Expert Mortgage Brokers in Norfolk: Finding the right mortgage can feel complex. A trusted mortgage broker in Norfolk can help you explore options with confidence.

Connect Experts connects you with advisers who understand local property markets across Norwich, King’s Lynn, Great Yarmouth, and surrounding towns.

All brokers listed are FCA-authorised and offer advice based on your circumstances.

Every borrower has different needs. Norfolk mortgage advisers can support clients looking for:

- First-time buyer mortgages

- Home mover applications

- Remortgage solutions

- Buy-to-let and landlord mortgages

- Support for self-employed applicants

Your adviser will search across lenders to help find a suitable deal for your situation.

Connect Experts makes it easier to choose an adviser who fits your goals.

With our platform, you can:

- Match with qualified professionals near you

- Filter by mortgage type and expertise

- Choose brokers who speak your preferred language

- Access advisers with local Norfolk experience

Map with Our Mortgage Brokers in Norfolk

Mortgage Advice in Norfolk That Reflects Local Property Needs

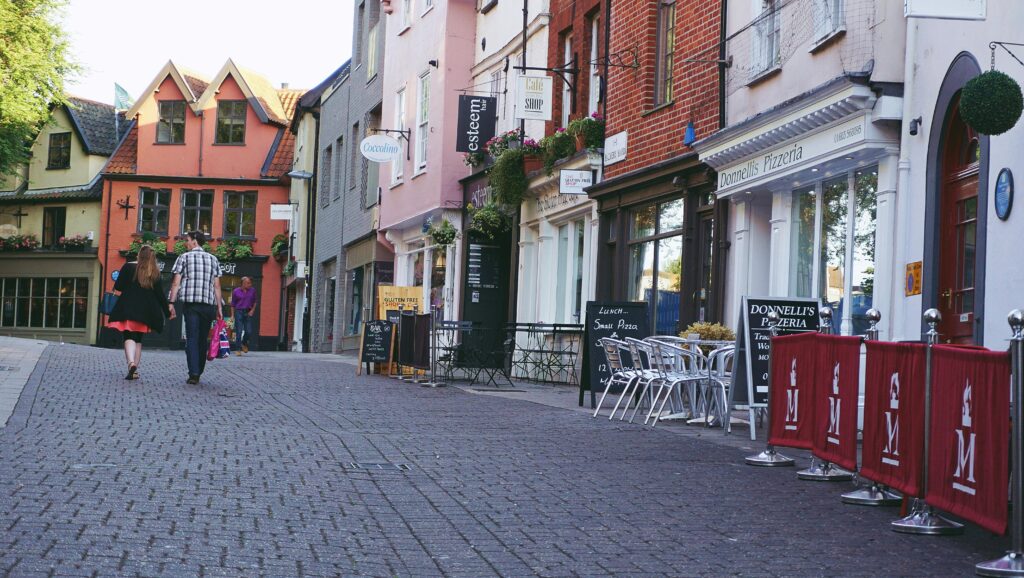

Buying a property in Norfolk often involves very different considerations from those in larger metropolitan areas. The county includes historic market towns, coastal communities, protected rural landscapes, and growing urban centres such as Norwich.

These regional differences can affect property valuations, lender expectations, and mortgage suitability.

Working with a mortgage adviser who understands Norfolk can help you plan with greater clarity, especially when local property features influence lending decisions.

Connect Experts helps you connect with advisers who are familiar with Norfolk’s housing market, from the Norfolk Broads to coastal towns along the North Sea.

Norfolk Property Styles and Lending Considerations

Norfolk offers one of the most varied property landscapes in East Anglia. Buyers may come across:

- Period cottages in villages near Holt

- Victorian terraces in central Norwich

- New-build estates outside King’s Lynn

- Coastal homes in Cromer or Sheringham

- Converted barns and rural detached properties inland

Some homes may be subject to conservation restrictions, have non-standard construction, or be located in areas where flood-risk assessments apply.

Lenders may take additional factors into account, including:

- Property age and structural type

- Coastal exposure and maintenance considerations

- Rural access and resale demand

- Leasehold or shared ownership arrangements

A locally aware adviser can help borrowers understand how these points may affect mortgage options.

Mortgage Advice for Different Norfolk Borrowers

Mortgage needs in Norfolk vary significantly depending on location and buyer type.

