Development Finance Mortgage Brokers – A development finance mortgage helps property developers, investors, and builders fund construction and refurbishment projects. This type of funding is commonly used for new builds, property conversions, and large-scale renovations.

Development finance is designed to support projects from start to completion. Funds are released in stages as work progresses, rather than as a single upfront payment. This approach helps manage cash flow and ensures funding aligns with each phase of the build.

Unlike standard mortgages, development finance is based on the project’s viability. Lenders assess the build costs, end value, and the developer’s experience. Because criteria can vary widely, specialist advice is essential.

Working with an experienced development finance mortgage broker can make the process clearer and more efficient. A broker will assess your project, compare lender requirements, and identify suitable funding options. Many specialist lenders are not available directly to the public, so brokers can access a wider range of solutions.

If your project also involves residential or investment property, a qualified adviser can help you find a mortgage adviser with experience across multiple funding types. This ensures your development finance fits alongside your wider property plans.

Development finance may be suitable for both small developments and larger multi-unit projects. Each case is assessed individually, and funding is tailored to the project timeline.

Understanding Development Finance

Development finance is a short-term funding solution for individuals and companies involved in property development. It is commonly used for new builds, conversions, and major refurbishment projects. Loan terms typically range from 6 to 24 months and are repaid either through the sale of the property or by refinancing into a longer-term mortgage.

For example, if a development site is valued at £500,000 and the estimated build costs are £800,000, a lender may offer up to 70% of the land value and up to 100% of the construction costs. Funds are typically released in stages, based on professional site inspections and progress reports.

Working with experienced development finance brokers can help ensure the funding structure meets both lender criteria and the developer’s objectives. Brokers assess viability, manage drawdown schedules, and help identify suitable lenders for each project type.

If you are exploring complex funding options, speaking to a specialist through our “Find a Mortgage Adviser“ service can help you access expert guidance tailored to your development plans.

Why Consider Development Finance

| Benefit | Description |

|---|---|

| Access Large Project Funding | Finance multi-unit developments, conversions, or large-scale refurbishments without tying up all your capital. |

| Stage-Based Drawdowns | Funds are released as construction progresses, improving cash flow and aligning with project milestones. |

| Tailored Loan Terms | Each loan is structured around your project type, timescale, and exit strategy. |

| Short-Term Flexibility | Finance typically runs for 6 to 24 months, allowing repayment after sale or refinance. |

| Competitive Interest Options | Rates reflect project risk and experience, often better than unsecured borrowing. |

Role of a Development Finance Broker

Development finance brokers act as the link between property developers and specialist lenders. They assess key details such as planning permission, build costs, developer experience, and exit strategy before recommending suitable funding options.

Their expertise helps ensure applications are presented clearly and accurately. This improves approval times and reduces the risk of delays. Developers also gain access to lenders that are not available through high street banks.

Working with a broker helps ensure development funding is structured to match build stages and cash flow requirements. This is essential for managing costs throughout the project lifecycle.

By using an experienced development finance broker, you can access tailored lending solutions for residential, commercial, and mixed use developments. Brokers also negotiate terms on your behalf and oversee staged fund releases as work progresses.

If you are comparing options, our expert mortgage brokers in the UK can help you identify lenders that align with your project goals and funding timeline.

All finance is subject to lender criteria, status, and valuation. Your property may be repossessed if you do not keep up with your loan repayments.

Understanding Development Finance

Development finance is used by a wide range of borrowers involved in property projects.

Property developers often use development finance to fund new build schemes or property conversions. This may include residential housing, apartments, or mixed-use developments. Funding is usually released in stages as the build progresses.

Investors refurbishing residential or commercial units may rely on development finance to improve property condition and increase value. This type of funding can support structural works, modernisation, and change of use, subject to planning approval.

Businesses undertaking multi phase projects may use development finance to manage cash flow across larger developments. This allows funding to be aligned with construction milestones and project costs.

Landowners looking to maximise property value before sale may also use development finance. Funding can support planning, infrastructure works, or site preparation prior to disposal or long term investment.

If your project involves borrowing against land or property, speaking with a development finance broker can help you understand lender criteria, loan structure, and risk considerations.

For projects that involve mixed-use or commercial elements, advisers listed within our commercial mortgage brokers section may also be relevant.

All lending is subject to valuation, planning status, affordability, and lender approval. Your property may be at risk if repayments are not maintained.

Alternatives to Development Finance

While development finance suits many projects, other options may be considered depending on your goals:

- Bridging Loans: For short-term purchases or auction property completions before development starts.

- Commercial Mortgages: For long-term financing of income-generating properties after completion.

- Joint Venture Funding: Where investors provide capital in exchange for a profit share.

- Mezzanine Finance: Secondary funding that complements senior debt to increase total available capital.

