Finding the Right Mortgage Broker in Romford, Essex | Choosing the right mortgage broker in Romford, Essex is essential for securing a competitive deal, whether you’re buying your first home, remortgaging, or investing in property. With deep knowledge of the local area, mortgage expert Amna Saif provides whole-of-market advice tailored to your unique financial situation and property goals.

Finding the Right Mortgage Broker in Romford, Essex | Choosing the right mortgage broker in Romford, Essex is essential for securing a competitive deal, whether you’re buying your first home, remortgaging, or investing in property. With deep knowledge of the local area, mortgage expert Amna Saif provides whole-of-market advice tailored to your unique financial situation and property goals.

From navigating complex lender criteria to securing bespoke mortgage products, Amna supports you every step of the way—from the first consultation to mortgage completion.

📍 Find me on the Connect Expert Directory

Amna Saif – Mortgage Broker in Romford, Essex

As a trusted Mortgage Broker in Romford, Amna Saif offers clients a personalised and professional service across a wide range of mortgage types, including:

-

Residential mortgages for first-time buyers and movers

-

Buy-to-let and HMO mortgages for landlords

-

Bridging loans for fast or short-term purchases

-

Limited company buy-to-let mortgages

-

Second charge mortgages for equity release

-

Protection and insurance to cover your mortgage and lifestyle

Amna takes time to understand your income, deposit, future plans, and financial situation—crafting a bespoke mortgage strategy suited to your needs, including self-employed or credit-impaired clients.

From submitting applications to chasing lenders, liaising with solicitors, and ensuring your deal completes on time, Amna handles the entire process for you.

Understanding the Romford Property Market

Romford, Essex, offers excellent opportunities for buyers, landlords, and investors. Its blend of affordable housing, strong commuter links, and growing amenities makes it a hotspot for those seeking value without sacrificing convenience.

Property Types in Romford:

-

Edwardian and Victorian terraces

-

1930s semi-detached houses

-

Modern flats and new-build developments

-

Shared ownership and Help to Buy schemes

Romford remains more affordable than Central London, with excellent potential for growth due to recent regeneration projects and upcoming Crossrail benefits.

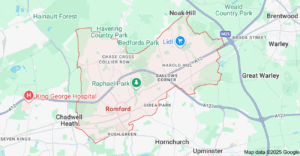

Exploring Neighbouring Towns in Essex

Looking for a mortgage in Romford or the surrounding areas? The wider Essex region offers some of the most attractive property options in the South East—whether you’re a first-time buyer, a remortgager, or an investor. From leafy suburbs to regeneration zones, each town has its own unique housing profile, lending landscape, and buyer demographic.

At ConnectExperts, we understand that finding the right mortgage means more than just comparing rates. That’s why we offer expert support across Essex, including towns like Brentwood, Hornchurch, Upminster, Dagenham, and Ilford—helping you make confident, well-informed decisions.

Brentwood – A Commuter’s Dream with Luxury Appeal

Keywords: Mortgage broker Brentwood, buy a home in Brentwood, remortgage advice Brentwood

Located just off the A12 and served by the Elizabeth Line, Brentwood is a magnet for professionals and families alike. Known for its high-performing schools, boutique high street, and executive-style homes, Brentwood combines commuter convenience with countryside charm.

Mortgage Insight:

Brentwood is well-suited for high-value residential mortgages, professional clients, and those looking to remortgage homes with strong equity growth. New build developments are prevalent, so brokers familiar with Help to Buy or developer-approved lender panels are essential.

Hornchurch – A Family Favourite with Strong Community Vibes

Keywords: Hornchurch mortgage broker, family homes Essex, fixed-rate mortgages Hornchurch

Hornchurch blends suburban living with community warmth. With access to the District Line, well-regarded schools, and family-friendly parks, it appeals strongly to long-term homeowners and second-time buyers.

Mortgage Insight:

This area sees strong demand for residential mortgages for families, particularly 5-year fixed-rate deals and home mover applications. Many buyers in Hornchurch prefer longer mortgage terms to support affordability as they upsize.

Upminster – Leafy, Well-Connected and Buy-to-Let Ready

Keywords: Mortgage broker Upminster, buy-to-let Essex, investment properties in Upminster

Upminster balances quiet, green surroundings with exceptional transport links via the C2C and District Line. It’s popular with older homeowners, London leavers, and landlords seeking stable rental demand.

Mortgage Insight:

With its mix of detached homes and flats, Upminster is ideal for buy-to-let mortgages, particularly for landlords seeking capital growth. It’s also a strong fit for interest-only remortgages and portfolio refinancing strategies.

Dagenham – A Regeneration Hotspot with First-Time Buyer Appeal

Keywords: Mortgage broker Dagenham, affordable homes East London, shared ownership mortgages

Dagenham is undergoing substantial transformation, with major investment projects and new residential developments reshaping its housing landscape. It remains one of the most affordable locations in East London.

Mortgage Insight:

Dagenham is ideal for first-time buyers and clients using shared ownership or government-backed schemes. Buyers with smaller deposits will benefit from a broker who understands 90-95% LTV mortgage options and can compare lenders open to new build flats.

Ilford – Fast-Growing, Diverse and Crossrail-Connected

Keywords: Mortgage broker Ilford, Crossrail homes London, new build mortgage advice

Ilford has transformed from a budget-friendly suburb into a thriving commuter town, thanks to Crossrail. It boasts new apartment developments, a vibrant high street, and a diverse community—attracting both first-time buyers and second-generation property owners.

