Mortgage Advisor in Watford, Hertfordshire | Clear Advice from a Local Expert – Getting a mortgage isn’t just about interest rates—it’s about finding a lending option that fits your plans. Based in Watford, Hertfordshire, mortgage broker Anil Patel provides clear, tailored advice to property investors, landlords, and limited companies across the region.

Mortgage Advisor in Watford, Hertfordshire | Clear Advice from a Local Expert – Getting a mortgage isn’t just about interest rates—it’s about finding a lending option that fits your plans. Based in Watford, Hertfordshire, mortgage broker Anil Patel provides clear, tailored advice to property investors, landlords, and limited companies across the region.

With a firm understanding of lender requirements and strong ties to the Watford property market, Anil helps clients secure suitable mortgage and finance solutions. Whether you’re growing a buy-to-let portfolio, funding a refurbishment, or buying through a company, Anil offers practical and easy-to-follow support.

Mortgage Advisor in Watford | Straightforward Guidance, Start to Finish

Anil reviews your income, credit status, and investment objectives to recommend products that meet UK lending standards. From initial consultation to completion, he takes care of:

-

Document preparation

-

Lender communication

-

Application submission

-

Ongoing support throughout the process

He handles the detail, so you can stay focused on your property goals. Whether you’re applying for bridging finance, second charge borrowing, or a commercial mortgage, you’ll receive advice that’s structured, compliant, and free from industry jargon.

Why Choose Anil Patel – Mortgage Advisor in Watford

Anil Patel supports property professionals across Watford and Hertfordshire, offering clear advice for more complex cases. His expertise covers:

-

Buy-to-let finance, including limited company applications and portfolio structuring

-

HMO mortgages for shared accommodation or high-yield rental strategies

-

Commercial and semi-commercial finance tailored to business premises and mixed-use buildings

-

Bridging loans, suitable for time-sensitive purchases or property renovations

-

Second charge mortgages, offering access to existing equity without refinancing your main loan

-

Protection reviews, ensuring your properties and income are safeguarded

Mortgage Advisor in Watford | Local Knowledge Makes the Difference

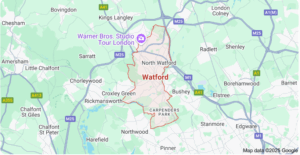

Watford’s strong rental market, excellent transport links, and growing demand make it a prime location for landlords and investors. From high-yield opportunities near Watford General to mixed-use developments in the town centre, Anil’s local insight helps clients make informed choices.

He understands lender expectations and how they apply in areas like Watford, Bushey, and Rickmansworth. This means you benefit from precise, up-to-date advice every time.

Keeping Up with Market Changes

Lending rules and mortgage products change regularly. Anil works with a wide panel of UK lenders, including options not available directly to borrowers. His recommendations are based on your goals, up-to-date market data, and current lending rules—ensuring your application stands the best chance of success.

Living in Watford: Why It’s a Popular Spot for Property Buyers

Transport Links

-

By Road: Fast access to the M1, M25, and A41

-

By Rail: Direct trains from Watford Junction to London Euston in under 20 minutes

-

By Bus: Frequent local services across Hertfordshire

Local Highlights

-

Shopping & Dining: Atria Watford, cafés, restaurants, and cultural venues like Palace Theatre

-

Schools: Highly regarded options including Watford Grammar

-

Parks: Cassiobury Park offers outdoor space, sports, and riverside walks

-

Attractions: Warner Bros. Studio Tour, museums, and historic sites

Areas Served Beyond Watford

While based in Watford, Anil also helps clients in:

-

Bushey – Strong family appeal and good commuter links

-

Rickmansworth – High rental demand and scenic surroundings

-

Croxley Green – Ideal for both homebuyers and investors

-

Abbots Langley – Community-driven village with ongoing development

-

Kings Langley – Excellent schools and motorway access

Speak to Anil Patel – A Trusted Name in Watford

If you’re buying property, reviewing your portfolio, or looking for advice on commercial or bridging loans, Anil Patel provides support that’s clear, reliable, and fully compliant with UK lending rules.

Get in touch today to arrange a consultation and explore the right mortgage for your needs.

Thank you for reading our “Mortgage Advisor in Watford | Mortgage Broker in Watford” publication. Stay “Connect“-ed for more updates soon!