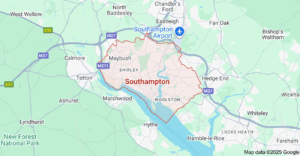

Finding the Right Mortgage Advisor in Southampton | Southampton is a vibrant port city located on the south coast of England. It offers a unique mix of maritime history, urban living, and scenic green spaces. This combination makes it a popular choice among first-time buyers, home movers, and property investors.

Finding the Right Mortgage Advisor in Southampton | Southampton is a vibrant port city located on the south coast of England. It offers a unique mix of maritime history, urban living, and scenic green spaces. This combination makes it a popular choice among first-time buyers, home movers, and property investors.

With strong transport links, including direct rail access to London and ferry services to the Isle of Wight, Southampton is well-connected and convenient. Its economy is bolstered by the port, two universities, and a growing tech sector, which contribute to its appeal as a place to live and invest.

Meet: Jonathan Veers – Mortgage Advisor in Southampton

Jonathan Veers is an experienced Mortgage Advisor in Southampton, offering whole-of-market mortgage advice tailored to your needs. Whether you’re a first-time buyer, remortgaging, or expanding a property portfolio, Jonathan ensures expert guidance and access to competitive rates.

Services Include:

- Buy-to-Let & HMOs: Ideal for landlords looking to invest or refinance in rental property.

-

Bridging Finance: Quick funding solutions for purchases, renovations, or property chains.

-

Limited Company Mortgages: Tax-efficient options for portfolio landlords and SPVs.

- Protection & Insurance: Safeguarding your income, mortgage, and family’s future.

Jonathan works closely with clients to understand their income, credit history, deposit size, and goals. He’ll help you navigate complex scenarios like self-employment, adverse credit, or multi-property portfolios.

He manages the full application process, liaising with lenders, solicitors, and estate agents to ensure a smooth journey from offer to completion.

Find me on the Connect Expert Directory

Exploring Nearby Hampshire Towns

Suppose you’re considering buying or remortgaging a home in Hampshire. In that case, the region offers a diverse mix of property types from family homes in commuter towns to luxury properties and rural retreats. Below, we explore some of Hampshire’s most sought-after locations, each with its own lifestyle appeal and mortgage opportunities.

Eastleigh

Property Snapshot:

Eastleigh sits just 15 minutes from central Southampton and offers a welcoming, family-friendly community. With strong local schools, convenient amenities, and excellent rail connections to both Southampton and London, it’s ideal for young professionals and families looking for value without sacrificing convenience. Property prices remain competitive compared with surrounding areas, making Eastleigh a strong contender for first-time buyers and remortgagers alike.

Mortgage Tips:

-

First-time buyers: Look into low-deposit or shared ownership mortgages — Eastleigh has good availability of starter homes.

-

Commuters: Consider offset mortgages or flexible repayment options if you plan to balance work between home and the city.

-

Families: A long-term fixed-rate mortgage can offer stability amid rising interest rates.

Winchester

Property Snapshot:

Winchester, one of the UK’s most desirable cathedral cities, blends rich heritage with modern living. Known for its excellent schools, independent shops, and cultural life, Winchester attracts professionals and families seeking a high standard of living. Property values are typically higher here, reflecting the city’s reputation and limited housing stock.

Mortgage Tips:

-

High-value property buyers: Explore professional or bespoke mortgage options that consider complex income streams.

-

Remortgaging: Regularly review rates — Winchester’s strong property appreciation makes equity release or home improvement loans attractive.

-

Relocating professionals: Seek lenders offering fast-track processing for buyers moving from London or abroad.

Romsey

Property Snapshot:

Romsey is a charming market town that balances peaceful countryside living with easy access to Southampton and Winchester. With historic architecture and a strong sense of community, it’s perfect for those who value character and lifestyle. The area attracts families, retirees, and downsizers seeking tranquillity without isolation.

Mortgage Tips:

-

Residential buyers: Consider long-term fixed deals for predictability in retirement or semi-retirement.

-

Self-employed borrowers: Romsey’s local market suits those using specialist mortgage products designed for variable income.

