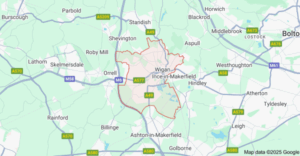

Find a Mortgage Broker in Wigan, Lancashire | Wigan is a thriving market town in Greater Manchester with strong ties to Lancashire, offering a perfect blend of heritage, connectivity, and affordability. Its property market has remained resilient and attractive for first-time buyers, families, and buy-to-let investors alike.

Find a Mortgage Broker in Wigan, Lancashire | Wigan is a thriving market town in Greater Manchester with strong ties to Lancashire, offering a perfect blend of heritage, connectivity, and affordability. Its property market has remained resilient and attractive for first-time buyers, families, and buy-to-let investors alike.

Wigan’s rich industrial past, combined with its ongoing regeneration and investment, makes it an excellent place to settle or invest. From canals and historic mills to modern shopping centres and excellent schools, the town offers a balanced lifestyle at a competitive price.

Whether you’re buying your first investment property, remortgaging, or bridging finance, the Wigan area offers solid property value, reliable tenant demand, and access to great commuter links.

Your Local Mortgage Broker in Wigan: Stephen Charnock

Stephen Charnock is a highly experienced and trusted Mortgage Broker in Wigan, offering tailored advice based on your needs and goals. With a strong understanding of the Lancashire property market, Stephen helps clients secure the right mortgage solution with ease and confidence.

He specialises in:

- Buy-to-let mortgages, including HMOs and limited company options

-

Bridging finance and short-term lending

- General insurance solutions

Stephen manages the entire mortgage journey, liaising with lenders, solicitors, and estate agents to ensure you receive clear advice and a smooth processing experience from start to finish.

Find me on: the Connect Expert Directory

Exploring Nearby Lancashire Towns

If you are considering moving beyond Wigan, Lancashire offers an excellent selection of neighbouring towns with attractive property options and diverse mortgage opportunities. From family-friendly communities to investor-friendly markets, each area has its own appeal for buyers, homeowners, and landlords.

Below is a detailed look at some of the best nearby Lancashire towns to consider when buying or remortgaging a property.

Chorley

Property Snapshot:

Chorley is one of Lancashire’s most desirable commuter towns, offering a blend of countryside charm and convenient access to major employment centres such as Preston, Bolton, and Manchester. The town is surrounded by scenic green spaces, including the West Pennine Moors and Astley Park, making it ideal for families and outdoor enthusiasts.

House prices in Chorley remain competitive, and new housing developments continue to attract first-time buyers and families seeking modern, energy-efficient homes. The local schools have excellent reputations, further boosting the town’s family-friendly appeal.

Mortgage Tips:

-

Residential mortgages: Chorley’s steady property prices make it suitable for standard residential mortgage products, including fixed-rate and tracker options.

-

Help to Buy: Government-backed schemes are widely available in new-build developments, particularly for first-time buyers.

-

Remortgaging: With stable property growth, remortgaging can help homeowners unlock equity to fund home improvements or consolidate debt.

Leigh

Property Snapshot:

Leigh offers some of the best value property in the Greater Manchester and Lancashire border region. Its location near the A580 East Lancashire Road provides easy access to both Manchester and Liverpool, making it popular with commuters. The area has seen ongoing investment in regeneration and infrastructure, which continues to drive housing demand.

Leigh’s property market caters to a wide range of buyers, from first-time homeowners to landlords expanding buy-to-let portfolios. With affordable pricing and rental yields above the regional average, it is particularly appealing for new investors entering the market.

Mortgage Tips:

-

First-time buyers: Look for lenders offering low-deposit or shared ownership options, as the area’s affordability aligns well with entry-level mortgage products.

-

Buy-to-let: Strong tenant demand from young professionals and families makes Leigh an excellent area for landlords seeking consistent rental income.

-

Remortgages: Review your existing mortgage regularly to take advantage of competitive rates, especially if your property has appreciated.

Skelmersdale

Property Snapshot:

Skelmersdale is a well-connected town in Lancashire undergoing significant regeneration. New business parks, residential developments, and infrastructure improvements are transforming the local economy and driving demand for housing. Its proximity to the M58 and M6 makes it ideal for commuters travelling to Liverpool, Wigan, or Preston.

Property prices in Skelmersdale remain lower than in many surrounding areas, offering excellent opportunities for buyers seeking affordability and future growth potential. Investors are also showing increased interest, anticipating value increases as regeneration continues.