Browse Our Development Finance Mortgage Brokers

Suggestions Inspired By Your Recent Activity

FAQ: Development Finance Mortgage Brokers

| Question | Answer |

|---|---|

| What is development finance? | Development finance is a short-term funding option designed to help property developers and investors finance the purchase and construction of residential or commercial projects. It covers land acquisition, building costs, and sometimes professional fees. |

| Who can apply for development finance? | Property developers, experienced investors, and limited companies can apply. Some lenders also consider applications from first-time developers with strong business plans and professional support. |

| How much can I borrow with development finance? | Most lenders offer between 60% and 70% of the gross development value (GDV) or up to 90% of the total project costs, depending on experience, location, and the project’s risk level. |

| What can development finance be used for? | It can fund residential developments, commercial conversions, new builds, or renovation projects. Some lenders also support mixed-use and semi-commercial schemes. |

| How is development finance different from a bridging loan? | A bridging loan is often used to buy property quickly or cover a short-term gap, while development finance is structured in stages and linked to project milestones such as land purchase, construction, and completion. |

| How are funds released during a project? | Funds are typically released in stages known as drawdowns. After each phase of work, a valuer inspects the site before the next tranche of funding is released. |

| What is the typical term for development finance? | The average term ranges from 6 to 24 months, depending on the size and scope of the project. Longer-term options may be available for large-scale or phased developments. |

| Do I need to provide security? | Yes. Most lenders require the property or land as security. Personal guarantees and debentures are also common, particularly for limited companies. |

| Can I get 100% development finance? | Full funding is rare, but possible if additional security or joint venture arrangements are in place. Lenders may fund 100% of build costs if the land is owned outright. |

| Why use a development finance mortgage broker? | A specialist broker understands lender criteria, negotiates competitive terms, and helps structure deals to suit cash flow and exit strategy. They also save time by managing paperwork and lender communication. |

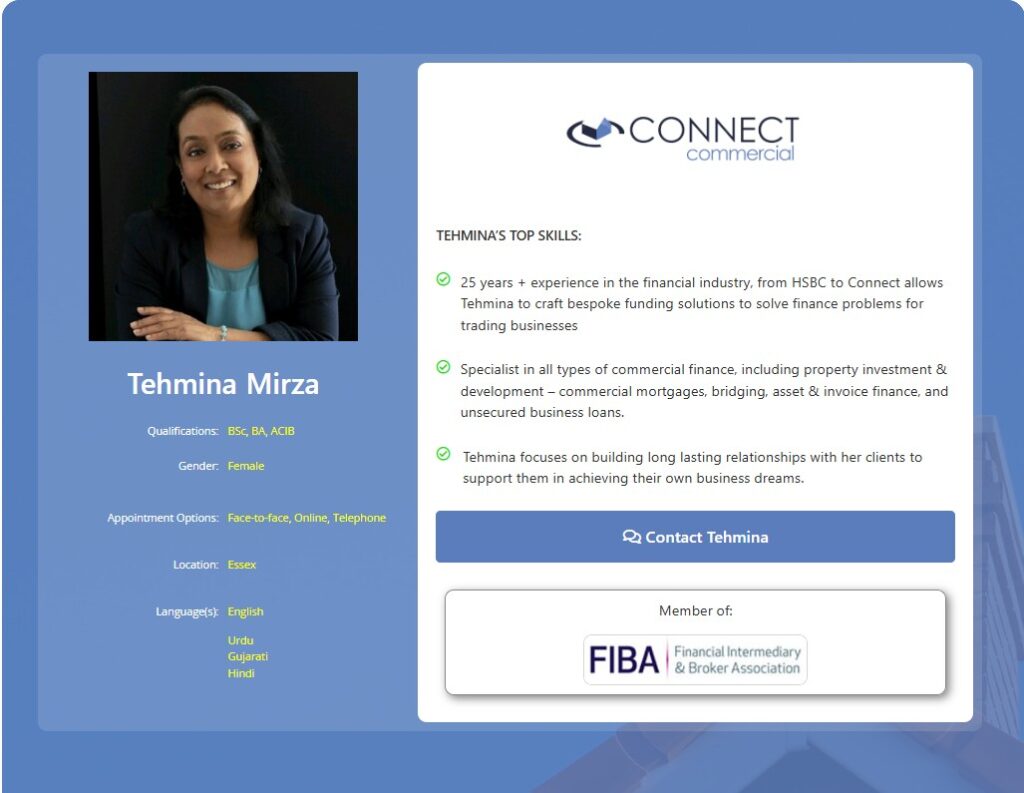

| How do I find a development finance broker near me? | Use Connect Experts to search by location, language, and area of expertise. You can connect with brokers across the UK who specialise in development and bridging finance. |

If you are Looking for a Mortgage Network

“Hi, I’m Liz Syms, Chief Executive Officer and founder of Connect Experts, Connect Mortgages, and Connect for Intermediaries.

If you are a UK mortgage broker, joining our mortgage network can help you increase your visibility to clients actively searching for trusted, FCA-authorised advice. Brokers featured on our mortgage brokers in your location are matched with clients who value clear communication and professional guidance, including those who prefer advice in a specific language.

Our platform is designed to support compliant, client-focused advisers and help you connect with the right audience across the UK.”

Choose the option that suits you best:

Option 1: Schedule a call with our Business Recruitment Manager

Option 2: Complete our contact form

Option 3: Call us