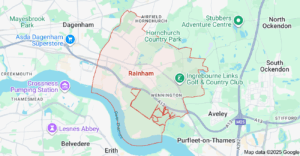

Finding the Right Mortgage Broker in Rainham, Essex | Located in the borough of Havering, Rainham in Essex offers a unique blend of suburban charm, historic significance, and growing development. Situated along the River Thames, Rainham combines riverside living with access to London and Essex countryside. Its strategic position near the A13 and proximity to the M25 and London’s Zone 6 transport network make it highly appealing to commuters and families alike.

Finding the Right Mortgage Broker in Rainham, Essex | Located in the borough of Havering, Rainham in Essex offers a unique blend of suburban charm, historic significance, and growing development. Situated along the River Thames, Rainham combines riverside living with access to London and Essex countryside. Its strategic position near the A13 and proximity to the M25 and London’s Zone 6 transport network make it highly appealing to commuters and families alike.

The area is seeing increased attention from property investors and first-time buyers due to ongoing regeneration projects, improved transport links, and expanding housing developments. Whether you’re looking to settle down or invest, Rainham is a growing hotspot for accessible living and long-term property value.

Meet: Peter Etiaka – Your Trusted Mortgage Broker in Rainham

Peter Etiaka is an experienced Mortgage Broker in Rainham providing independent, whole-of-market advice tailored to your personal goals. He understands the nuances of the Essex and East London property market and works with a diverse range of lenders—from high-street names to niche providers.

Peter supports clients through:

-

Residential Mortgages – For first-time buyers, home movers, and remortgagers.

-

Buy-to-Let and HMOs – Advice for landlords expanding portfolios or entering the rental market.

-

Bridging Finance – Quick-access loans for auction purchases or short-term solutions.

-

Limited Company Mortgages – For landlords looking to optimise tax and borrowing structures.

- Protection and Insurance – Tailored cover to protect your income, home, and loved ones.

Peter handles the entire process—from application to completion—liaising with solicitors, estate agents, and lenders to reduce stress and delays.

👉 Find me on the Connect Expert Directory

Exploring Neighbouring Essex Towns

Living in Rainham places you in an excellent position to explore some of Essex’s most desirable towns. Each nearby location offers a distinct lifestyle, varied property markets, and different mortgage opportunities suited to first-time buyers, families, and investors. Whether you are looking to upsize, remortgage, or invest in buy-to-let property, these neighbouring areas provide strong value and convenience for both commuters and long-term homeowners.

Hornchurch

Property Snapshot:

Hornchurch is a thriving town that combines suburban comfort with a lively atmosphere. It is well known for its independent restaurants, boutique shops, and a strong sense of community. Families are particularly drawn to the area because of its highly rated schools and access to green spaces such as Harrow Lodge Park. Property types range from period semi-detached homes to modern new-build developments, offering options for a variety of budgets.

Mortgage Insights:

-

Families upgrading: A long-term fixed-rate mortgage can provide security and predictable monthly payments.

-

Remortgaging opportunities: Rising property values in Hornchurch make equity release or home improvement loans a worthwhile consideration.

-

Commuters: With strong rail links via Emerson Park and Upminster Bridge stations, flexible or offset mortgages may suit those with variable commuting costs.

Romford

Property Snapshot:

Romford is one of Essex’s most dynamic urban centres, combining a thriving retail and business scene with excellent transport links into Central London. Its Crossrail (Elizabeth Line) connection has further boosted demand, making it a hotspot for investors and professionals. The local property market includes a mix of modern apartments, family houses, and new developments that attract both homeowners and landlords.

Mortgage Insights:

-

Buy-to-let investors: Look for high-yield opportunities near Romford Station, where rental demand is particularly strong.

-

First-time buyers: Government schemes such as Shared Ownership and First Homes are available in selected new developments.

-

Professionals: Flexible tracker mortgages could suit those expecting to relocate or upgrade in the future.