Mortgage Tips:

-

Investors: Consider buy-to-let or development finance to capitalise on regeneration projects.

-

Affordable homes: Look for lenders offering flexible criteria or smaller deposits to take advantage of entry-level property opportunities.

-

Future homeowners: Buyers planning ahead can benefit from locking in competitive fixed rates before property values rise further.

Bolton

Property Snapshot:

Bolton is one of Lancashire’s largest and most dynamic towns, offering a strong mix of traditional properties, modern housing developments, and excellent amenities. The town’s convenient rail connections to Manchester make it popular with professionals seeking affordable homes within commuting distance.

The area also offers a variety of suburban communities such as Horwich, Farnworth, and Westhoughton, each with distinct housing styles and price points. With reputable schools and a thriving local economy, Bolton appeals to families and long-term homeowners alike.

Mortgage Tips:

-

Remortgaging: Homeowners can benefit from competitive rates and potentially release equity for renovations or extensions.

-

Family buyers: Lenders often favour applicants with stable employment and strong credit profiles, making Bolton a good choice for conventional residential products.

-

Home movers: Consider portable mortgages if you are relocating within the area.

St Helens

Property Snapshot:

Although St Helens is technically located in Merseyside, its proximity to Lancashire makes it an appealing option for those exploring property in the region. The town offers affordable house prices, a variety of property types, and reliable transport links to Liverpool, Warrington, and Wigan.

The rental market in St Helens remains stable, attracting investors looking for solid yields without excessive entry costs. Local regeneration projects continue to support property value growth, making it a good choice for both first-time buyers and seasoned landlords.

Mortgage Tips:

-

Buy-to-let investors: Look for lenders with experience in regional markets who can accurately assess rental yield potential.

-

Residential buyers: Competitive pricing means buyers can often access favourable loan-to-value ratios.

-

Remortgaging: Property improvements and ongoing regeneration can make refinancing a smart way to access better terms.

Property Market Overview – Lancashire (2025)

| Metric | Latest estimate/status | Key insight for buyers & mortgage advisers |

|---|---|---|

| Average property price (Lancashire) | ~ £205,000 as of early 2025, based on regional market forecasts and Land Registry data. | Advisers can use this as a benchmark for affordability discussions, especially for first-time buyers seeking value compared with southern counties. |

| Growth since 2019 | ~ +13% rise from 2019 to late 2024 (county-wide). | Reflects steady, sustainable appreciation; useful for advising clients on historic equity growth and regional stability. |

| Forecast price growth 2025 | ~ +2.8% expected through 2025 (North West regional trend). | Suggests continued modest growth; advisers should plan mortgage terms around steady but not speculative value increases. |

| Recent annual price change | +0.9% nominal / −2.7% real (after inflation) over the past year. | Highlights that while real-term growth is limited, Lancashire remains resilient and competitively priced compared with the UK average. |

| Sales/turnover indicator | Around 1 in 34 properties changed hands in 2024, slightly below pre-pandemic activity levels. | Indicates a stable but selective market; useful for discussions about transaction pace, liquidity, and timing for buyers. |

| Buyer demand & market sentiment | Demand remains moderate, supported by affordability and employment stability; cautious optimism among buyers. | Advisers should highlight that confidence is returning, though rate sensitivity continues to shape affordability calculations. |

| Key demand drivers | Affordable housing, strong regional employment in manufacturing and services, improving transport links (M6 corridor, Preston to Manchester), and growing student/young professional markets. | Focus on affordability, rental yield potential, and commuter access when advising clients; energy-efficient homes are increasingly popular. |

| Risk/consideration factors | Mortgage affordability remains influenced by interest rates, slower sales in rural areas, and uneven new-build supply. | Advisers should guide clients to factor in mortgage flexibility and rate projections when structuring deals or refinancing. |

| Investor focus / buy-to-let | Key investor hotspots include Preston, Blackburn, and Lancaster with yields averaging 6–7%. | Advisers should highlight the strong rental market for students and professionals and consider limited company BTL or HMO options for clients. |

Living in Wigan: Property, Transport, and Lifestyle

Located in Greater Manchester, Wigan has become one of the North West’s most appealing property destinations. The town strikes a balance between affordability and accessibility, offering an excellent quality of life for families, professionals, and investors. With a thriving local economy, strong commuter links, and diverse housing options, Wigan stands out as a smart choice for homeowners and landlords alike.

