Chiswick

-

Victorian and Edwardian terraced houses in Bedford Park and Grove Park

-

1930s semi-detached homes, ideal for growing families

-

Luxury apartments and new-build developments along the river or Chiswick High Road

As of 2025, the average property price in Chiswick remains well above the London average. However, this reflects the area’s strong appeal, its premium housing stock, and consistently high rental demand. Chiswick continues to attract both homeowners and buy-to-let investors looking for long-term capital growth and lifestyle value.

If you’re applying for a mortgage in Chiswick, it’s essential to factor in:

-

Loan-to-value (LTV) limits for higher-priced properties

-

Affordability stress tests that reflect rising interest rates

-

Rental income potential for investment properties

Our brokers provide whole-of-market mortgage advice, ensuring you’re matched with the right lender for your profile and property type. Whether you’re purchasing a family home or refinancing a portfolio property, we structure your mortgage to meet both short- and long-term financial goals.

Transport Links: Seamless Connectivity

Chiswick offers exceptional transport links, making it ideal for commuting to Central London, Heathrow, or even further afield. It’s particularly attractive to professionals who want suburban peace without sacrificing city access.

Rail and Tube Stations

-

Turnham Green Station (District and Piccadilly Lines) connects to the West End, Heathrow, and King’s Cross.

-

Chiswick Park Station (District Line) is ideal for commuting to Hammersmith, Victoria, and the City.

-

Gunnersbury Station offers both Underground (District) and Overground services.

-

Chiswick Railway Station provides National Rail services to London Waterloo in around 25 minutes.

Road and Bus Access

-

A4/M4 Corridor offers direct access to Heathrow Airport, the M25, and Central London.

-

Multiple bus routes serve Chiswick, providing links to Hammersmith, Kensington, Richmond, and Ealing.

These transport links are also viewed favourably by mortgage lenders, particularly when assessing buy-to-let applications or properties near key commuter routes.

Local Amenities and Lifestyle Attractions

Chiswick’s unique charm lies in its balance of village ambience and urban sophistication. It’s not just a place to live—it’s a lifestyle choice.

Attractions and Culture

-

Chiswick House & Gardens – A beautifully restored Grade I-listed villa surrounded by landscaped grounds, perfect for history lovers and weekend walks.

-

Fuller’s Griffin Brewery – A working brewery offering tours and insight into one of the UK’s oldest beer brands.

-

The River Thames – Chiswick’s riverside walkways are popular for running, cycling, and leisurely strolls.

Shopping and Dining

-

Chiswick High Road features independent boutiques, bookstores, and artisan food shops.

-

A wide range of cafés, gastropubs, and award-winning restaurants cater to both family brunches and fine dining.

Sports and Schools

-

Dukes Meadows offers golf, tennis, rowing, and a popular Sunday food market.

-

Highly rated local schools include:

-

Belmont Primary School

-

Chiswick School

-

Heathfield House School

-

Access to international schools in nearby Hammersmith and Ealing

-

For families, being near good schools is a key mortgage consideration. Many lenders will assess the property’s location against OFSTED data and catchment demand when evaluating long-term value.

Mortgage Advice in Chiswick: How Mark Miller Can Help

Mark Miller, a trusted mortgage adviser within the Connect Experts network, has years of experience helping clients finance property in and around West London. Based locally, Mark understands the nuances of the Chiswick market—from lender preferences for Georgian terraces to income criteria for high-value mortgage loans.

Ready to Take the Next Step?

Whether you’re purchasing in Chiswick, investing in West London, or remortgaging to release equity, Mark Miller is here to guide you.

Don’t leave your mortgage to chance; get advice you can trust. 📞 Contact Mark today for a free, no-obligation consultation.

Thank you for reading our publication “Mortgage Adviser in Chiswick | Chiswick Mortgage Broker.” Stay “Connect“-ed for more updates soon!