-

Downsizers: Ask about porting your mortgage if you’re selling and buying simultaneously.

Fareham

Property Snapshot:

Positioned strategically between Southampton and Portsmouth, Fareham is ideal for commuters. It offers a wide selection of family homes, good schools, and modern infrastructure. With excellent road and rail links, the area also has a buoyant rental market, making it a top choice for investors.

Mortgage Tips:

-

Buy-to-let investors: Investigate limited company buy-to-let options or portfolio mortgages to maximise returns.

-

Commuters: Look for mortgages with flexible repayment holidays if travel impacts your cash flow.

-

Growing families: Remortgaging for home improvements could add significant value to properties in this expanding area.

Lyndhurst & The New Forest

Property Snapshot:

Lyndhurst, often called the “capital” of the New Forest, offers a mix of rural charm and natural beauty. The surrounding New Forest region attracts buyers seeking space, character, and a slower pace of life. Properties range from quaint cottages to luxury homes, many with holiday-let potential.

Mortgage Tips:

-

Holiday-let buyers: Choose specialist lenders who understand the seasonal income from short-term rentals.

-

Second-home owners: Consider interest-only mortgages to manage cash flow while maintaining long-term investment value.

-

Self-employed professionals: Lenders with manual underwriting can assess income more flexibly than standard high-street banks.

Property Market Overview – Hampshire (2025)

| Metric | Latest estimate/status | Key insight for buyers & mortgage advisers |

|---|---|---|

| Average property price (Hampshire) | ~ £389,400 as per forecast for county-wide average. | Advisers should use this as a benchmark when discussing affordability, deposit requirements and LTVs in the region. |

| Growth since 2019 | ~ +17% rise from 2019 to Nov 2024 (county-wide) in average prices. | Indicates that Hampshire has outperformed some neighbouring counties; a positive point for equity growth discussions. |

| Forecast price growth 2025 | ~ +3.5% expected for 2025 (South East/Hampshire region) | Buyers and investors should still expect growth, but at a more modest pace than the past decade — helpful for mortgage term planning. |

| Recent annual price change | +0.5% nominal / −3.3% real (after inflation) over the last year in Hampshire. | Shows that while headline price increases are modest, long-term value remains; important for comparing real returns. |

| Sales/turnover indicator | In some parts of Hampshire (e.g., Eastleigh, Fareham), approximately 1 in 29 properties changed hands in the last year. | Indicates reasonably healthy transaction activity — useful for advising on market liquidity and exit strategy. |

| Buyer demand & market sentiment | Activity remains steady but cautious: nationally, “market in waiting” due to tax/interest rate uncertainty. | Advisers should emphasise that while the market remains open, factors such as interest rates and tax changes are influencing buyer behaviour. |

| Key demand drivers | Strong commuter links (to London/Southampton), lifestyle appeal (rural/resort areas), family housing, and energy-efficient homes are gaining appeal. | When discussing mortgage suitability, emphasise transport links, property type, and energy efficiency as drivers of demand and resale value. |

| Risk/consideration factors | Higher stamp duty thresholds ended, interest rates remain elevated; supply remains constrained. | For mortgage planning, it means budgeting for higher upfront costs or potentially slower equity growth. |

| Investor focus / buy-to-let | Areas like Fareham and Eastleigh appear active for investors; rural/lifestyle zones (New Forest/Lyndhurst) appeal to second-home/holiday-let buyers. | Advisers should explore specialist mortgage products (holiday-let, limited company BTL) if targeting investor buyers in Hampshire. |

Attractions, Transportation & Amenities in Southampton

Attractions & Lifestyle

Southampton is a vibrant coastal city that perfectly blends maritime heritage with modern living. Whether you’re exploring its cultural landmarks or enjoying its lively waterfront, the city offers something for everyone.

Southampton Common

Covering more than 300 acres, Southampton Common is one of the largest green spaces in the city. It’s a popular destination for families, joggers, and nature lovers, with woodlands, ponds, and open parkland. Throughout the year, it hosts community events and music festivals, including the Common People Festival and regular outdoor fairs, making it a cornerstone of local recreation.