Property Market Insights

Wigan offers an impressive variety of properties to suit all buyer types and budgets. From traditional homes to modern developments, the local housing market continues to attract attention from first-time buyers and investors across the North West.

Types of Property in Wigan

-

Traditional Victorian terraces and semi-detached homes: Found throughout neighbourhoods like Swinley and Springfield, these properties are popular with first-time buyers and offer great renovation potential.

-

Modern family developments: New build estates in areas such as Winstanley, Standish, and Aspull provide spacious, energy-efficient homes with excellent local amenities.

-

Buy-to-let opportunities: With two major train stations and a growing professional population, Wigan’s rental market remains robust, particularly around the town centre and near Wigan Infirmary.

Property Prices and Investment Potential

Wigan’s average house prices remain significantly more affordable than those in nearby Manchester or Liverpool, offering excellent value for money. The combination of strong rental yields, growing regeneration projects, and demand from commuters makes Wigan an attractive location for both residential buyers and property investors.

For investors, the town’s expanding employment base and ongoing town centre regeneration contribute to long-term capital growth and consistent tenant demand.

Mortgage Considerations in Wigan

Buyers exploring mortgages in Wigan can access a wide range of options, including fixed-rate, tracker, and buy-to-let products. Local affordability means smaller deposit mortgages are often available for first-time buyers.

Investors may benefit from limited company buy-to-let mortgages or remortgage options to expand their portfolios. Consulting a whole-of-market mortgage adviser can ensure access to competitive rates and lenders experienced in the North West property market.

Transportation and Connectivity

Wigan is exceptionally well connected, making it one of the most convenient commuter towns in the region. Its location between Manchester and Liverpool provides excellent access to both cities, while its road and rail infrastructure supports fast, reliable travel.

Rail Connections

-

Wigan North Western: Offers direct services to London Euston, Preston, and Glasgow, making it ideal for long-distance commuters.

-

Wigan Wallgate: Provides frequent connections to Manchester Victoria, Southport, and other regional hubs.

Road Access

Motorists benefit from quick access to the M6, M58, and A580 East Lancashire Road, linking Wigan to nearby towns such as Bolton, Warrington, and St Helens. These major routes make daily commuting straightforward for professionals working across Greater Manchester or Merseyside.

Local and Regional Transport

Local bus routes connect Wigan with surrounding towns including Leigh, Skelmersdale, Orrell, and Chorley. For international travel, Manchester Airport is less than 40 minutes away by car or train, making the town convenient for frequent travellers and business professionals.

Amenities and Attractions in Wigan

Beyond its strong transport network and affordable property market, Wigan offers a vibrant community and a wide range of lifestyle amenities. From outdoor adventures to family entertainment, the town combines modern living with traditional Northern character.

Leisure and Green Spaces

-

Haigh Woodland Park: A popular destination for families, offering woodland walks, adventure trails, a golf course, and a historic country park atmosphere.

-

Wigan Flashes Nature Reserve: A network of wetlands perfect for walking, cycling, and wildlife spotting.

Shopping and Entertainment

-

Galleries Shopping Centre: Home to local retailers and high-street favourites.

-

Wigan Pier Quarter: Currently under regeneration, this area is transforming into a modern mix of housing, cultural attractions, and creative business spaces.

-

Robin Park Leisure Complex: Offers sports facilities, restaurants, and retail outlets adjacent to the DW Stadium, home to Wigan Athletic and Wigan Warriors Rugby League Club.

Education and Community

Wigan has an excellent selection of Ofsted-rated schools, colleges, and nurseries, making it an ideal location for families. Healthcare facilities, medical centres, and community libraries are well distributed across the borough, supporting a balanced and convenient lifestyle for residents of all ages.

Living and Investing in Wigan

Wigan combines the best of both worlds: affordability and accessibility. Its central location in the North West, affordable housing stock, and high quality of life make it an attractive choice for homebuyers and investors alike. Whether you are seeking your first home, expanding your property portfolio, or relocating for work, Wigan delivers consistent value and long-term growth potential.

Get in Touch with Stephen Charnock Today

Don’t leave your mortgage journey to chance. Whether you’re buying, remortgaging, or investing in Wigan or the surrounding Lancashire towns, Stephen Charnock is ready to help.

With access to the whole market, specialist lenders, and a deep understanding of local property trends, Stephen will help you secure the right mortgage deal for your circumstances.

Book your free consultation today and move forward with confidence.

Thank you for reading our publication “Mortgage Broker in Wigan | Find Mortgage Advisers UK.” Stay “Connect“-ed for more updates soon!