Mortgage Insight:

Due to the number of new build flats and off-plan properties, Ilford buyers need guidance on developer-approved mortgage lenders, Help to Buy (equity loan), and affordability assessments for new schemes. Ilford also sees higher demand for brokers who speak Punjabi, Urdu, Bengali and Gujarati—language support matters here.

Attractions, Transport, and Amenities in Romford

Romford is a well-connected and fast-growing town in East London, part of the London Borough of Havering. Popular with commuters, families, and property investors alike, Romford combines urban convenience with a community feel. With strong transport links, reputable schools, shopping hubs, and green spaces, it’s no surprise that Romford continues to rise in popularity as a residential destination.

Local Attractions in Romford

Romford is not only a commuter town—it offers a rich blend of culture, history, and entertainment. Whether you’re looking to shop, relax in a park, or enjoy local events, Romford has something for everyone.

-

Romford Market: One of the largest and oldest street markets in the UK, trading since 1247. It operates on Wednesdays, Fridays, and Saturdays, featuring hundreds of stalls offering fresh produce, fashion, and home goods.

-

The Brewery Shopping Centre: A modern retail and leisure hub home to major high street brands, restaurants, cafés, and a 16-screen Vue cinema—perfect for weekend outings or after-work entertainment.

-

Raphael Park and Lodge Farm Park: These scenic parks provide open green space, children’s play areas, sports facilities, and a peaceful boating lake. Ideal for families and outdoor enthusiasts.

-

Havering Museum: Located in a former brewery building, this museum tells the story of the borough’s history, featuring exhibitions on local culture, industry, and notable figures.

These attractions make Romford not just a place to live, but a destination with lifestyle appeal, contributing to its growing demand among first-time buyers and investors.

Transport Links in Romford

Romford offers excellent connectivity, making it a top choice for professionals working in London and beyond. Whether you’re commuting by train, bus, or car, Romford’s transport infrastructure makes getting around efficient and reliable.

-

Romford Station (Elizabeth Line): The Crossrail/Elizabeth Line connects Romford to London Liverpool Street in under 30 minutes, with direct services to Stratford, Canary Wharf, and Heathrow Airport. Ideal for City workers or international travellers.

-

Local Train Services: Greater Anglia trains provide connections to Shenfield and Southend, expanding commuting and leisure travel options across Essex.

-

Bus Network: A wide network of TfL buses links Romford to neighbouring areas including Ilford, Dagenham, Brentwood, and Barking. Several night buses operate from central London.

-

Road Access: Romford is strategically positioned near the A12, A127, and M25, offering easy access to Essex, Kent, and Central London. There’s also ample parking in and around the town centre.

These transport links make Romford ideal for those who want to enjoy suburban life while staying close to central London.

Amenities in Romford

Romford is well-equipped with amenities that cater to a wide range of needs—from healthcare and education to leisure and spiritual wellbeing. It’s a town designed for both everyday convenience and long-term living.

Healthcare

-

Queen’s Hospital (Romford): A major NHS hospital offering a wide range of services including A&E, maternity care, and specialist treatment units.

-

King George Hospital (Goodmayes): Serves nearby areas with additional NHS services, elective surgeries, and outpatient care.

-

Private Clinics: A number of private GP practices, dental surgeries, and physiotherapy centres are available throughout the area.

Education

Romford boasts a variety of high-performing schools and early education centres:

-

Primary and Secondary Schools: Several local schools are rated “Good” or “Outstanding” by Ofsted, such as St Peter’s Catholic Primary School and Frances Bardsley Academy for Girls.

-

Colleges and Further Education: Havering Sixth Form College and Havering College of Further and Higher Education offer a wide range of courses and vocational training.

Family and Lifestyle Amenities

-

Nurseries and Childcare: Numerous Ofsted-registered nurseries and childminders are available throughout the area.

-

Leisure Centres and Gyms: Facilities like Sapphire Ice & Leisure, which includes an ice rink, swimming pool, and gym, cater to health and fitness enthusiasts.

-

Places of Worship: Romford is home to churches, mosques, gurdwaras, and temples—supporting its diverse and multicultural community.

-

Restaurants and Cafés: From family-run curry houses to Italian trattorias and modern cafés, Romford offers a variety of dining options.

Romford: A Strong Investment Opportunity

Romford continues to attract attention from property investors and buy-to-let landlords due to its:

-

Strong rental yields

-

Continued infrastructure investment (e.g. Crossrail/Elizabeth Line)

-

Regeneration projects in the town centre

-

Growing population of professionals and families relocating from Central London

Its relative affordability (compared to central London boroughs) and high rental demand make it a promising location for those looking to expand their property portfolio.

Thinking About Moving to Romford?

Whether you’re a first-time buyer, a growing family, or an investor looking for the next opportunity, Romford is a town that ticks all the boxes. To make the most of what Romford has to offer, it helps to have the right mortgage adviser on your side.

Ready to Get Started?

If you’re buying, refinancing, or investing in Romford or the wider Essex area, don’t navigate the mortgage market alone.

📞 Contact Amna Saif today for a free, no-obligation consultation and take the first step toward your property goals.

Thank you for reading our publication “Mortgage Broker in Romford, Essex | Romford Mortgage Broker.” Stay “Connect“-ed for more updates soon!