SeaCity Museum & Tudor House and Garden

Southampton’s rich maritime history comes to life at the SeaCity Museum, which explores the city’s connection to the RMS Titanic and its wider seafaring heritage. Just a short walk away, the Tudor House and Garden offers a glimpse into over 800 years of history, featuring period furnishings, archaeological artefacts, and tranquil gardens. These attractions make Southampton a must-visit for history enthusiasts and families alike.

Westquay Shopping Centre

Located in the heart of the city, Westquay is a premier shopping and leisure destination. With over 100 stores, including high-street brands and designer outlets, plus a wide range of restaurants and entertainment options, it’s a central hub for shopping and dining in Southampton. The adjacent Westquay South area further enhances the experience with rooftop dining and luxury brands.

Mayflower Theatre

As one of the largest theatres in Southern England, the Mayflower Theatre attracts world-class performances, from West End musicals and ballet to comedy and opera. Its grand architecture and top-tier programming make it a cultural landmark for residents and visitors.

Ocean Village Marina

A striking example of modern waterfront regeneration, Ocean Village Marina is home to luxury apartments, stylish bars, and restaurants overlooking the marina. With its blend of nautical charm and cosmopolitan lifestyle, it’s a sought-after area for both living and leisure, hosting events, sailing activities, and sunset dining experiences.

Transportation Links

Southampton’s strategic location on the South Coast makes it one of the best-connected cities in the UK. Whether you’re commuting to London, travelling abroad, or exploring the South Coast, transport options are abundant and efficient.

Rail

The city’s main train station, Southampton Central, offers fast and frequent services. Passengers can reach London Waterloo in under 90 minutes, while direct routes also connect to Winchester, Bournemouth, Portsmouth, Salisbury, and Cardiff. This makes it ideal for both commuters and leisure travellers.

Air

Just a short drive from the city centre, Southampton Airport (SOU) provides convenient access to domestic and European destinations. Regular flights connect travellers to major cities such as Manchester, Glasgow, and Amsterdam, making it a key hub for business and leisure trips alike.

Road

Southampton enjoys excellent road connectivity, with the M3 motorway offering a direct route to London and the M27 linking to Portsmouth, Bournemouth, and the wider South Coast. These routes provide smooth access to the South West, Midlands, and beyond, appealing to both commuters and logistics operators.

Buses & Ferries

A reliable bus network connects Southampton’s residential and commercial areas efficiently, with frequent services operated by Bluestar and Unilink. The Red Funnel ferries provide a scenic and practical link to the Isle of Wight, while additional ferry routes serve surrounding coastal destinations.

Amenities & Services

Southampton’s infrastructure supports a high standard of living, with strong educational, healthcare, and lifestyle amenities that cater to residents and professionals alike.

Education

The city is home to two prestigious institutions: the University of Southampton, a member of the Russell Group and globally recognised for research and innovation, and Solent University, known for its industry-focused courses and creative specialisms. Alongside these, there’s a wide selection of high-performing primary and secondary schools, including both state and independent options.

Healthcare

Southampton General Hospital serves as a major NHS teaching and research centre, offering comprehensive services including trauma, oncology, and paediatrics. The city is also supported by numerous private healthcare providers, dental practices, and GP surgeries, ensuring residents have access to first-rate medical care.

Retail & Dining

Southampton’s dining scene has flourished in recent years, with everything from independent coffee houses and harbourside bistros to Michelin-rated restaurants. The city’s retail landscape combines modern shopping centres like Westquay with boutique stores in Bedford Place and the historic Old Town, providing a balance of convenience and character.

Living in Southampton

With its combination of rich history, coastal beauty, modern infrastructure, and transport connectivity, Southampton is one of the most desirable places to live and work in Southern England. Whether you’re relocating for education, employment, or lifestyle, the city offers a welcoming community and a high quality of life.

Ready for a Mortgage in Southampton?

Contact Jonathan Veers today for expert advice, access to exclusive deals, and support throughout your journey.

Thank you for reading our publication “Mortgage Advisor in Southampton | Find a UK Mortgage Adviser.” Stay “Connect“-ed for more updates soon!