Multilingual Mortgage Brokers

Multilingual Mortgage Brokers Helping You Find the Right Adviser – Finding the right mortgage adviser can be challenging, especially if English is not your first language.

Connect Experts makes it easier to work with multilingual mortgage brokers across the UK who can clearly and confidently explain your options.

Our platform allows you to find a mortgage adviser who speaks your preferred language and understands your financial goals. This helps ensure important details are not missed and that you feel confident at every stage of the mortgage process.

All advisers listed on Connect Experts are FCA authorised and appropriately qualified. They provide regulated mortgage advice based on your personal circumstances. Advice is always clear, professional, and easy to understand.

Find a Mortgage Broker Who Speaks Your Language

We know how important it is to work with someone who truly understands you. Connect Experts has advisers fluent in over 30 languages, serving communities across England, Scotland, Wales, and Northern Ireland. You can connect with brokers who speak:

Why Choose a Multilingual Mortgage Broker

Language should never be a barrier to getting the right financial advice. When you work with one of our multilingual advisers, you benefit from:

- Clear explanations of every stage of your mortgage process in your preferred language.

- Access to whole-of-market mortgage deals from hundreds of lenders across the UK.

- Specialist support for residential, buy-to-let, commercial, and bridging finance.

- Flexible communication meets in person, online, or by phone at a time that suits you.

- Protection and insurance advice to safeguard your property and income.

Our advisers are based across the UK, including London, Birmingham, Manchester, Leeds, Glasgow, and other major cities — so you can find support wherever you live.

Expert Advice, Made Easy

At Connect Experts, we believe good advice starts with good communication. By choosing a broker who speaks your language, you can be sure your questions are answered clearly, your goals are understood, and your mortgage journey is handled with care.

Suggestions Inspired By Your Recent Activity

FAQ: Multilingual Mortgage Brokers

| Question | Answer |

|---|---|

| What is a multilingual mortgage broker? | A multilingual mortgage broker is a qualified adviser who provides mortgage and protection advice in more than one language. They help clients understand the full process clearly, removing communication barriers and ensuring no important detail is missed. |

| Why should I choose a broker who speaks my language? | Choosing a broker who speaks your native language helps you feel confident when discussing financial details. It allows you to ask questions freely, understand complex terms, and make informed decisions with complete clarity. |

| Which languages are available through Connect Experts? | Our network includes advisers who speak over 20 languages, including Punjabi, Urdu, Hindi, Gujarati, Mandarin, Arabic, Tamil, Polish, Spanish, and French. Each adviser is FCA-authorised and based across the UK. |

| Are multilingual brokers fully qualified and regulated? | Yes. Every mortgage adviser listed with Connect Experts is FCA-authorised and trained to UK regulatory standards. They follow strict compliance procedures to provide accurate, ethical, and transparent mortgage advice. |

| Can I get mortgage advice online in my preferred language? | Absolutely. Many advisers offer video or phone appointments in multiple languages, so you can receive expert mortgage advice from the comfort of your home anywhere in the UK. |

| Do multilingual brokers charge extra for language support? | No. There is no additional charge for receiving advice in your preferred language. Fees are based on the service provided, not the language spoken. All costs are explained clearly before you proceed. |

| What services can multilingual mortgage brokers help with? | They can assist with residential mortgages, buy-to-let, HMOs, bridging finance, commercial loans, remortgages, and protection. Their goal is to help you access the best mortgage solution for your circumstances. |

| Where are multilingual brokers located in the UK? | Connect Experts works with advisers based across England, Scotland, Wales, and Northern Ireland. You can search by language and location to find a professional who is near you or available online. |

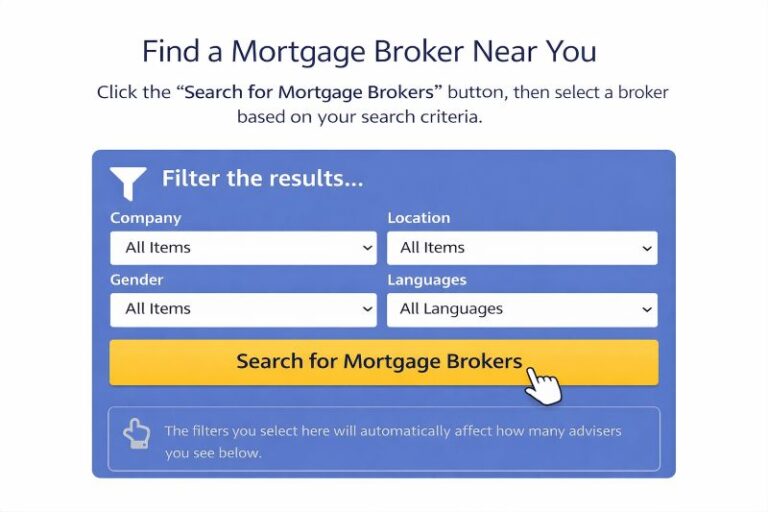

| How can I find a multilingual mortgage broker near me? | Use our search tool to filter advisers by language, location, and area of expertise. Simply choose your preferred language and region to see qualified advisers who are ready to help. |

| Is my personal information secure when I contact an adviser? | Yes. Connect Experts complies with UK data protection and GDPR regulations. Your information is shared only with the advisers you choose to contact, keeping your details safe and confidential. |

“Hi, I’m Liz Syms, the Chief Executive Officer and founder of Connect Mortgages and Connect for Intermediaries. If you are a mortgage broker wanting to join a network, we welcome you to join our!

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us