A first-time buyer purchasing a flat near Norwich station may face different affordability checks compared to a landlord investing in a rental property near Great Yarmouth.

Advisers can assist with:

- Residential mortgage applications

- Remortgage planning when deals expire

- Buy-to-let borrowing in key Norfolk towns

- Support for self-employed income cases

- Specialist lending for unique property types

All advice is based on lender policy, affordability rules, and FCA-regulated standards.

Mortgage Help Across Norfolk Communities

Norfolk includes locations with distinct housing pressures and lending characteristics.

Advisers with local knowledge understand how lenders may assess:

- Demand in university-linked Norwich neighbourhoods

- Coastal pricing differences in seaside towns

- Rental yields in tourist-heavy areas

- Rural property valuation consistency

This insight can help borrowers make more informed and realistic decisions.

Support Beyond Mortgage Rates

Mortgage advisers do more than compare products. They also support clients through the full application process, including:

- Reviewing documentation before submission

- Responding to lender underwriting questions

- Managing valuation outcomes

- Structuring applications for complex cases

This can be particularly helpful in Norfolk, where some purchases involve:

- Listed buildings in historic areas

- Properties near waterways such as the Broads

- Rural homes with private access roads

- Holiday-let opportunities in coastal regions

All advisers listed through Connect Experts are authorised and regulated by the Financial Conduct Authority.

Access to UK Lenders With Norfolk Experience

Advisers on Connect Experts review mortgage products from across the UK market, including mainstream lenders and specialist providers.

This can benefit clients who are:

- Moving into commuter areas outside Norwich

- Refinancing family homes in Thetford

- Purchasing new developments around Wymondham

- Reviewing options after personal or employment changes

Recommendations are always based on suitability, affordability, and lender criteria.

For wider browsing, you may also explore our A-Z mortgage adviser directory.

Language and Cultural Support in Norfolk

Norfolk is home to increasingly diverse communities, particularly around Norwich and King’s Lynn.

Some clients feel more comfortable speaking with an adviser who understands cultural and language needs.

You can access our multilingual mortgage support network, designed for households who prefer guidance in another language or with greater cultural familiarity.

You may also wish to compare services in other parts of the UK, such as mortgage brokers in Manchester, depending on future plans.

Fun Fact

Norfolk is home to the Norfolk Broads, one of the UK’s largest protected wetland regions. The county’s combination of coastline, countryside, and historic towns continues to shape its distinctive housing market today.

Why Work With Mortgage Brokers in Norfolk

Norfolk offers a distinctive mix of coastal towns, historic city living, and wide rural landscapes. From Norwich and King’s Lynn to market towns such as Fakenham and Thetford, mortgage needs across the county often depend on location, property type, and lenders’ view of local demand.

Working with a mortgage broker in Norfolk can help you make informed decisions and receive advice tailored to your circumstances, all provided under FCA-regulated standards.

Understanding Norfolk’s Property Landscape

Norfolk’s housing market is shaped by both countryside living and coastal demand. Buyers may encounter very different lending considerations depending on whether they are purchasing near the North Sea or further inland.

A locally experienced broker can help explain lender approaches to:

- Period homes in Norwich and surrounding villages

- Coastal properties near Cromer or Sheringham

- Rural cottages with larger boundaries

- New developments in expanding commuter areas

- Valuation differences across market towns and remote locations

This insight is valuable in a county where property types vary widely within short distances.

Advice That Supports the Full Mortgage Process

Mortgage brokers provide more than product comparisons. They help borrowers understand what is realistic, what lenders require, and how to structure applications.

Support often includes:

- Reviewing paperwork before submission

- Advising on affordability and suitability

- Managing lender questions during underwriting

- Assisting through property valuation stages

This can reduce delays, particularly for homes with non-standard features or complex ownership structures.

Helping Borrowers Across Different Norfolk Communities

Borrowers in Norfolk often have very different goals. A first-time buyer in Great Yarmouth may have different needs from someone refinancing a rural property outside King’s Lynn.

Mortgage brokers can assist with:

- Residential mortgages for home movers

- Remortgage planning when deals expire

- Buy-to-let borrowing in high-demand rental locations

- Applications involving self-employed income

- Options for borrowers with past credit difficulties

All recommendations must remain suitable, affordable, and compliant with FCA requirements.

