A let-to-buy mortgage helps homeowners move into a new property while keeping their current home as a rental investment.

Instead of selling, you can release equity from your existing property, let it out, and use those funds toward your next purchase.

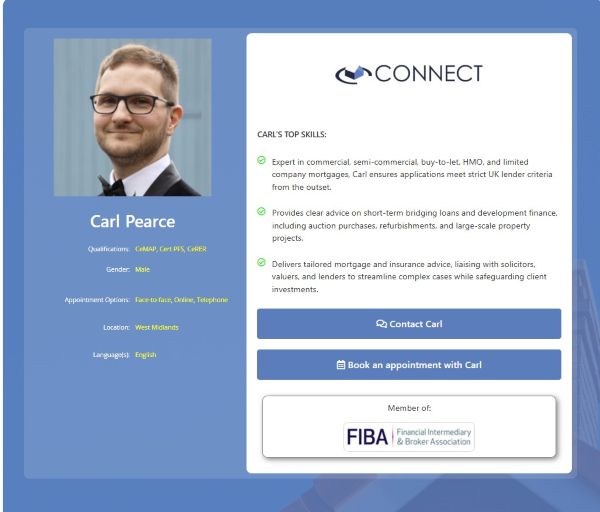

A let-to-buy mortgage broker specialises in arranging this type of mortgage structure.

They work with lenders who understand the financial complexity of managing two mortgages simultaneously.

Affordability is assessed on both properties to ensure the arrangement is sustainable.

Engaging an experienced broker can help you find lenders whose criteria suit let-to-buy mortgages.

Many advisers also assess whether a standard remortgage combined with a new residential mortgage may be more suitable.

You can speak with a mortgage adviser experienced in let-to-buy cases to review your options based on your income, rental potential, and long-term plans.

Understanding Let-to-Buy Mortgages

A let-to-buy mortgage allows you to remortgage your existing home onto a buy-to-let product and use the released equity to help fund your next purchase. This type of mortgage differs from a standard remortgage because the lender is aware that the property will be rented out to tenants.

Many homeowners use let to buy when they want to move but keep their current property as a rental investment. With the right structure, rental income from the existing property covers the buy-to-let mortgage payments, while a separate residential mortgage is arranged for the new home.

For example, if your property is valued at £350,000 with an outstanding mortgage of £150,000, you may be able to remortgage up to 75% LTV, subject to lender criteria. This could release equity to use as a deposit on your next home. Rental income is then assessed to ensure it meets the lender’s affordability requirements.

Working with experienced let-to-buy mortgage brokers helps ensure both mortgages are structured correctly. A specialist adviser will review rental income, personal affordability, and lender criteria to ensure the buy-to-let and residential mortgages align.

If you are unsure whether this option is suitable, speaking to a mortgage adviser can help you understand the risks, costs, and long-term commitments involved.

Why Consider a Let-to-Buy Mortgage

| Benefit | Description |

|---|---|

| Move Without Selling | Keep your existing home as an investment property while moving into a new one. |

| Access to Equity | Release funds from your current property to use as a deposit on your next home. |

| Rental Income Potential | Generate monthly income from tenants to help offset your existing mortgage. |

| Avoid Property Chain Delays | Move sooner without waiting for your current property to sell. |

| Flexible Future Options | Sell or keep your first property later depending on market conditions. |

Role of a Let-to-Buy Mortgage Broker

A let-to-buy mortgage broker helps structure two linked mortgage applications so they work together smoothly. One mortgage is arranged on a buy-to-let basis, while the new home is financed with a residential mortgage. This coordinated approach reduces risk and improves the likelihood of approval.

An experienced broker reviews lender criteria, affordability models, rental stress tests, and rental yield requirements. This ensures both mortgages meet current lending standards.

Working with a specialist helps ensure:

Affordability is assessed accurately across both properties

Lenders are selected based on let-to-buy experience and rental income criteria

The application process is managed efficiently to support realistic completion times

By using a find-a-mortgage adviser service, borrowers can access brokers who specialise in let-to-buy transactions and complex lending scenarios.

A specialist broker may also provide access to lenders not commonly available on the high street. This can be particularly valuable where equity release is required from an existing property or where rental income plays a key role in affordability.

Advice may also cover tax considerations and ongoing property rental obligations. All recommendations are based on individual circumstances and current lender criteria.