Upminster

Property Snapshot:

Upminster offers a more refined, village-like environment while maintaining fast access to Central London through the District and C2C lines. The area features a mix of elegant detached homes, tree-lined streets, and well-maintained parks. Local schools and amenities make it especially popular among professionals and growing families seeking a balance of countryside and city life.

Mortgage Insights:

-

Remortgaging: Homeowners with substantial equity can explore competitive remortgage rates to fund extensions or renovations.

-

Upsizing buyers: High Loan-to-Value mortgages may assist those moving from smaller properties into family homes.

-

Professional clients: Private bank mortgages may be suitable for higher-income buyers with complex earnings or bonuses.

South Ockendon

Property Snapshot:

South Ockendon offers a more affordable entry point into the Essex housing market. It is a popular choice for first-time buyers and investors, thanks to its well-priced homes and direct train connections into London Fenchurch Street. The area has seen continued development, including modern housing estates and improved local facilities, supporting consistent property value growth.

Mortgage Insights:

-

First-time buyers: Low-deposit mortgages or Help to Buy remortgages can make stepping onto the property ladder more achievable.

-

Investors: Rental demand from commuters creates a steady market for buy-to-let mortgages.

-

Growing families: With ongoing regeneration projects, consider mortgage products with overpayment flexibility to manage future upgrades.

Property Market Overview – Essex (2025)

| Metric | Latest estimate/status | Key insight for buyers & mortgage advisers |

|---|---|---|

| Average property price (Essex) | ~ £375,800 as per latest regional forecasts for 2025. | This serves as a solid benchmark when assessing affordability, deposit size, and LTV ratios for clients purchasing across the county. |

| Growth since 2019 | ~ +15% increase in average prices between 2019 and late 2024. | Reflects steady price resilience; Essex has shown balanced growth compared to other South East counties, supporting confidence in long-term property values. |

| Forecast price growth 2025 | ~ +3.2% projected for 2025 (East/South East regional forecast). | Indicates moderate appreciation, suggesting advisers should guide clients to focus on stability and medium-term value rather than speculative short-term gains. |

| Recent annual price change | +0.8% nominal / −3.0% real (adjusted for inflation) across Essex. | Demonstrates that while growth is slowing, the market remains fundamentally strong, offering consistency for cautious buyers. |

| Sales/turnover indicator | Approximately 1 in 30 properties changed hands in 2024, with strongest turnover in Chelmsford, Colchester, and Southend-on-Sea. | Suggests active yet competitive conditions; advisers can use this to discuss time-to-sell expectations and market liquidity. |

| Buyer demand & market sentiment | Buyer sentiment remains steady, supported by easing mortgage rates and improved affordability compared with 2023. | Advisers should note renewed first-time buyer interest, particularly in commuter and coastal areas. |

| Key demand drivers | Strong commuter links to London, growing employment hubs (Chelmsford, Basildon), expanding infrastructure, and coastal lifestyle appeal. | Highlighting proximity to London and local development projects can strengthen discussions around long-term value and demand sustainability. |

| Risk/consideration factors | Elevated borrowing costs, ongoing cost-of-living pressures, and limited new housing supply in certain districts. | Advisers should help clients prepare for tighter affordability checks and encourage rate reviews or remortgage strategies as rates stabilise. |

| Investor focus / buy-to-let | Buy-to-let activity remains healthy in commuter areas such as Brentwood, Chelmsford, and Southend; smaller seaside towns showing rising short-let interest. | Advisers should consider limited company BTL and holiday-let products to suit investor strategies, particularly in mixed-use or coastal zones. |

Transport Links and Connectivity in Rainham

Rainham offers some of the best transport connections in East London, making it a highly desirable area for both homeowners and property investors. Its combination of fast rail services, road accessibility, and proximity to key business districts makes it particularly appealing to professionals and families looking for convenient commuting options.

