Selecting a mortgage broker in Golders Green requires careful thought. You need a professional who understands your financial situation and the specifics of the local property market. A broker with local expertise can provide tailored advice to help you make informed decisions.

Selecting a mortgage broker in Golders Green requires careful thought. You need a professional who understands your financial situation and the specifics of the local property market. A broker with local expertise can provide tailored advice to help you make informed decisions.

An experienced broker will compare mortgage options from various lenders, ensuring you secure a competitive deal. Lender criteria vary so that professional guidance can improve your chances of approval. Expert advice simplifies the process, whether you’re a first-time landlord, remortgaging, or investing in property.

Golders Green’s property market includes family homes, investment properties, and luxury apartments. A local broker understands market trends and can introduce you to lenders offering suitable terms for your financial profile. With mortgage rates and lending criteria frequently changing, clear professional guidance is essential.

Searching for a mortgage can be complex, but expert support makes the process more manageable. A broker will assess your income, credit history, and deposit size to match you with the right lenders. This reduces the risk of rejection and protects your future borrowing potential.

Working with a mortgage broker specialising in Golders Green ensures you receive advice suited to your needs. A trusted local broker can make all the difference if you need expert mortgage guidance.

Find a Mortgage Broker in Golders Green

Looking for an expert mortgage broker in Golders Green? Tsvi’s extensive knowledge of the UK mortgage market and commitment to clear guidance ensure you receive tailored advice suited to your needs. Tsvi provides expert support at every stage, whether you are a first buy-to-let, remortgaging, or investing in buy-to-let.

By choosing Tsvi, you receive more than just mortgage advice—you gain a professional who simplifies complex financial terms and delivers clear, practical guidance. No matter your circumstances, Tsvi ensures the mortgage process remains smooth, straightforward, and stress-free.

Why Choose a Mortgage Broker in Golders Green?

Using a mortgage broker in Golders Green ensures you get access to the best mortgage rates and terms suited to your needs. Tsvi Pappenheim provides expert guidance and simplifies the application process, helping you avoid common pitfalls and delays.

Advantages of Choosing a Mortgage Broker in Golders Green:

- Local Market Knowledge – Tsvi understands the unique property trends in Golders Green, helping you make informed decisions.

- Exclusive Mortgage Deals – Brokers have access to mortgage products that are not always available directly from banks.

- Personalised Service – Every client’s financial situation is different. Tsvi provides bespoke mortgage solutions based on your circumstances.

Multilingual Mortgage Broker in Golders Green

Tsvi Pappenheim offers mortgage advice in multiple languages, ensuring clients from diverse backgrounds receive clear and helpful guidance. He is fluent in:

- English

- Dutch

- French

- Hebrew

This makes the mortgage process easier for international buyers and residents who prefer advice in their native language.

Golders Green Property Market Overview

Golders Green is a desirable area in North London with a mix of detached homes, period properties, and modern apartments.

- Average Property Price: £1,501,426 (as of February 2025)

- Detached Homes: £3,185,000 (average price)

- Flats: £567,458 (average price)

- Average Time on Market: 18 weeks

With house prices in Golders Green varying widely, professional mortgage advice can make all the difference in securing the right deal.

Mortgage Services in Golders Green

Tsvi Pappenheim specialises in various mortgage types, ensuring you find the right financing for your property purchase.

Types of Mortgages Available:

- Second Charge Mortgages – Helping you with home improvement, debt consolidation, etc

- Remortgaging – Finding better rates and reducing your monthly repayments.

- Buy-to-Let Mortgages – Advising investors on the best mortgage deals for rental properties.

- Bridging Loans – Short-term financing for buyers needing flexibility.

- Commercial Mortgages – Financing solutions for business property purchases.

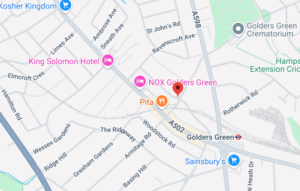

Transport Links in Golders Green

Golders Green has excellent transport connections, making it a convenient place to live and invest.

- Underground – Golders Green Station (Northern Line) provides direct access to central London, including Euston and Bank.

- Bus Services – Numerous routes connect Golders Green to nearby areas such as Finchley, Hampstead, and Brent Cross.

- Road Links – Easy access to the M1 and North Circular (A406), making commuting simple for drivers.

Nearby Towns to Consider

If you’re exploring other locations near Golders Green, here are three excellent alternatives:

Hampstead Garden Suburb

It is a quiet, picturesque neighbourhood with beautiful period homes and green spaces. It offers a peaceful environment with easy access to Golders Green’s transport links.

Finchley

It is a vibrant area with excellent schools, shops, and restaurants. Finchley offers strong transport connections, with multiple Northern Line stations providing quick links to central London.

Cricklewood

It is an up-and-coming area with a mix of traditional and modern properties. Cricklewood has excellent transport links, including Thameslink services for easy commuting.

FAQs About Mortgage Brokers in Golders Green

What does a mortgage broker in Golders Green do?

A mortgage broker helps you find the best mortgage deals by comparing lenders, assisting with paperwork, and increasing your chances of approval.

How much does a mortgage broker charge?

Fees vary; some brokers charge a fixed fee, while others receive lender commissions. Tsvi Pappenheim provides transparent pricing with no hidden costs.

Can a mortgage broker help me if I have bad credit?

Yes, a mortgage broker can help find lenders who approve mortgages for applicants with poor credit, improving your chances of securing a loan.

How long does the mortgage process take?

The average mortgage application takes 4–8 weeks. Tsvi ensures a smooth and efficient process, keeping you informed at every step.

Do I need a mortgage broker, or can I go directly to a bank?

While you can apply directly to a bank, a mortgage broker provides access to a wider range of mortgage products and expert guidance, making the process easier.

Secure Your Mortgage Broker in Golders Green

Expert advice can make all the difference whether you’re a first buy-to-let, looking to remortgage, or expanding your property portfolio. Tsvi Pappenheim and Connect Experts are here to help you find the right mortgage. Contact Tsvi today to start your journey toward securing the best mortgage deal in Croydon.

Thank you for reading our publication, “Mortgage Broker in Golders Green | Adviser in Golders Green.” Stay “Connect“-ed for more updates soon!