Who Uses Let-to-Buy Mortgages

Let-to-buy mortgages are commonly used by homeowners who want to move home without selling their current property. This option allows the existing home to be rented out while a new residential mortgage is arranged on the next property.

Homeowners relocating for work often use let to buy when they need to secure a new home before selling. Rental income from the existing property may help support affordability, subject to lender assessment.

Families who are upsizing may choose to buy mortgages to avoid rushed property sales. Retaining the original home can provide long-term rental income and future capital growth.

Some first-time landlords use a let-to-buy when converting a former main residence into their first rental property. In these cases, lenders assess expected rental income and apply specific affordability and stress testing rules.

Couples combining assets may also use let to buy mortgages. One property may be retained as a rental while purchasing a new joint home, helping to maintain income diversification.

Individuals planning a long-term property strategy often use a let-to-buy as a gradual route into property investment. Speaking with a let-to-buy mortgage adviser helps ensure both the residential purchase and rental mortgage are structured correctly.

If you are considering this route, using a location search to find a mortgage adviser can help you speak with brokers experienced in let-to-buy and landlord lending.

Alternatives to Let-to-Buy Mortgages

| Option | When It’s Suitable |

|---|---|

| Buy-to-Let Mortgage | If you already own multiple rental properties and want to expand your portfolio. |

| Residential Remortgage | When you plan to sell your existing home instead of letting it. |

| Bridging Loan | Useful for temporary finance when buying before your sale completes. |

| Consent to Let | For short-term rentals where you keep your existing residential mortgage with lender approval. |

Browse Our Let-to-Buy Mortgage Brokers

Suggestions Inspired By Your Recent Activity

FAQ: Let-to-Buy Mortgage Brokers

| Question | Answer |

|---|---|

| What is a let-to-buy mortgage? | A let-to-buy mortgage allows you to rent out your current home and use the equity released to buy a new property. It is ideal for homeowners who want to move without selling their existing property. |

| How does a let-to-buy mortgage work? | You convert your existing residential mortgage into a buy-to-let loan while applying for a new residential mortgage on your next property. The rental income from your old home is considered when lenders assess affordability. |

| Who can apply for a let-to-buy mortgage? | Let-to-buy mortgages are available to homeowners who have sufficient equity in their current property, a good credit history, and meet affordability checks for both the rental and new residential mortgage. |

| Do I need a larger deposit for let-to-buy? | Yes, lenders usually require a minimum of 25% equity in your current home for the buy-to-let portion. For your new property, you may need at least 10% deposit depending on your credit profile and lender criteria. |

| Can first-time buyers get a let-to-buy mortgage? | No. Let-to-buy is specifically for existing homeowners. First-time buyers typically need a standard residential mortgage as they do not own a property to let. |

| What are the benefits of let-to-buy mortgages? | You can move quickly without waiting to sell, keep your current home as an investment, and potentially earn rental income while purchasing a new property. It also helps if the market conditions are not ideal for selling. |

| Are there risks with let-to-buy mortgages? | Yes. You will be responsible for two mortgages, and if your rental property remains empty or rental income drops, you must still meet both payments. Changes in interest rates can also affect affordability. |

| Do I pay higher interest rates for let-to-buy? | Typically, yes. The buy-to-let element of a let-to-buy mortgage often has slightly higher rates than standard residential loans due to perceived lending risk. However, rates are competitive and vary by lender. |

| Can I remortgage my property for a let-to-buy? | Yes. You can remortgage your current home onto a buy-to-let product while applying for a new residential mortgage. This process is common when moving home and retaining your property as an investment. |

| Do I need a mortgage broker for let-to-buy? | It is strongly recommended. A qualified let-to-buy mortgage broker can compare both the residential and buy-to-let aspects, coordinate timing between lenders, and ensure you meet regulatory requirements. |

| Can I let my property before I complete my new purchase? | It depends on your lender’s policy. Most lenders require the buy-to-let mortgage to be in place before you let the property. A broker can help plan this sequence correctly. |

| Where can I find a let-to-buy mortgage broker near me? | You can use Connect Experts’ UK-wide broker finder to locate an FCA-authorised mortgage broker experienced in let-to-buy. Filter by location, language, and expertise to find the right adviser for your situation. |

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in your location are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across the UK.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us