Rainham Station (C2C Line) provides regular and direct services to London Fenchurch Street, with journey times of around 25 minutes. This makes Rainham an attractive base for those working in Canary Wharf, the City of London, or Docklands. Trains are frequent and reliable, offering a stress-free alternative to driving into central London.

Nearby stations, including Dagenham Dock and Elm Park on the District Line, provide additional transport flexibility. These links expand travel choices across Greater London and beyond, making Rainham ideal for professionals who need access to multiple business hubs or frequent travel routes.

For drivers, Rainham’s position is equally advantageous. The A13 runs through the area, offering quick access to East London, the M25, and key motorways connecting Essex and Kent. This makes it easy for residents to reach London airports, including London City and Southend, in under an hour.

Public transport is also well established, with local bus services linking Rainham to Romford, Hornchurch, Dagenham, and neighbouring towns. Regular routes ensure residents can travel easily for work, shopping, or leisure without relying on a car.

Commuting advantages:

-

Fast rail connections to central London

-

Easy access to Canary Wharf and Docklands

-

Strong local and regional bus network

-

Quick road links via the A13 and M25

For professionals seeking affordability without sacrificing convenience, Rainham represents one of the best-connected residential areas in Essex. This strong infrastructure also supports rising property demand, making it an attractive option for first-time buyers, landlords, and remortgage clients.

Local Amenities, Attractions, and Lifestyle in Rainham

Rainham combines historic charm with modern living, offering residents a balanced lifestyle that is surrounded by nature, heritage, and a strong community spirit. The area’s growing amenities, leisure options, and green spaces contribute to its increasing popularity among both homebuyers and investors.

Cultural and Heritage Sites

At the heart of the town is Rainham Hall, a beautifully restored Georgian house managed by the National Trust. Surrounded by landscaped gardens, it hosts regular community events, exhibitions, and workshops that highlight Rainham’s rich local history. This landmark serves as both a cultural centre and a symbol of the area’s long-standing heritage.

Parks and Outdoor Spaces

Rainham is known for its impressive natural surroundings. Beam Parklands and the RSPB Rainham Marshes Nature Reserve offer miles of scenic walking trails, birdwatching opportunities, and picnic areas. These green spaces attract nature lovers and families seeking outdoor recreation while remaining close to London.

Shopping and Dining

For daily essentials, Rainham Shopping Centre offers local convenience, while Lakeside Shopping Centre is just a short drive away and provides an extensive range of shops, restaurants, and entertainment venues. Independent retailers and cafes on Rainham’s high street add to the town’s community-driven atmosphere.

Education and Schools

Families benefit from access to a variety of well-rated primary and secondary schools. Popular options include The Brittons Academy, Harris Academy Rainham, and several strong-performing primaries. The focus on educational improvement continues to attract young families to the area.

Healthcare and Wellbeing

Residents have access to multiple GP surgeries, local dental practices, and nearby healthcare facilities. Queen’s Hospital in Romford serves as the main regional hospital, providing comprehensive medical and emergency services.

Community and Development

Rainham is undergoing continued investment in infrastructure and regeneration projects, which are enhancing public spaces, housing quality, and local amenities. The area’s development, combined with its affordable property prices, makes it a prime location for buyers seeking long-term growth and lifestyle convenience.

Lifestyle advantages:

-

Strong community atmosphere

-

Access to nature reserves and outdoor spaces

-

Variety of schools and family facilities

-

Expanding retail and leisure options

-

Ongoing regeneration and investment

Looking for a Mortgage Broker in Rainham?

If you’re buying, refinancing, or investing in Rainham or surrounding Essex towns, speak to a mortgage expert who knows the local market inside out.

Peter Etiaka offers clear, expert guidance to help you make informed mortgage decisions.

📞 Ready to take the next step? Contact Peter Etiaka today for a free, no-obligation consultation.

Thank you for reading our publication “Mortgage Broker in Rainham | Find an Adviser in Essex.” Stay “Connect“-ed for more updates soon!