Mortgage Broker in Leicester – Dinesh Joshi | Expert Mortgage Advice in Leicester and Leicestershire

Mortgage Broker in Leicester – Dinesh Joshi | Expert Mortgage Advice in Leicester and Leicestershire

Choosing the right mortgage broker in Leicester is crucial for securing the most suitable property finance. With ever-changing lender criteria and mortgage rules, expert advice ensures a smoother and more successful application process. Dinesh Joshi, a professional mortgage broker based in Leicester, provides trusted support for clients across residential, commercial, buy-to-let, bridging finance, protection, and general insurance.

Dinesh understands both the local property market and your unique financial needs. His deep insight into lender requirements helps clients avoid delays and rejections.

Mortgage Broker in Leicester | Why Choose Dinesh Joshi in Leicester?

Dinesh Joshi offers tailored mortgage solutions backed by up-to-date market knowledge. Whether you’re a first-time buyer, home mover, landlord, or business owner, he works to find the right deal. He provides clear, honest advice and manages the process from start to finish.

-

Searches across a wide range of lenders, including specialist providers

-

Helps clients with unique needs, including self-employed or limited credit

-

Offers protection advice and general insurance to cover your property and income

-

Ensures applications are well-prepared to increase approval chances

Each recommendation is personalised based on your deposit, income, and long-term goals. Dinesh’s experience simplifies complex cases.

Residential Mortgages in Leicester

Buying your first home or moving house in Leicester? Dinesh offers step-by-step guidance. He helps you understand affordability, compares mortgage options, and prepares your application to fit lender criteria.

Leicester offers a wide range of property types including:

-

Victorian terraces in Highfields and Clarendon Park

-

New builds in Hamilton and Thorpe Astley

-

Family homes in Oadby, Knighton, and Wigston

Local insight matters—Dinesh keeps you informed on property values, local schools, and upcoming developments.

Commercial Mortgages and Business Finance

Dinesh also supports Leicester businesses seeking finance for offices, shops, or mixed-use premises. Whether you’re expanding your footprint or refinancing, he ensures your business goals align with lender expectations.

He works with investors and trading businesses, offering:

-

Semi-commercial mortgage support

-

Lending for shops with flats above

-

Offices, warehouses, and industrial unit finance

-

Access to lenders not available on the high street

Commercial lending requires specialist advice—Dinesh ensures clarity at every stage.

Buy-to-Let and Limited Company Mortgages

Investing in Leicester’s vibrant rental market? Dinesh supports landlords, whether buying individually or via a limited company.

He advises on:

-

Interest-only vs repayment strategies

-

HMOs, student rentals, and standard BTLs

-

Company structures and tax considerations

-

Remortgaging to release equity or reduce costs

Areas like Evington, Braunstone, and Westcotes are popular for tenants. Knowing the rental yields helps you invest wisely.

Bridging Loans and Short-Term Finance

Need fast funding to secure a property, renovate, or break a chain? Dinesh arranges short-term bridging finance with quick turnaround.

He works with lenders who:

-

Offer competitive rates and fast decisions

-

Support auction purchases and refurbishment projects

-

Accept applications with limited credit history

-

Consider both regulated and unregulated loans

These flexible solutions are ideal when speed matters more than long-term structure.

Protection and General Insurance

Dinesh ensures your mortgage is protected if the unexpected happens. He advises on:

-

Income protection for self-employed and PAYE workers

-

Critical illness cover for long-term security

-

Life insurance to protect your family

-

Buildings and contents cover from trusted insurers

Protection planning is often overlooked—Dinesh makes sure your assets and income are safeguarded.

Multilingual Mortgage Broker in Leicester

Dinesh Joshi proudly serves Leicester’s diverse community. He speaks:

English, Urdu, Hindi, Punjabi, and Gujarati

This makes it easier for clients to ask questions in their preferred language, understand documents, and feel confident throughout the process. Communication should never be a barrier to homeownership or investment success.

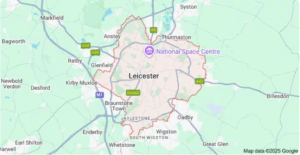

Mortgage Broker in Leicester | Local Knowledge of Leicester

Leicester is one of the UK’s most culturally rich and affordable cities, making it a prime spot for buyers and investors alike. The city boasts:

-

Strong universities and schools, including University of Leicester and De Montfort University

-

Modern shopping centres like Highcross Leicester

-

Award-winning parks and green spaces such as Abbey Park and Victoria Park

Transport links are excellent, with:

-

Direct trains to London in just over an hour from Leicester Station

-

The M1, A6, and A46 offering great road connectivity

-

East Midlands Airport just 30 minutes away

Dinesh’s local knowledge helps clients understand how location affects property values and borrowing options.

Neighbouring Towns in Leicestershire

Dinesh supports clients across Leicester and surrounding towns:

Loughborough

Home to Loughborough University and a thriving student rental market. Great for buy-to-let investors.

Market Harborough

A charming town with a mix of period homes and new developments. Popular with commuters and families.

Hinckley

Offers affordable housing, strong local industry, and good transport connections to Birmingham and Coventry.

Melton Mowbray

Known for rural charm, food heritage, and family-friendly housing.

Coalville & Wigston

Well-priced homes and excellent commuter access to Leicester make these growing towns attractive to first-time buyers.

Wherever you’re buying, Dinesh guides mortgage affordability, property types, and local lender appetite.

Mortgage Broker in Leicester | Making Mortgages Simple and Stress-Free

The mortgage process includes affordability checks, lender criteria, property surveys, legal work, and completion. Dinesh takes care of:

-

Explaining each step in clear terms

-

Liaising with estate agents and solicitors

-

Avoiding common delays with well-prepared applications

-

Providing updates so you stay informed

He offers a smooth, supported journey from enquiry to keys in hand.

Thank you for reading our “Mortgage Broker in Leicester | Leicester Mortgage Broker ” publication. Stay “Connect“-ed for more updates soon!