Access to More Specialist Lending Options

Some mortgage products are not available directly from high-street lenders. Brokers can often access a broader range of criteria and solutions, especially for borrowers with unique circumstances.

This can benefit households who are:

- Relocating to Norfolk for lifestyle or retirement

- Purchasing homes in coastal demand areas

- Refinancing long-term family properties

- Managing changing income or employment patterns

A broker helps match borrowing options to borrowers, rather than forcing them into limited product choices.

Supporting Communication Preferences

Norfolk continues to welcome new communities, particularly around Norwich and larger towns. Some clients feel more confident working with advisers who offer support that reflects language or cultural preferences.

Many borrowers benefit from speaking with advisers who provide multilingual guidance, helping communication stay clear throughout the mortgage process.

Finding Mortgage Support Across Norfolk

A mortgage broker in Norfolk can provide structure, reassurance, and local understanding during one of the most significant financial commitments a household will make.

Independent advice can be especially valuable in a county where rural property, coastal markets, and regional valuations all shape lending decisions.

What Norfolk Is Known For Why People Choose to Live Here

Norfolk Property & Lifestyle Overview

| Category | Details |

|---|---|

| Overview | Norfolk, on England’s eastern coast, blends vibrant city life with rural charm, historic architecture, and coastal beauty. |

| Local Highlights | Norwich: Cultural hub with medieval heritage, independent shops, and two universities. King’s Lynn: Maritime town with modern services. Great Yarmouth: Seaside destination and gateway to the Norfolk Broads. Thetford: Surrounded by forest trails, perfect for outdoor pursuits. North Norfolk: Sandy beaches, scenic villages (e.g. Wells-next-the-Sea), and protected landscapes. Breckland: Affordable homes and close-knit communities. Broadland: Peaceful living with strong transport links to Norwich. Interesting Fact: Norwich was the UK’s first UNESCO City of Literature. |

| Finding Accommodation | Norfolk’s housing market includes riverside cottages, village homes, and modern city flats. Property search: Rightmove, Zoopla, OnTheMarket. Consider: Commute distance, flood risk (especially near rivers/coasts), local amenities, and school catchment areas. Popular areas: Wymondham & Aylsham (families), Golden Triangle in Norwich (young professionals). |

| Employment Opportunities | Norfolk supports multiple key industries: • Healthcare: Norfolk & Norwich University Hospital and NHS Trusts. • Renewable Energy: Offshore wind projects near Great Yarmouth. • Technology: Growing around Norwich Research Park. • Agriculture: Major rural employer. • Tourism: Coastal and Broads-based hospitality. Job search: Indeed, LinkedIn, local recruiters. Fact: Norfolk hosts one of the UK’s largest offshore wind farms. |

| Transport & Travel | Buses: First Bus, Konectbus linking towns/villages. Trains: Norwich–London Liverpool Street in under 2 hours. Air Travel: Norwich International Airport for UK & Europe. Community Transport: Rural mobility schemes. Plan journeys: Traveline East Anglia or Norfolk County Council planners. |

| Managing Living Costs | Norfolk is more affordable than southern England. Average living costs (excl. rent): £750–£800/month per person. Rents: Higher in Norwich but still below London/Cambridge. Budgeting tools: Monzo, Starling, Emma. |

| Healthcare Access | GP registration: Free, no proof of immigration status required. Tools: NHS GP Finder. Oversight: Norfolk Integrated Care Board. Fact: The Norfolk & Norwich University Hospital is among the UK’s largest teaching hospitals. |

| Education Options | Schools: Use Ofsted ratings. University: University of East Anglia (UEA) – renowned for writing, environmental science, and health research. Colleges: City College Norwich & others for vocational and adult learning. Tip: Check catchment areas early when moving with children. |

| Community & Culture | Norfolk offers rich heritage, arts, and nature experiences. Attractions: Norwich Castle Museum, Holkham Estate, Norfolk Coast Path. Festivals: Wells Carnival, Norfolk & Norwich Festival. Leisure: Sailing, hiking, arts clubs, volunteering. Interesting Fact: Norfolk has over 650 medieval churches — more than any other UK county. |

| Moving Checklist |

|

People Also Browse these Counties

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker based in Norfolk, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our Norfolk mortgage brokers page are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across Norfolk.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us